Applying for a position at Bank of America means you're entering a highly competitive field, where having a polished, impactful and great resume can make all the difference.

In this guide, we’ll walk you through the steps to create a Bank of America resume that showcases your strengths, highlights your achievements, and aligns with what this organization values in its employees.

With such a prestigious financial institution, recruiters look for specific qualities in candidates—like attention to detail, relevant experience, and strong communication skills.

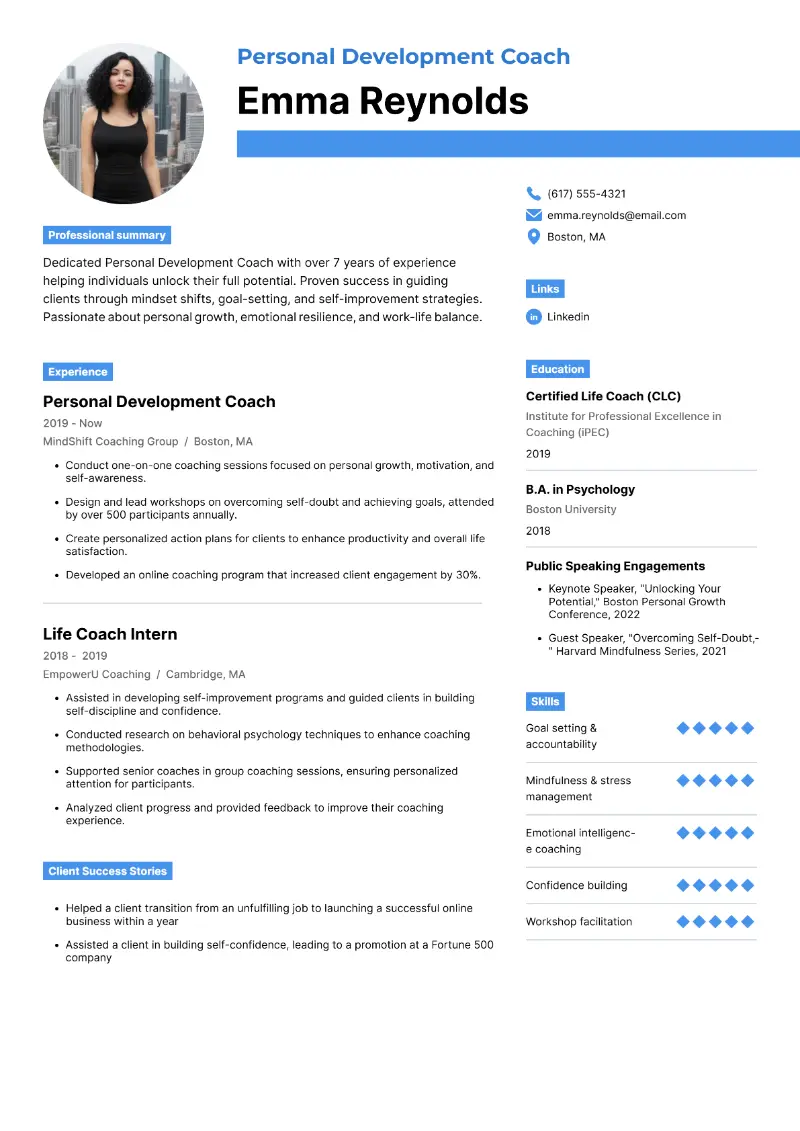

Bank of America resume examples

Bank of America teller resume sample

Bank teller resume example

Resume for bank teller | Plain text

Sarah Williams

Charlotte, NC | sarah.williams@email.com | (555) 123-4567

Professional Summary

Detail-oriented and customer-focused Bank Teller with 7+ years of experience in handling daily transactions, providing excellent customer service, and ensuring compliance with banking regulations. Adept at identifying customer needs and promoting banking products to enhance customer satisfaction and loyalty.

Professional Experience

First Citizens Bank, Charlotte, NC

Bank Teller

April 2020 – Present

- Process daily cash transactions including deposits, withdrawals, and loan payments, handling up to $30,000 in cash per day.

- Provide exceptional customer service, resolving client inquiries and assisting with account maintenance.

- Promote and cross-sell banking products such as savings accounts, credit cards, and loan services, increasing product sales by 15%.

- Accurately balance cash drawers at the end of each shift, maintaining a 100% accuracy rate over the last year.

- Serve as backup vault custodian, managing large sums and tracking inventory of financial instruments.

PNC Bank, Charlotte, NC

Teller Trainee

June 2018 – March 2020

- Assisted customers with routine transactions, including deposits and account inquiries, while maintaining a professional demeanor.

- Supported senior tellers in managing customer flow during peak hours, reducing wait times by 10%.

- Helped identify fraud attempts by adhering to strict compliance protocols and ensuring proper identification verification.

- Learned foundational bank security protocols and cash drawer reconciliation techniques.

Education

Central Piedmont Community College, Charlotte, NC

Associate Degree in Business Administration

Graduated May 2018

Certifications

- Certified Bank Teller (CBT) – Issued July 2019

Skills

- Cash handling and transaction processing

- Customer service and problem-solving

- Cross-selling banking products

- Attention to detail and accuracy

- Knowledge of banking regulations and procedures

- Microsoft Office and banking software proficiency (e.g., Fiserv, TellerPro)

- Mobile and online banking assistance

- Risk mitigation and fraud prevention

- Interpersonal communication in high-traffic environments

- Vault operations and secure cash management

Awards & Recognition

- Employee of the Month – First Citizens Bank, August 2022: Awarded for achieving 100% accuracy in cash handling and exceeding monthly sales targets for cross-sold products.

Strong sides of this bank teller resume sample:

- It has specific metrics (e.g., handling $30,000 in cash daily, increasing product sales by 15%) that demonstrate performance and impact.

- The opening statement in resume clearly outlines relevant experience and skills tailored for the position, emphasizing customer service and transaction handling.

- The inclusion of an award adds credibility and showcases exceptional performance in the previous role.

How to properly format a resume for Bank of America

- Stick with professional fonts like Arial, Calibri, or Times New Roman. They are easy to read and convey a sense of professionalism.

- The font size should be 10 to 12 points for the main body, and slightly larger (14 to 16) for section headings.

- Keep your resume length concise, ideally within one to two pages.

- Maintain consistent formatting throughout the document.

- Use 1-inch margins on all sides and ensure that there’s adequate spacing between entries.

- Utilize bold or italics to separate the sections in resume, ensuring your application is easy to scan.

- Avoid clutter—too much text on a page can be overwhelming and may detract from key points.

One of the best ways to avoid formatting issues is to use a free AI resume builder.

Resume Trick provides pre-set online resume templates, ensuring that your document is clean and consistent without the need for constant adjustments.

Create your professional Resume in 10 minutes for FREE

Build My Resume

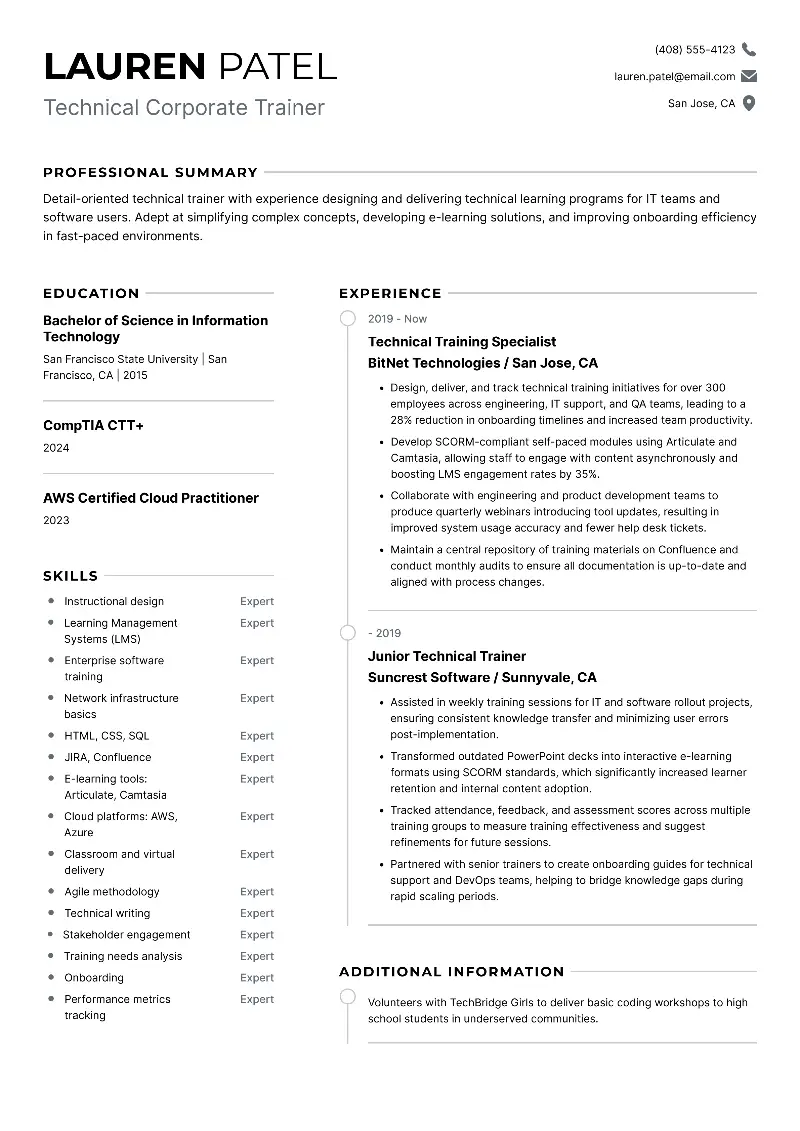

CICS systems programmer resume example

Sample Bank of America resume

James Reynolds

Plano, TX | james.reynolds@email.com | (555) 987-6543

Professional Summary

Experienced CICS Systems Programmer with over 11 years of expertise in designing, maintaining, and troubleshooting mainframe systems. Extensive knowledge of IBM z/OS environments, CICS transaction processing, and system optimization.

Professional Experience

JP Morgan Chase, Plano, TX

CICS Systems Programmer

August 2017 – Present

- Administer CICS systems, performing installation, customization, and maintenance to support a high-availability environment.

- Monitor and tune system performance, reducing response time by 20% and improving transaction throughput by 15%.

- Coordinate with application development teams to deploy CICS applications and troubleshoot performance issues.

- Implement disaster recovery procedures and conduct system backups to ensure data integrity and system reliability.

- Provide support for production issues, ensuring minimal downtime and timely resolution.

- Upgrade CICS TS levels and apply PTFs, ensuring compliance with IBM support standards.

Fidelity Investments, Westlake, TX

Mainframe Systems Programmer

May 2014 – July 2017

- Supported z/OS mainframe systems, focusing on system stability, availability, and performance.

- Worked closely with application teams to ensure seamless operation of CICS systems, resolving performance bottlenecks.

- Assisted in the migration from older mainframe platforms to newer z/OS systems, improving overall efficiency by 25%.

- Developed and implemented JCL scripts to automate routine tasks, reducing manual intervention by 30%.

- Built and maintained system exits and SVC routines for tailored processing logic.

Education

University of North Texas, Denton, TX

Bachelor of Science in Computer Science

Graduated May 2014

Certifications

- IBM Certified System Programmer – CICS Transaction Server for z/OS – Issued October 2016

Skills

- IBM z/OS and CICS systems administration

- Mainframe performance tuning and optimization

- Systems design and troubleshooting

- JCL, COBOL, and REXX programming

- CICS application support and upgrades

- Disaster recovery planning

- Systems automation and monitoring (IBM Omegamon, BMC MainView)

- Log analysis and diagnostic dump interpretation

Technical Projects

- CICS Performance Tuning Initiative. Developed and implemented system improvements for CICS transaction processing at JP Morgan Chase, reducing average response time from 1.8 seconds to 1.4 seconds and improving throughput by 15%.

This example of a Bank of America resume will impress recruiters:

- The summary effectively showcases extensive technical experience and computer skills, which is crucial for a systems programmer role.

- Relevant educational background and certifications highlight qualifications.

- The technical projects section demonstrates initiative and ability to contribute to significant improvements, showcasing problem-solving skills.

Should I choose a Bank of America resume objective or summary?

A resume summary is ideal for professionals.

This section provides a brief overview (2–3 sentences) of your most relevant experiences and skills, effectively summarizing why you’re a strong candidate for the role. It allows you to quickly showcase your qualifications to hiring managers.

Bank of America resume summary sample:

Experienced financial analyst with 6+ years in corporate banking. Proven track record in risk management, financial forecasting, and improving client satisfaction scores by 25%. Seeking to leverage my expertise in banking operations at Bank of America.

An objective in resume is better suited for individuals who are new to the workforce, transitioning careers, or applying for entry-level positions.

This statement focuses on your career goals and how you plan to contribute to the company, rather than summarizing past expertise.

Bank of America resume objective example:

Recent finance graduate with a strong understanding of financial principles and market analysis. Seeking to apply my academic knowledge and internship experience in a banking analyst role at Bank of America.

How to showcase your Bank of America resume skills?

The skills section is critical for showcasing both the technical competencies and personal qualities you bring to the table. Bank of America values employees who can navigate the complexities of banking while working effectively with teams.

- Hard skills are measurable and teachable abilities directly related to the job, such as proficiency in financial software or expertise in risk management.

- Soft skills, on the other hand, are interpersonal attributes like communication and leadership that enable you to work well with others and handle workplace challenges.

Bank of America hard skills:

- Financial analysis

- Data management

- Budgeting and forecasting

- Risk management

- Regulatory compliance

- Investment strategies

- Financial software (e.g., Excel, Bloomberg)

- Loan processing

- Credit analysis

- Financial modeling

Soft skills for the Bank of America:

- Communication

- Problem-solving

- Attention to detail

- Teamwork

- Leadership

- Customer service

- Adaptability

- Time management

- Critical thinking

- Emotional intelligence

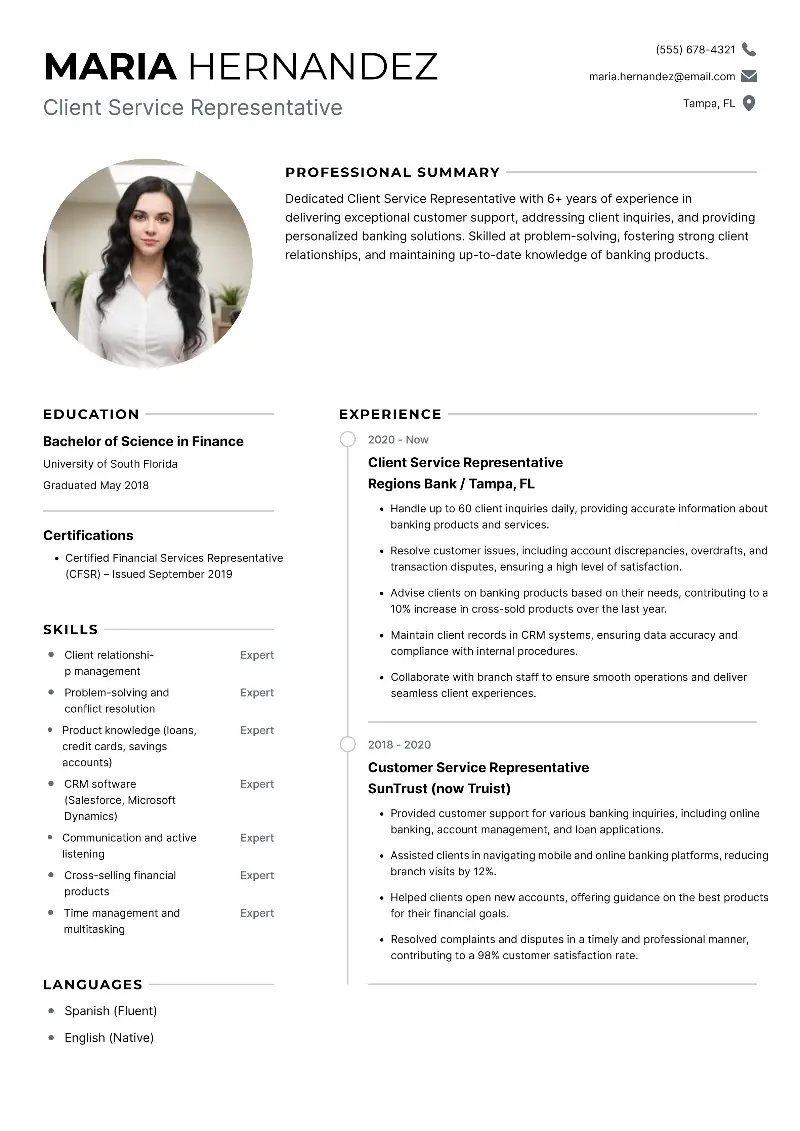

Client service representative resume sample

Bank of America resume template

Resume for Bank of America | Text version

Maria Hernandez

Tampa, FL | maria.hernandez@email.com | (555) 678-4321

Professional Summary

Dedicated Client Service Representative with 7+ years of experience in delivering exceptional customer support, addressing inquiries, and providing personalized banking solutions. Skilled at problem-solving, fostering strong client relationships, and maintaining up-to-date knowledge of banking products.

Professional Experience

Regions Bank, Tampa, FL

Client Service Representative

June 2020 – Present

- Handle up to 60 client inquiries daily, providing accurate information about banking products and services.

- Resolve customer issues, including account discrepancies, overdrafts, and transaction disputes, ensuring a high level of satisfaction.

- Advise clients on banking products based on their needs, contributing to a 10% increase in cross-sold products over the last year.

- Maintain client records in CRM systems, ensuring data accuracy and compliance with internal procedures.

- Collaborate with branch staff to ensure smooth operations and deliver seamless client experiences.

- Conduct client outreach calls to promote new offers and gather feedback to improve services.

SunTrust (now Truist), Tampa, FL

Customer Service Representative

March 2018 – May 2020

- Provided customer support for various banking inquiries, including online banking, account management, and loan applications.

- Assisted clients in navigating mobile and online banking platforms, reducing branch visits by 12%.

- Helped clients open new accounts, offering guidance on the best products for their financial goals.

- Resolved complaints and disputes in a timely and professional manner, contributing to a 98% customer satisfaction rate.

- Trained new hires on customer service protocols and product offerings.

Education

University of South Florida, Tampa, FL

Bachelor of Science in Finance

Graduated May 2018

Certifications

- Certified Financial Services Representative (CFSR) – Issued September 2019

Skills

- Client relationship management

- Problem-solving and conflict resolution

- Product knowledge (loans, credit cards, savings accounts)

- CRM software (Salesforce, Microsoft Dynamics)

- Communication and active listening

- Cross-selling financial products

- Time management and multitasking

- Risk identification and fraud prevention

Languages

- Spanish (Fluent)

- English (Native)

This sample Bank of America resume is effective for several reasons:

- It clearly articulates the candidate’s experience in customer service and their capability to provide personalized banking solutions.

- Familiarity with various banking products is beneficial for a client service role.

- The ability to communicate in Spanish adds value and expands the candidate’s potential client base.

What educational credentials should I add to my resume?

A well-crafted education section helps you highlight the academic foundations that qualify you for the role.

Include the following:

- Degree(s) earned (e.g., Bachelor of Science in Finance)

- Institution name and location

- Graduation date (or anticipated date)

- Relevant coursework (optional for recent graduates)

- Certifications (e.g., CFA, CPA)

How to organize the experience section in a resume

This section should demonstrate how your previous roles have prepared you for the position you're applying for at Bank of America.

Highlighting your accomplishments in this part will help recruiters understand the impact you’ve had in past roles.

- List your most recent position first, and work backward in reverse chronological order. Hiring managers care about your most relevant experiences.

- Clearly state your professional resume title at each company.

- Include both the company name and its location (city and state).

- For the dates of employment, use a standard format, such as "March 2020 – Present".

- Add bullet points to describe your responsibilities and focus on achievements rather than duties.

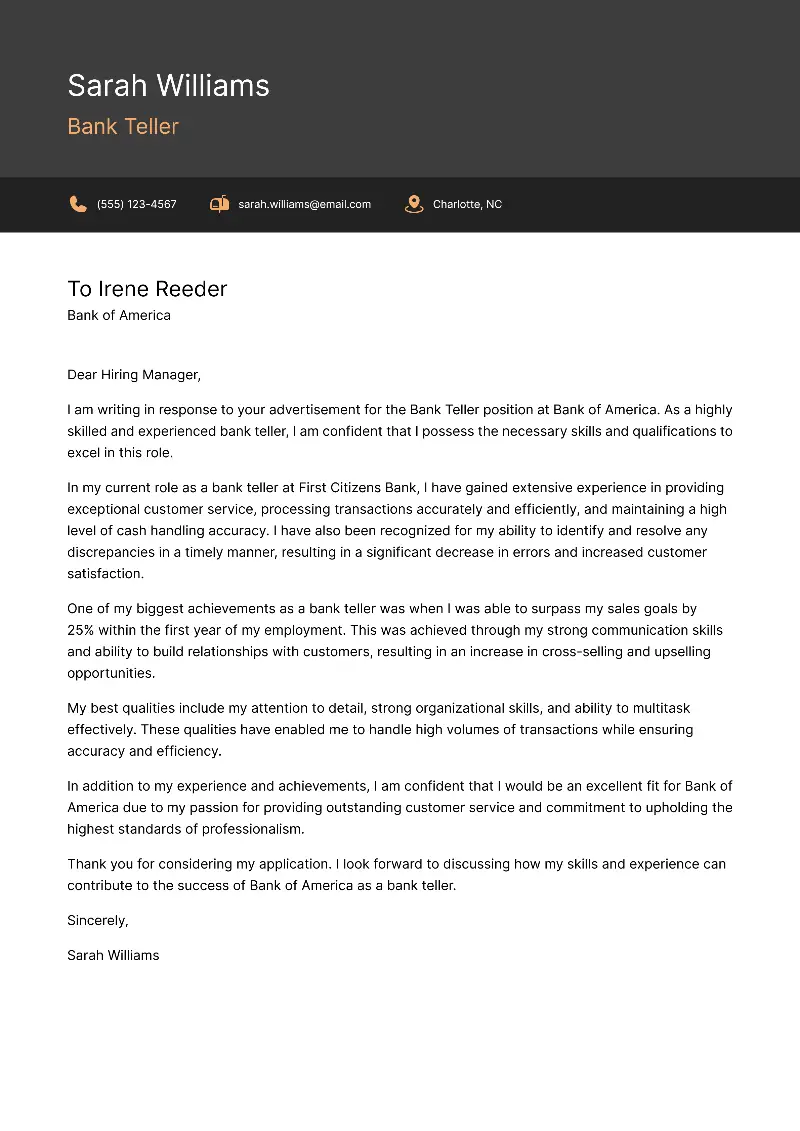

Cover letter for Bank of America

A cover letter is a one-page document submitted with an application that introduces you to the employer, highlights your qualifications, and explains why you're a good fit for the position.

Create your professional Cover letter in 10 minutes for FREE

Build My Cover Letter

How to write a Bank of America cover letter:

- Address it to the right person if possible. Look for the hiring manager’s name on the job posting or company website. If unavailable, use "Dear Hiring Manager."

- Start with a strong opening. Mention the specific position you're applying for and briefly highlight your enthusiasm for the role and the company.

- Tailor it to the job description. Use key skills and experiences that match what Bank of America is looking for, such as customer service, financial knowledge, or risk management.

- Highlight relevant achievements. Add quantifiable examples, like increasing customer satisfaction, managing large accounts, or improving efficiency in a previous role.

- Keep it concise and professional. Aim for a short cover letter that is three to four short paragraphs with clear, direct language. Avoid unnecessary fluff.

- End with a call to action. Express your interest in discussing your qualifications further and include your contact information.

- Proofread carefully. Check for grammar, spelling, and formatting errors to ensure a polished final product.

Bank of America cover letter example:

Conclusion

A well-crafted resume tailored to Bank of America can open doors to one of the largest financial institutions in the world.

By emphasizing relevant experience, showcasing measurable achievements, and presenting yourself as a solution-oriented candidate, you significantly increase your chances of standing out.

Take the time to review and refine your resume, ensuring it highlights your potential to contribute meaningfully to Bank of America’s mission. Remember, your application is your first impression—make it count.

Create your professional Resume in 10 minutes for FREE

Build My Resume