In the fast-paced world of security, having a strong fraud analyst resume is the first opportunity to make a lasting impression.

Whether you are a seasoned professional looking to take the next step in your career or a newcomer eager to join the field, a well-crafted document is essential to set you apart in a competitive market.

This article provides an in-depth resume making guide, complete with basic resume examples showcasing the key elements necessary to impress hiring managers.

Fraud analyst resume examples

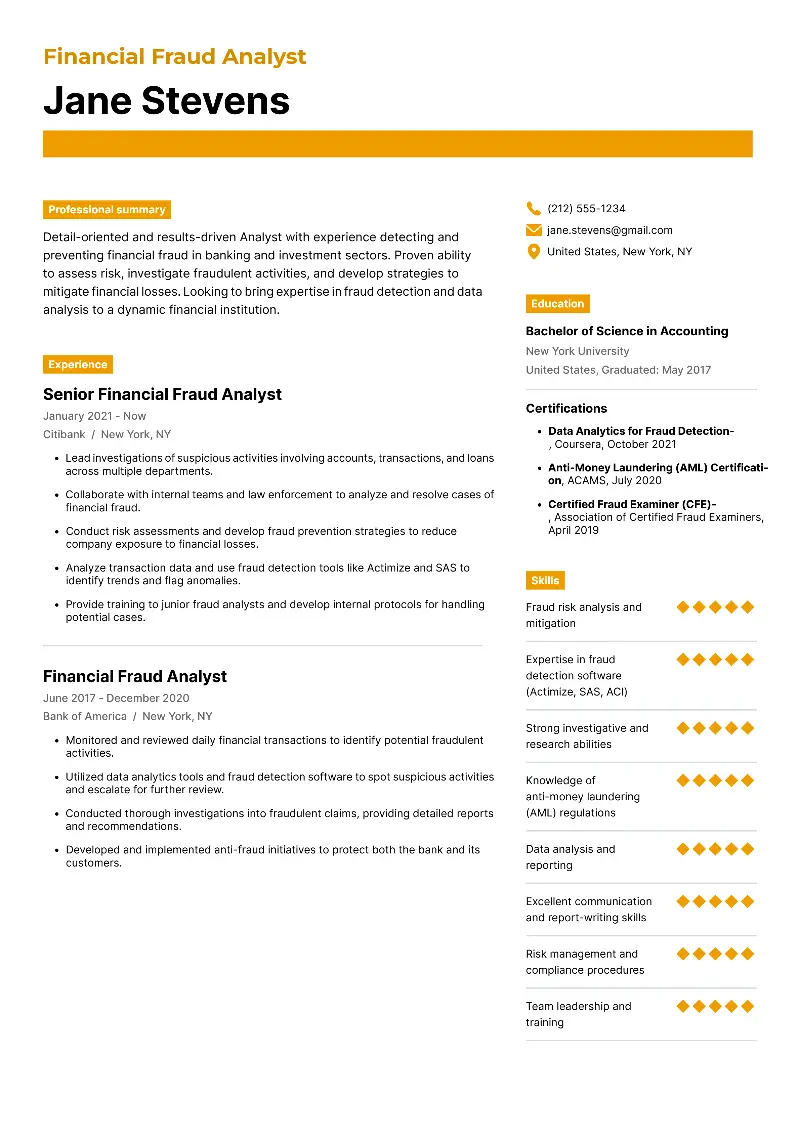

Financial fraud analyst resume

Financial fraud analyst resume template

Financial fraud analyst resume sample | Plain text

Jane Stevens

New York, NY

Email: jane.stevens@gmail.com

Phone: (212) 555-1234Objective

Detail-oriented and results-driven Analyst with experience detecting and preventing financial fraud in banking and investment sectors. Proven ability to assess risk, investigate fraudulent activities, and develop strategies to mitigate financial losses. Looking to bring expertise in fraud detection and data analysis to a dynamic financial institution.

Experience

Senior Financial Fraud Analyst

Citibank, New York, NY | January 2021 – Present

- Lead investigations of suspicious activities involving accounts, transactions, and loans across multiple departments.

- Collaborate with internal teams and law enforcement to analyze and resolve cases of financial fraud.

- Conduct risk assessments and develop fraud prevention strategies to reduce company exposure to financial losses.

- Analyze transaction data and use fraud detection tools like Actimize and SAS to identify trends and flag anomalies.

- Provide training to junior fraud analysts and develop internal protocols for handling potential cases.

Financial Fraud Analyst

Bank of America, New York, NY | June 2017 – December 2020

- Monitored and reviewed daily financial transactions to identify potential fraudulent activities.

- Utilized data analytics tools and fraud detection software to spot suspicious activities and escalate for further review.

- Conducted thorough investigations into fraudulent claims, providing detailed reports and recommendations.

- Developed and implemented anti-fraud initiatives to protect both the bank and its customers.

Education

Bachelor of Science in Accounting

New York University, NY

Graduated: May 2017

Certifications

- Data Analytics for Fraud Detection, Coursera, October 2021

- Anti-Money Laundering (AML) Certification, ACAMS, July 2020

- Certified Fraud Examiner (CFE), Association of Certified Fraud Examiners, April 2019

Skills

- Fraud risk analysis and mitigation

- Expertise in fraud detection software (Actimize, SAS, ACI)

- Strong investigative and research abilities

- Knowledge of anti-money laundering (AML) regulations

- Data analysis and reporting

- Excellent communication and report-writing skills

- Risk management and compliance procedures

- Team leadership and training

Why this fraud analyst sample resume is effective?

- The document showcases progression, from a junior analyst to a senior role, demonstrating growth and increased expertise.

- Certifications establish credibility and show that Jane stays current in the field.

- Key achievements highlight her leadership and ability to drive initiatives.

- How to format a fraud specialist resume?

- Ideally, your document should be 1 page for those with fewer than 10 years of experience.

- Set margins to 1 inch on all sides of the application.

- Stick to clean, legible fonts like Arial, Calibri, Times New Roman, or Helvetica.

- The standard size for most of the text should be between 10 to 12 points.

- Use black or dark gray for the body text. Avoid adding too many colors or bright hues to your fraud analyst resume.

- Leave enough space between different sections.

- The content should be left-aligned throughout the paper.

- Start each sentence with a strong action verb to demonstrate your achievements and initiative.

- Make sure to include relevant keywords from the job description.

- Do not write personal information such as age, marital status, or an SSN.

- Proofread your draft for any typos, grammatical mistakes, or formatting inconsistencies.

To guarantee you don't miss any important details, try an online resume AI builder.

Resume Trick offers a variety of free to use templates to choose from, each crafted to suit different job roles and industries.

Create your professional Resume in 10 minutes for FREE

Build My Resume

Corporate fraud analyst resume

Corporate fraud analyst resume example

Michael Johnson

Chicago, IL

Email: michael.johnson@gmail.com

Phone: (312) 555-9876Objective

Seasoned Corporate Analyst with expertise in fraud prevention, risk management, and case resolution. Proven track record of identifying and mitigating fraudulent activities in large corporate environments, leveraging advanced investigative techniques, data analysis, and compliance strategies.

Professional Experience

Lead Corporate Fraud Analyst

McKinsey & Company, Chicago, IL | March 2020 – Present

- Lead and manage investigations into internal fraud, employee misconduct, and financial irregularities.

- Develop, implement, and monitor anti-fraud programs tailored to the company’s policies.

- Prepare and deliver comprehensive fraud analysis reports and presentations to senior management.

- Mentor and train junior fraud analysts on investigative techniques and data analysis.

Corporate Fraud Analyst

Bain & Company, Chicago, IL | June 2014 – February 2020

- Worked with cross-functional teams, including legal counsel and accountants, to conduct forensic investigations and uncover discrepancies in financial reporting.

- Played a key role in the development of corporate fraud prevention initiatives, including awareness training and education programs.

- Utilized advanced data mining and forensic analysis techniques to uncover hidden fraud patterns.

Education

Bachelor of Science in Criminal Justice

University of Illinois, Chicago, IL

Graduated: May 2014

Certifications

- Certified Fraud Examiner (CFE), August 2020

- Certified Information Systems Auditor (CISA), December 2019

- Certified in Risk and Information Systems Control (CRISC), July 2019

Skills

- Expert in managing investigations, including financial misconduct, employee theft, and vendor fraud.

- Advanced ability to identify, assess, and mitigate risks to minimize corporate vulnerabilities.

- Proficient in utilizing forensic accounting techniques and data mining tools.

- Extensive experience in conducting internal audits to ensure compliance with legal and regulatory standards.

- Excellent written and verbal communication skills, with experience presenting findings and recommendations.

Languages

- French (Fluent)

- Spanish (Intermediate)

Volunteer Experience

Fraud Prevention Advisor

Nonprofit Organization for Financial Literacy, Chicago, IL | January 2018 – Present

- Advise and train nonprofit staff on fraud detection and prevention strategies, helping to reduce financial vulnerabilities within the organization.

Why this resume for fraud analyst works?

- The opening statement is concise, yet powerful. It clearly presents Michael's experience and focuses on his core strengths.

- Including languages is an added bonus, especially in large, global organizations where multilingual communication could be an asset.

- Working with a nonprofit organization helps to portray him as a well-rounded individual with a passion for fraud prevention beyond his obligations.

- What is the difference between fraud analyst resume summary and objective?

| Aspect | Summary | Objective |

|---|---|---|

| Purpose | Provides a snapshot of qualifications. | States goals and the position being targeted. |

| Focus | Highlights career progression. | Focuses on future aspirations. |

| Length | 2-4 lines. | 1-2 lines. |

| Usage | Suitable for experienced professionals with a clear track record. | Ideal for entry-levels or those changing industry. |

| Example | Tech-savvy Fraud Analyst with a specialization in cybersecurity. Over 4 years of experience investigating digital fraud, identifying vulnerabilities, and implementing measures to protect sensitive information. Skilled in using tools, data encryption, and algorithms to combat emerging threats. | Seeking to apply my expertise in risk management as a Fraud Analyst to enhance prevention measures and protect the company from financial losses. |

- How to list education on a resume for fraud?

Each entry should include the following:

- The type of your degree.

- The name of the school, university, or college where you studied.

- The city and state (or country if abroad) of the institution.

- The date you graduated or are expected to.

- GPA, if it is particularly high (e.g., 3.5 or above).

- Relevant coursework, honors or any academic awards.

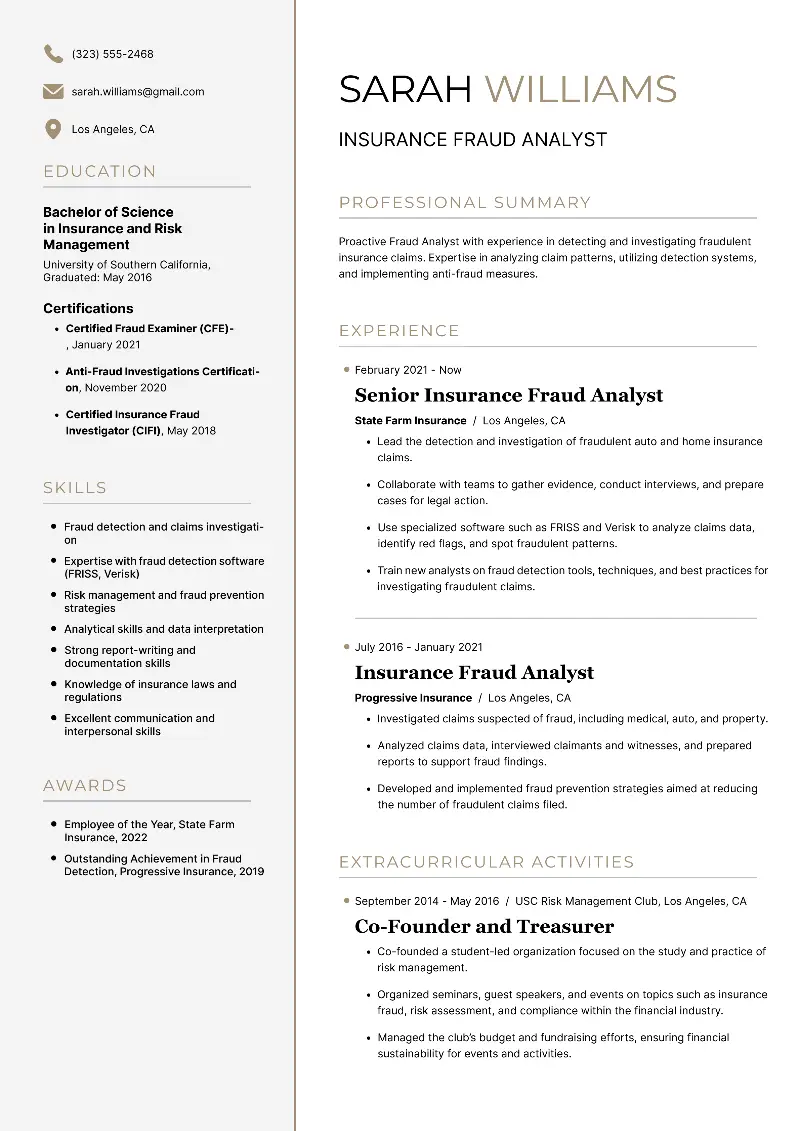

Insurance fraud analyst resume

Insurance fraud analyst resume template

Insurance fraud analyst resume sample | Plain text

Sarah Williams

Los Angeles, CA

Email: sarah.williams@gmail.com

Phone: (323) 555-2468Objective

Proactive Fraud Analyst with experience in detecting and investigating fraudulent insurance claims. Expertise in analyzing claim patterns, utilizing detection systems, and implementing anti-fraud measures.

Experience

Senior Insurance Fraud Analyst

State Farm Insurance, Los Angeles, CA | February 2021 – Present

- Lead the detection and investigation of fraudulent auto and home insurance claims.

- Collaborate with teams to gather evidence, conduct interviews, and prepare cases for legal action.

- Use specialized software such as FRISS and Verisk to analyze claims data, identify red flags, and spot fraudulent patterns.

- Train new analysts on fraud detection tools, techniques, and best practices for investigating fraudulent claims.

Insurance Fraud Analyst

Progressive Insurance, Los Angeles, CA | July 2016 – January 2021

- Investigated claims suspected of fraud, including medical, auto, and property.

- Analyzed claims data, interviewed claimants and witnesses, and prepared reports to support fraud findings.

- Developed and implemented fraud prevention strategies aimed at reducing the number of fraudulent claims filed.

Education

Bachelor of Science in Insurance and Risk Management

University of Southern California, Los Angeles, CA

Graduated: May 2016

Certifications

- Certified Fraud Examiner (CFE), January 2021

- Anti-Fraud Investigations Certification, November 2020

- Certified Insurance Fraud Investigator (CIFI), May 2018

Skills

- Fraud detection and claims investigation

- Expertise with fraud detection software (FRISS, Verisk)

- Risk management and fraud prevention strategies

- Analytical skills and data interpretation

- Strong report-writing and documentation skills

- Knowledge of insurance laws and regulations

- Excellent communication and interpersonal skills

Awards

- Employee of the Year, State Farm Insurance, 2022

- Outstanding Achievement in Fraud Detection, Progressive Insurance, 2019

Extracurricular Activities

Co-Founder and Treasurer

USC Risk Management Club, Los Angeles, CA | September 2014 – May 2016

- Co-founded a student-led organization focused on the study and practice of risk management.

- Organized seminars, guest speakers, and events on topics such as insurance fraud, risk assessment, and compliance within the financial industry.

- Managed the club’s budget and fundraising efforts, ensuring financial sustainability for events and activities.

Strong sides of this resume for fraud analyst:

- Awards demonstrate that Sarah's performance has been recognized by her employers.

- The extracurricular experience also highlights her ability to manage projects, organize events, and collaborate with others.

- The education section includes a relevant degree from a respected institution, which further strengthens qualifications.

- How to organize experience on a fraud specialist resume?

- Arrange your work history in reverse chronological order.

- Make sure to outline your job title clearly for each role.

- List the company name and its location. If remote, mention this.

- Always include start and end dates (month and year).

- Focus on accomplishments and responsibilities.

- Use bullet points to break up the information.

- Quantify results where possible.

- What are the key fraud analyst skills for resume?

- Hard skills are teachable abilities or knowledge sets that are typically gained through education, training, or work experience. They are often measurable.

- Soft skills are more subjective and relate to how you interact with others and approach your work. They are harder to quantify but are equally important for career success.

Hard skills for fraud analyst resume:

- Fraud detection software (e.g., FRISS, Verisk, Actimize)

- Data analysis and data mining

- Forensic accounting

- Risk assessment and management

- Anti-money laundering (AML) practices

- Fraud investigation techniques

- Legal and regulatory compliance (e.g., FCPA, GDPR)

- Knowledge of insurance fraud

- Report writing and documentation

- Use of fraud detection tools (e.g., ACL, SQL)

- Financial statement analysis

- Internal auditing

- Case management software

- Advanced Excel skills (e.g., pivot tables, VLOOKUP)

- Knowledge of financial regulations (e.g., Sarbanes-Oxley, SOX)

- Conducting interviews and interrogations

- Cybersecurity knowledge

- Identifying financial fraud trends

- Investigative techniques in legal settings

- Anti-fraud training and awareness programs

Soft skills for fraud analyst resume:

- Attention to detail

- Analytical thinking

- Problem-solving

- Communication (written and verbal)

- Critical thinking

- Time management

- Conflict resolution

- Collaboration and teamwork

- Decision making

- Adaptability

- Multitasking

- Stress management

- Interpersonal skills

- Organization and prioritization

- Negotiation skills

- Integrity and ethics

- Confidentiality

- Leadership and mentoring

- Empathy

- Customer service orientation

Conclusion

Creating a standout fraud analyst resume involves clearly showcasing your expertise, certifications, and achievements that align with the specific job.

By tailoring your document to highlight relevant skills, work experience, and strengths, you can make a compelling case to potential employers.

Create your professional Resume in 10 minutes for FREE

Build My Resume