In the ever-evolving world of insurance, staying ahead of the curve requires more than just experience; it demands a commitment to ongoing education and development.

Insurance certifications have become a vital component in this journey, offering professionals a structured path to enhance their knowledge, skills, and credibility.

These certificates not only bolster individual perspectives but also ensure that work practices adhere to the highest standards of quality and ethics.

This article delves into the various types of insurance certifications, their significance in professional growth, and how to write a resume and properly list them for a successful and dynamic career in the insurance field.

What is an insurance certification?

A certification for insurance is a formal recognition awarded to individuals who have demonstrated a specific level of expertise and proficiency in various aspects of the field.

These certifications are typically issued by professional organizations, educational institutions, or industry bodies and are designed to validate a person's qualifications and skills in specialized areas of insurance practice.

Key aspects:

- Focus on specialized areas within the industry, such as risk management, underwriting, claims adjustment, financial planning, or regulatory compliance.

- Achieving certification usually requires meeting certain educational qualifications and work experience.

- Often necessitate continuing education to maintain the credential.

- Holding certifications in insurance can enhance a professional's credibility, job prospects and professional goals.

Types of insurance certifications

Obtaining a certification in the insurance sphere can be a valuable asset for professionals looking to advance their careers. With a wide range of insurance certificate programs available, it can be overwhelming to decide which one is right for you.

Below is a list of insurance designations that can give you an edge in this competitive field.

1. Chartered Property Casualty Underwriter (CPCU)

Approximately $3,500 - $4,500 total for courses and exams

The CPCU designation represents a comprehensive understanding of risk management and insurance principles. It is one of the most prestigious credentials in the property and casualty insurance sector.

| Issuing Organization | Learning Duration | Validity Period | Requirements |

|---|---|---|---|

| The Institutes | 12-18 months, depending on student's progress and level. | Lifetime, with optional continuing education to stay current. | - Completion of 8 required courses (including passing exams). - Minimum 2 years of work experience in the insurance sphere. - Maintain membership and participate in continuing education. |

2. Certified Insurance Counselor (CIC)

Around $3,000 - $4,000 for all five institutes

The CIC certification demonstrates expertise across variety of insurance policies and practices, including commercial, personal, and life insurance.

| Issuing Organization | Learning Duration | Validity Period | Requirements |

|---|---|---|---|

| The National Alliance for Insurance Education & Research | 6-12 months, depending on course schedules and individual pace. | 3 years. | - Completion of five CIC institutes (including passing exams). - Continuing education requirements to keep certification. - Annual fee and adherence to ethical standards. |

3. Certified Risk Manager (CRM)

Approximately $2,000 - $3,000 for five courses

The CRM insurance accreditation focuses on advanced risk management practices, strategies, and frameworks.

| Issuing Organization | Learning Duration | Validity Period | Requirements |

|---|---|---|---|

| The National Alliance for Insurance Education & Research | 6-12 months. | 3 years. | - Combination of five CRM courses (plus passing exams). |

4. Certified Financial Planner (CFP)

$4,000 - $7,000 for education, exam, and certification fees

The CFP certification integrates financial planning and insurance components, focusing on providing comprehensive budget advice.

| Issuing Organization | Learning Duration | Validity Period | Requirements |

|---|---|---|---|

| Certified Financial Planner Board of Standards | 18-24 months, based on prior knowledge and study pace. | 2 years. | - Completion of CFP Board-registered education program. - Passing the CFP exam. - Relevant work experience (typically 3 years). - Continuing education and abiding by the CFP Board's ethical rules. |

5. Certified Employee Benefit Specialist (CEBS)

Roughly $4,500 - $6,000 for all course modules and exams

The CEBS insurance credential focuses on staff benefits and compensation, including health, retirement, and other plans.

| Issuing Organization | Learning Duration | Validity Period | Requirements |

|---|---|---|---|

| - International Foundation of Employee Benefit Plans. - Wharton School of the University of Pennsylvania | 12-18 months. | 2 years. | - Completion of a series of courses and exams (usually 8). - Background in workers benefits. |

6. Associate in Risk Management (ARM)

About $1,200 - $1,800 for three courses

The ARM certification is aimed at individuals focused on risk management principles and practices.

| Issuing Organization | Learning Duration | Validity Period | Requirements |

|---|---|---|---|

| The Institutes | 6-12 months. | 3 years. | - Pass three ARM courses. |

7. Associate in Claims (AIC)

Around $1,200 - $1,800 for three courses

The AIC insurance designation is for employees specializing in claims management, covering various aspects of claims processes and regulations.

| Issuing Organization | Learning Duration | Validity Period | Requirements |

|---|---|---|---|

| The Institutes | 6-12 months. | 3 years. | - Completion of three AIC courses (including passing exams). - Professional conduct adherence. |

8. Certified Insurance Fraud Investigator (CIFI)

Typically $1,500 - $2,500 including training and exam

The CIFI certification is designed for experts who focus on the detection and investigation of insurance fraud.

| Issuing Organization | Learning Duration | Validity Period | Requirements |

|---|---|---|---|

| International Association of Special Investigation Units (IASIU) | 6-12 months. | 3 years. | - Completion of fraud investigation training and coursework. - Passing a certification exam. - Relevant work experience. |

9. Certified Professional Insurance Agent (CPIA)

Approximately $800 - $1,200 for course and exam

The CPIA insurance credential focuses on sales, service, and agency management.

| Issuing Organization | Learning Duration | Validity Period | Requirements |

|---|---|---|---|

| National Association of Professional Insurance Agents (PIA) | 3-6 months. | 2 years. | - Course completion (including passing exams). |

10. Associate in Personal Insurance (API)

About $1,200 - $1,800 for three courses

The API certification covers personal lines insurance, including auto, home, and other policies.

| Issuing Organization | Learning Duration | Validity Period | Requirements |

|---|---|---|---|

| The Institutes | 6-12 months. | 3 years. | - Completion of three API courses (including passing exams). |

11. Certified Professional in Insurance Regulation (CPIR)

Roughly $1,000 - $1,500 depending on courses taken

This insurance license focuses on regulatory compliance and governance.

| Issuing Organization | Learning Duration | Validity Period | Requirements |

|---|---|---|---|

| National Association of Insurance Commissioners (NAIC) | 6-12 months. | 3 years. | - Take and pass the appropriate courses. - Experience in insurance regulation. |

12. Associate in Surplus Lines Insurance (ASLI)

Around $1,200 - $1,800 for required courses

The ASLI certification focuses on surplus lines insurance, which covers high-risk or unusual insurance needs not addressed by standard insurers.

| Issuing Organization | Learning Duration | Validity Period | Requirements |

|---|---|---|---|

| The Institutes | 6-12 months. | 3 years. | - Completion of relevant courses and passing exams. - Work experience in surplus lines insurance. |

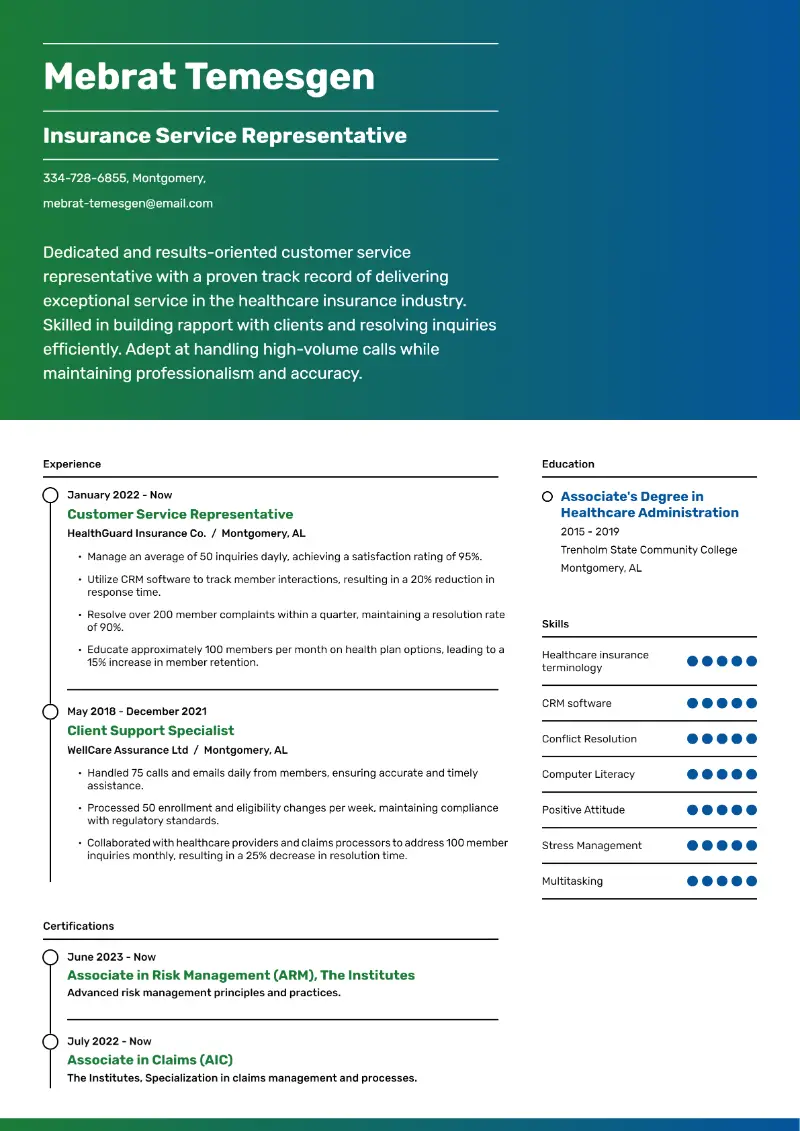

How to list insurance certifications on a resume?

Certifications can lead to better job security and opportunities for advancement within your organization. They show you are keeping up with changes in the insurance industry.

Some jobs require specific certifications as a prerequisite.

Below is a step-by-step guide on how to put certifications for insurance agents on your resume.

Step 1. Create a Certifications Section

- Add a dedicated insurance designations list to ensure they are easily visible.

- Place this section near the top of your resume if the credentials are crucial to the job you are applying for.

Create your professional Resume in 10 minutes for FREE

Build My Resume

Step 2. Format the Section

- Use a consistent format for recording insurance licensing.

- Include the certificate name, issuing organization, date obtained, and expiration date if applicable.

Step 3. Prioritize

- Write the most relevant and prestigious certifications first.

- If you have many certificates, consider grouping them by relevance or area of expertise.

Example:

Certified Financial Services Counselor (CFSC)

- Issuing Organization: National Association of Financial Planners (NAFP)

- Date Obtained: August 2022

FAQ

- Are insurance certifications mandatory?

- While certificates are not always legally required, many employers prefer or require them to ensure employees have a high level of expertise. Additionally, certain specialized roles may mandate specific certifications as part of industry regulations.

- Where can I find resources to help prepare for exams?

- Many professional insurance organizations, such as The Institutes and NAIC, provide study materials, courses, and preparation tools. Additionally, many online platforms offer training programs and practice exams.

Conclusion

Investing in insurance certifications is a strategic move that can lead to increased job security, higher earning potential, and greater professional fulfillment.

As the industry continues to grow and adapt, staying certified ensures that you remain at the forefront of knowledge and practice, ready to meet the demands of today's dynamic insurance environment.