Your investment banking resume? Think of it as your VIP pass — without it, good luck getting past the velvet rope.

Whether you’re a hustling analyst eyeing that promotion, or a fresh grad ready to bring some noise to finance, you’ve gotta build a resume that actually gets you noticed.

This guide’s got your back, breaking down how to whip up an application that packs a punch, and tossing in free resume examples for every type of banking role. We’ll run through the core stuff like skills, work history, and those bonus sections that’ll show off what makes you a catch.

Investment banking resume examples

- Investment banking analyst resume

- Investment banking associate resume

- Mergers and acquisitions investment banking resume

- Venture capital investment banking resume

- Corporate finance investment banking resume

Investment banking analyst resume

The BLS states that “Business and Financial Operations Occupations” are projected to grow faster than average for all occupations from 2023-2033.

Investment banking analyst resume template

Investment banking analyst resume sample | Plain text

Jim Harper

New York, NY

Email: jim.harper@gmail.com

Phone: (555) 123-4567Resume Summary

Detail-oriented Investment Banking Analyst with 5+ years of experience in financial modeling, equity research, and advising clients on complex transactions. Strong proficiency in analyzing financial statements and developing strategies for mergers and acquisitions.

Experience

Investment Banking Analyst

Goldman Sachs, New York, NY — June 2021 – Present

- Develop detailed financial models, including DCF, LBO, and comparable company analysis, to evaluate investment opportunities.

- Dive into industry and company research, making sure the senior team always has the latest insights.

- Help structure and negotiate M&A transactions, capital raises, and the occasional corporate shake-up.

- Tackle due diligence for clients from all sorts of sectors. I’m the one who double-checks everything so there are no surprises.

Intern, Investment Banking

Morgan Stanley, New York, NY — June – August 2020

- Kept a close eye on market trends and put together financial reports for the higher-ups.

- Created pitch materials and joined client meetings, learning the ropes of the business and picking up a few tricks along the way.

- Ran basic financial models and backed up the team as they sized up new opportunities.

Education

Bachelor of Science in Finance

New York University, NY — Graduated: May 2021

- GPA: 3.85/4.0

- Relevant Coursework: Corporate Finance, Investment Analysis, Derivatives

Certifications

- Financial Modeling & Valuation Analyst (FMVA), Corporate Finance Institute — Certified: August 2022

- Series 79 – Investment Banking Representative Exam, FINRA — Certified: June 2021

Skills

- Financial Modeling (DCF, LBO, M&A, Comparable Analysis)

- Advanced Excel and PowerPoint

- Due Diligence and Market Research

- Corporate Valuation

- Client Relationship Management

- Strong Analytical and Problem-Solving Skills

Awards

- Dean’s List, New York University (2019, 2020)

- 1st Place, Financial Modeling Competition, CFI (2020)

Why this resume for investment banking example is effective?

- This one doesn’t waste time — it spotlights essential skills like financial modeling and market research, which are absolute must-haves for landing a gig.

- Each bullet on this investment banking resume zooms in on a single task, centering what the candidate actually did and tossing in concrete achievements whenever possible.

- The inclusion of awards and relevant coursework is smart. It gives the whole profile an extra boost, proving the person’s got both knowledge and drive.

How to format an investment bank resume?

- Opt for plain fonts such as Calibri, Arial, or Times New Roman.

- Keep font sizes between 10 and 12 for the main text. Your name can pop a bit more.

- Set margins from 0.5 to 1 inch all around, so it doesn’t look cramped or too spaced out.

- Go with single spacing inside resume sections, but don’t forget a line break.

- Stick to one page resume examples — even if you’ve got years under your belt.

- Everything should be on the left side for easy scrolling. Make sure those bullet points are aligned too.

- Kick off every entry with strong action verbs.

- Tweak your resume to fit the job — throw in relevant keywords for resume.

- Avoid fancy graphics, colors, or tables.

- Ensure grammar, punctuation, and capitalization are consistent and error-free.

- Save your paper as a PDF so nothing gets messed up in transit.

To guarantee you cover all the bases, give an online resume generator a shot.

With a wide selection of modern resume templates, Resume Trick provides everything you need to craft a standout document that highlights your qualifications.

Create your professional Resume in 10 minutes for FREE

Build My Resume

Investment banking associate resume

Investment banking associate resume example

Sarah Lee

Chicago, IL

Email: sarah.lee@gmail.com

Phone: (555) 654-7890Resume Summary

Results-driven Private Equity Associate with experience in sourcing, evaluating, and executing investments in high-growth companies. Expertise in financial modeling, operational improvements, and managing portfolio companies to drive value creation. Proven track record in working with C-suite executives to strategize and execute growth initiatives.

Experience

Private Equity Associate

Blackstone Group, Chicago, IL — January 2020 – Present

- Scouted and reviewed more than 20 investment opportunities, always on the lookout for companies with unrealized potential (and a few diamonds in the rough).

- Conduct thorough due diligence and financial modeling for potential acquisitions, including LBO analysis.

- Lead the development of strategic plans for portfolio companies to optimize operational performance and growth.

- Work closely with management teams to implement value creation initiatives, including cost reduction and revenue enhancement strategies.

Private Equity Analyst

Kohlberg Kravis Roberts & Co., Chicago, IL — June 2017 – December 2019

- Supported senior investors on deals totaling over $2B (yep, billion with a “B”).

- Put together investment memos, models, and in-depth market research — lots of late nights, lots of caffeine.

- Helped map out operational strategies for portfolio companies, always chasing higher efficiency and bigger profits.

Education

Master of Business Administration (MBA)

University of Chicago Booth School of Business, IL — Graduated: June 2017

GPA: 3.9/4.0

Bachelor of Science in Economics

University of California, Berkeley, CA — Graduated: May 2013

Certifications

Chartered Financial Analyst (CFA) Level II

CFA Institute — Completed: June 2019

Skills

- Leveraged Buyouts (LBO) & Debt Financing

- Financial Modeling & Valuation

- Due Diligence & Investment Analysis

- Portfolio Management & Operational Improvement

- Market Research & Competitive Analysis

- Strong Negotiation & Communication Skills

Why this investment banking sample resume stands out?

- Sarah’s not just sitting still — she’s climbed from Analyst up to Associate, so you can see she’s actually leveling up and grabbing more responsibility.

- She nailed MBA at a top business school and kept her GPA high, which totally boosts her street cred.

- She’s rocking a CFA certification and has serious skills in financial modeling. Basically, she’s got the whole toolkit private equity firms drool over.

What is the difference between investment banking resume summary and objective?

| Aspect | Summary | Objective |

|---|---|---|

| Purpose | Spotlights major wins and qualifications. | Lays out your smart goals and what you’re hoping to get from the role. |

| Focus | Zeros in on your existing efforts. | Looks ahead to your next goal. |

| Target Audience | Usually for folks with some miles on the clock. | A better fit if you’re new or a career switcher. |

| Content | Calls out impressive deals and leadership achievements. | States interest in gaining investment banking exposure. |

| Tone | Confident and results-driven. | More about potential and ambition. |

| Example | Investment banking professional with 5+ years of experience in executing $1B+ transactions across M&A, debt restructuring, and IPOs. Skilled in building client relationships, conducting complex valuation analyses, and leading due diligence efforts. | Seeking an investment banking analyst role to leverage academic knowledge of corporate finance and valuation techniques while gaining hands-on experience. |

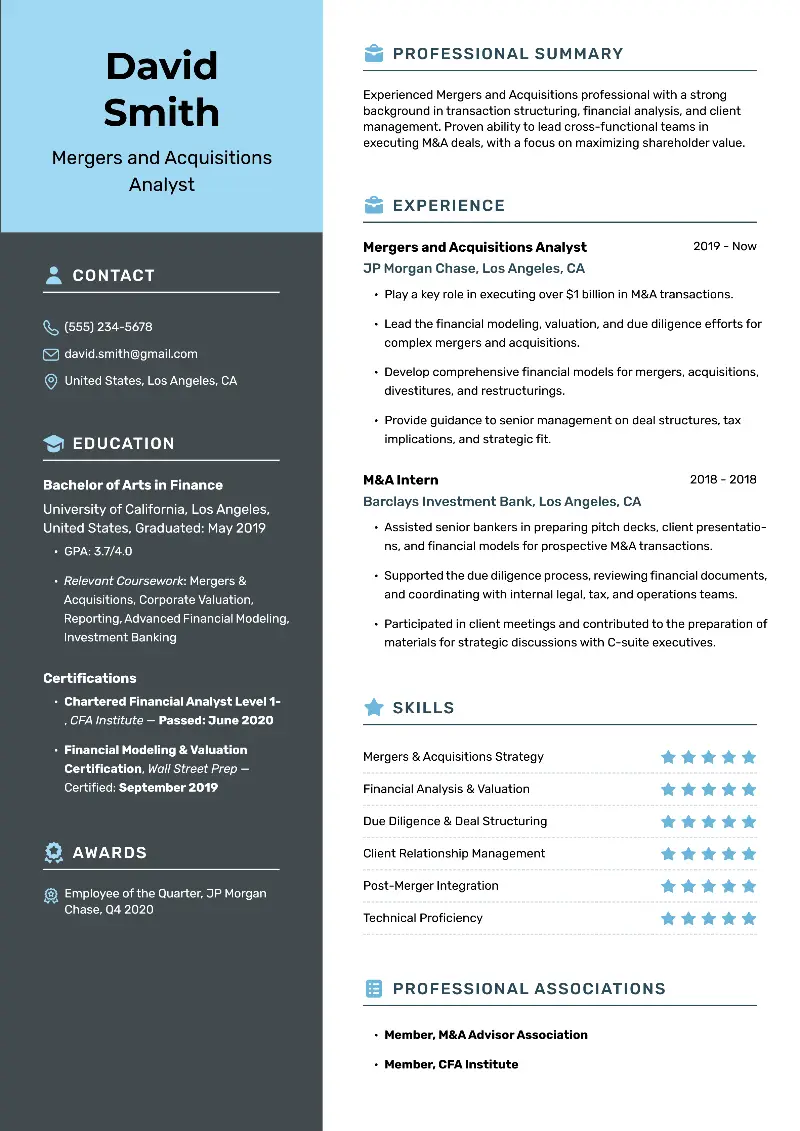

Mergers and acquisitions investment banking resume

Mergers and acquisitions investment banking resume template

Mergers and acquisitions investment banking resume sample | Plain text

David Smith

Los Angeles, CA

Email: david.smith@gmail.com

Phone: (555) 234-5678Resume Summary

Experienced Mergers and Acquisitions professional with a strong background in transaction structuring, financial analysis, and client management. Proven ability to lead cross-functional teams in executing M&A deals, with a focus on maximizing shareholder value.

Experience

Mergers and Acquisitions Analyst

JP Morgan Chase, Los Angeles, CA — April 2019 – Present

- Played a major part in executing over $1B in transactions.

- Lead the financial modeling, valuation, and due diligence efforts for complex mergers and acquisitions.

- Develop comprehensive financial models for mergers, acquisitions, divestitures, and restructurings.

- Provide guidance to senior management on deal structures, tax implications, and strategic fit.

M&A Intern

Barclays Investment Bank, Los Angeles, CA — June – August 2018

- Helped senior bankers put together killer pitch decks and client presentations.

- Got into the weeds with due diligence, reviewing financial docs and wrangling legal, tax, and ops teams to keep things moving.

- Sat in on client meetings and prepped materials for some pretty high-profile discussions with execs.

Education

Bachelor of Arts in Finance

University of California, Los Angeles (UCLA), CA — Graduated: May 2019

- GPA: 3.7/4.0

- Relevant Coursework: Mergers & Acquisitions, Corporate Valuation, Reporting, Advanced Financial Modeling, Investment Banking

Certifications

- Chartered Financial Analyst Level 1, CFA Institute — Passed: June 2020

- Financial Modeling & Valuation Certification, Wall Street Prep — Certified: September 2019

Skills

- Mergers & Acquisitions Strategy

- Financial Analysis & Valuation

- Due Diligence & Deal Structuring

- Client Relationship Management

- Post-Merger Integration

- Technical Proficiency

Awards & Recognition

- Employee of the Quarter, JP Morgan Chase, Q4 2020

Professional Associations

- Member, M&A Advisor Association

- Member, CFA Institute

Why this example investment banking resume works?

- The resume opening statement instantly spotlights hands-on M&A experience, leadership qualities, and clear value creation — not just generic claims.

- Extracurricular activities indicate real industry engagement and dedication beyond the job description.

- Listing targeted high income skills helps with keyword matching, giving the resume an edge with applicant tracking systems.

How to organize education on an investment banking resume?

Follow this format for each entry:

- Degree Earned

- Institution Name

- Location

- Graduation Date

- GPA (if 3.5 or higher)

- Latin Honors & Awards

Venture capital investment banking resume

Venture capital investment banking resume example

David Miller

San Francisco, CA

Email: david.miller@gmail.com

Phone: (555) 123-9876Resume Summary

Results-driven Venture Capital Analyst with of experience in evaluating early-stage investments, conducting market research, and performing due diligence. Proficient in identifying emerging trends, financial modeling, and assisting in the negotiation and structuring of deals.

Experience

Venture Capital Analyst

Tech Ventures Capital, San Francisco, CA, June 2021 – July 2025

- Conducted extensive market research to identify high-potential investment opportunities in the tech sector.

- Evaluated over 100 startup pitches and performed detailed financial modeling and valuation assessments.

- Assisted in due diligence processes, including financial analysis, competitor benchmarking, and risk assessment.

- Worked closely with senior partners to support the negotiation and execution of investment deals.

Investment Analyst Intern

Growth Capital Partners, San Francisco, CA, June – August 2020

- Assisted in sourcing and evaluating startup opportunities across a variety of industries, including healthcare and fintech.

- Prepared financial reports, including cash flow projections, valuation models, and SWOT analyses for potential investments.

- Participated in team meetings and strategy sessions, contributing to key decision-making processes.

Education

Bachelor of Science in Finance

University of California, Berkeley, CA

Graduated: May 2021

Relevant Coursework: Venture Capital, Financial Modeling, Startup Valuation, Business Strategy

Skills

- Financial modeling and valuation (DCF, comparables, precedent transactions)

- Market research and competitor analysis

- Due diligence and investment evaluation

- Proficient in Excel, PowerPoint, and Bloomberg Terminal

- Strong written and verbal communication skills

Certifications

Financial Modeling & Valuation Analyst (FMVA)

Corporate Finance Institute, June 2022

Languages

- French (fluent)

Hobbies

- Volunteering

- Soccer

Why this resume of investment banking sample is compelling?

- The education section isn’t just ticking boxes — it includes a degree and courses that fit right in with what banks want to see.

- Knowing more than one language? That’s a serious edge in this field. It can land you a seat at the table for global deals most folks can’t touch.

- Tossing in hobbies might seem extra, but it’s smart. Maybe your marathon running or random love for chess sparks a chat that helps you click with the interviewer.

How to list experience on a resume for investment banking?

- Stack your occupations from newest to oldest in reverse chronological order. For each entry provide employment dates.

- Use a clear job title. Include the full company name and where it’s based. No one wants to guess.

- If you have any gaps in employment, get ready to talk about them at the interview. It’s all good, be upfront.

- Utilize bullet points to break down your responsibilities and achievements.

- Whenever you can, slap in some numbers. Raised $2 million? Closed five deals in a month? Say it.

- Don’t leave out internships, especially if they’re banking-related. Even that one summer gig could be your ticket in.

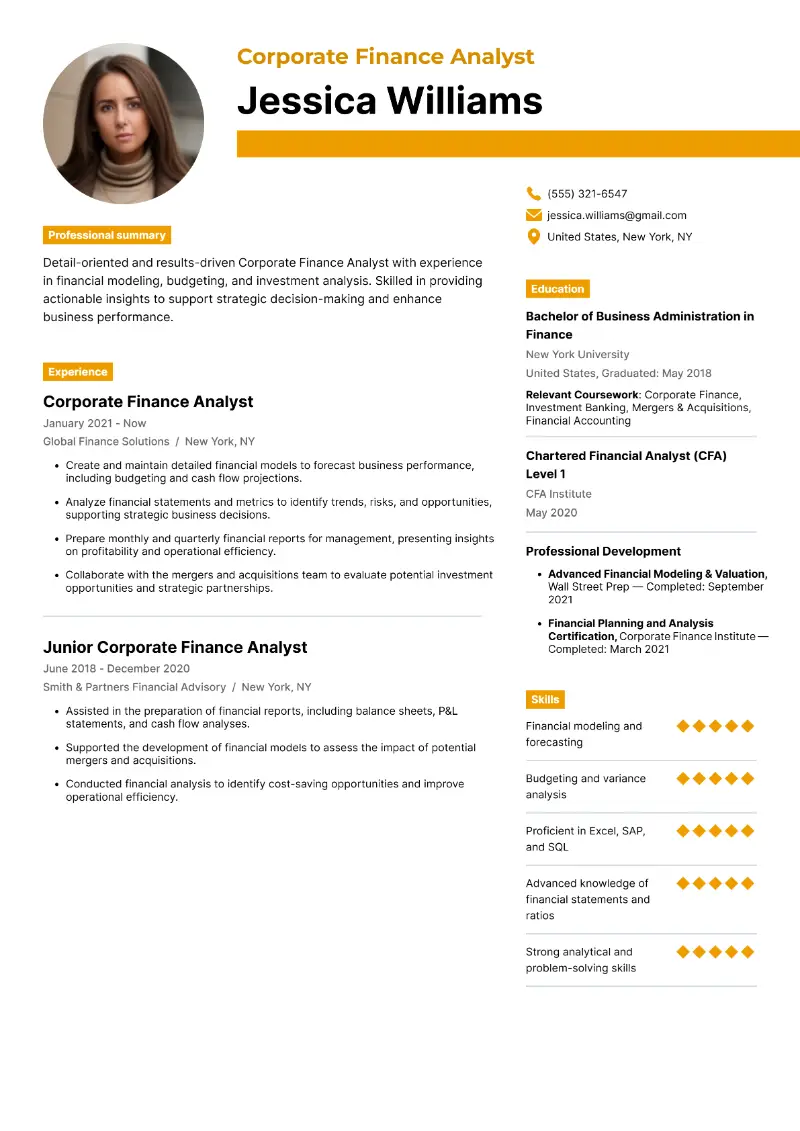

Corporate finance investment banking resume

Corporate finance investment banking resume template

Corporate finance investment banking resume sample | Plain text

Jessica Williams

New York, NY

Email: jessica.williams@gmail.com

Phone: (555) 321-6547Resume Summary

Detail-oriented and results-driven Corporate Finance Analyst with experience in financial modeling, budgeting, and investment analysis. Skilled in providing actionable insights to support strategic decision-making and enhance business performance.

Experience

Corporate Finance Analyst

Global Finance Solutions, New York, NY, January 2021 – Present

- Create and maintain detailed financial models to forecast business performance, including budgeting and cash flow projections.

- Analyze financial statements and metrics to identify trends, risks, and opportunities, supporting strategic business decisions.

- Prepare monthly and quarterly financial reports for management, presenting insights on profitability and operational efficiency.

- Collaborate with the mergers and acquisitions team to evaluate potential investment opportunities and strategic partnerships.

Junior Corporate Finance Analyst

Smith & Partners Financial Advisory, New York, NY, June 2018 – December 2020

- Assisted in the preparation of financial reports, including balance sheets, P&L statements, and cash flow analyses.

- Supported the development of financial models to assess the impact of potential mergers and acquisitions.

- Conducted financial analysis to identify cost-saving opportunities and improve operational efficiency.

Education

Bachelor of Business Administration in Finance

New York University, NY

Graduated: May 2018

Relevant Coursework: Corporate Finance, Investment Banking, Mergers & Acquisitions, Financial Accounting

Skills

- Financial modeling and forecasting

- Budgeting and variance analysis

- Proficient in Excel, SAP, and SQL

- Advanced knowledge of financial statements and ratios

- Strong analytical and problem-solving skills

Certifications

Chartered Financial Analyst (CFA) Level 1

CFA Institute, May 2020

Professional Development

Advanced Financial Modeling & Valuation

Wall Street Prep — Completed: September 2021

Financial Planning and Analysis Certification

Corporate Finance Institute — Completed: March 2021

Why this investment bank resume is good?

- Demonstrates serious technical skills and know-how — think financial modeling, forecasting, and keeping budgets on point.

- Professional experience is detailed, with specific examples of how the job seeker has supported strategic business decisions.

- CFA certification adds credibility and showcases dedication to professional growth.

What are the key skills for investment banking resume?

- Hard skills are technical abilities - something you can measure or teach, like crunching numbers, analyzing data, or using finance tools. You usually pick these up in school, training, or by getting your hands dirty at work.

- Soft skills are your people powers - things like working well with others, staying cool when stuff hits the fan, and bringing good vibes to the team. Not as easy to teach, but absolutely crucial if you want to survive (and actually enjoy) the job.

Hard skills for investment banking resume:

- Financial Modeling (DCF, LBO, M&A)

- Valuation (Comparable Company, Precedent Transactions)

- Financial Statement Analysis

- Mergers & Acquisitions (M&A) Strategy

- Financial Reporting & Analysis

- Excel Advanced Functions & Formulas

- PowerPoint for Presentations

- Due Diligence & Risk Assessment

- Market Research & Industry Analysis

- Investment Analysis & Portfolio Management

- Corporate Finance & Taxation Knowledge

- Knowledge of Securities and Investments

- Accounting (GAAP, IFRS)

- Bloomberg Terminal

- VBA Programming for Financial Models

- Legal & Compliance Knowledge

- Deal Structuring & Negotiation

- Quantitative Analysis

Soft skills for investment banking resume:

- Communication (Written and Verbal)

- Team Collaboration

- Leadership

- Time Management

- Problem-Solving

- Adaptability

- Attention to Detail

- Negotiation

- Client Relationship Management

- Critical Thinking

- Stress Management

- Decision-Making

- Conflict Resolution

- Emotional Intelligence (EQ)

- Presentation Skills

- Multitasking

- Strategic Thinking

- Networking

Conclusion

Crafting a standout investment banking resume requires highlighting strengths, showcasing measurable achievements, and tailoring the document to the specific role you're applying for.

With the right combination of skills, experience, and certifications, you can position yourself as a top candidate in the competitive world of investment banking.

Create your professional Resume in 10 minutes for FREE

Build My Resume