In the fast-paced world of banking, finance, and compliance, the role of a Know Your Customer analyst is critical.

A well-crafted KYC analyst resume can highlight your knowledge of anti-money laundering regulations, your attention to detail, and your ability to assess risk.

This article presents detailed yet simple resume examples for various roles, along with tips on easy resume writing to make a strong impact.

KYC analyst resume examples

Experienced KYC analyst resume

Experienced KYC analyst resume template

Experienced KYC analyst resume sample | Plain text

Michael Anderson

New York, NY

Email: michael.anderson@gmail.com

Phone: (555) 123-4567Resume Summary

Experienced KYC Analyst with expertise in the financial services industry. Skilled in performing customer, enhanced due diligence, and transaction monitoring. Adept at identifying potential compliance risks and providing actionable solutions to mitigate risks while ensuring strict adherence to AML and KYC regulations.

Professional Experience

Senior KYC Analyst

Goldman Sachs, New York, NY, August 2021 – Present

- Lead and oversee the due diligence process for high-risk clients, ensuring compliance with AML regulations.

- Conduct enhanced due diligence (EDD) reviews for complex customer structures and transactions.

- Collaborate with internal departments to assess and mitigate risk, ensuring a seamless customer onboarding process.

- Develop and implement KYC policies and procedures to align with regulatory changes.

- Provide training to junior KYC analysts and assist in the development of their professional growth.

KYC Analyst

Citigroup, New York, NY, May 2017 – August 2021

- Performed CDD for a wide range of individual and corporate clients.

- Conducted reviews of suspicious transactions, ensuring compliance with internal controls and AML regulations.

- Assisted in the implementation of new KYC systems and tools to streamline data collection and risk assessment.

- Prepared regulatory reporting for internal and external stakeholders, ensuring transparency in compliance matters.

Education

Bachelor of Science in Finance

New York University

Graduated: May 2017

Certifications

- Certified Anti-Money Laundering Specialist (CAMS), August 2020

- KYC and AML Fundamentals, March 2019

Skills

- KYC Customer Due Diligence (CDD)

- Enhanced Due Diligence (EDD)

- Risk Assessment and Mitigation

- Transaction Monitoring

- AML Regulatory Reporting

- Client Onboarding

- Knowledge of FATF Guidelines

- Proficient in KYC/AML Software (Actimize, Oracle)

- Attention to Detail and Critical Thinking

Why this sample resume for KYC analyst is effective?

- The document shows a clear career progression, emphasizing the candidate’s growing responsibilities and leadership experience.

- The inclusion of recent certifications proves that Michael's knowledge is current and relevant.

- The skills resume section highlights core competencies, making it easy for recruiters to see his expertise.

- How to format a KYC resume?

1. Font:

- Use professional ones: Arial, Calibri, or Times New Roman.

- 10-12 points for text, 14-16 points for name/section titles.

2. Margins:

- Standard 1-inch.

- Set 1.15 line spacing for readability.

- Add space between resume sections to ensure clarity.

3. Resume Length:

- 1 page resume for less than 10 years of experience.

- 2 pages resume for more extensive expertise.

4. Language:

- Incorporate action verbs for resume: Managed, Analyzed, Led, Implemented, etc.

- Avoid passive voice.

- Write industry terms and keywords.

- Eliminate spelling/grammar errors.

To ensure you don't miss any important details, use free resume builder online.

Resume Trick offers a wide range of online resume templates tailored to different roles, helping you pick a design that suits your needs.

Create your professional Resume in 10 minutes for FREE

Build My Resume

Entry-level KYC analyst resume

Entry-level KYC analyst resume example

Sarah Jenkins

Los Angeles, CA

Email: sarah.jenkins@gmail.com

Phone: (555) 987-6543Resume Objective

Detail-oriented and motivated finance graduate with a strong foundation in KYC/AML compliance. Eager to apply analytical skills, regulatory knowledge, and hands-on internship experience to support financial institutions in mitigating risk and ensuring regulatory compliance. Passionate about financial security and eager to contribute to a dynamic compliance team.

Education

Bachelor of Arts in Accounting

University of California, Los Angeles (UCLA), Los Angeles, CA

Graduated: May 2024

Relevant Coursework:

- Financial Crime Compliance

- International Business Regulations

- Risk Management in Finance

- Auditing and Forensic Accounting

- Business Ethics in Financial Services

Certifications

- Certified Anti-Money Laundering Specialist (CAMS) – AML Essentials, June 2024

- FCPA Compliance Training Certificate, March 2024

Experience

KYC Intern

Wells Fargo, Los Angeles, CA | January – May 2025

- Assisted in reviewing and verifying KYC documentation for new and existing clients, ensuring compliance with AML regulations.

- Conducted background checks on high-risk individuals and entities using LexisNexis, World-Check, and internal databases.

- Identified and escalated red flags related to potentially suspicious financial activity.

- Collaborated with compliance analysts and risk management teams to draft regulatory reports for senior management.

- Helped integrate updated KYC procedures following changes in global compliance regulations.

Skills

- KYC/AML Regulations & Compliance (BSA, USA PATRIOT Act, FinCEN guidelines)

- Customer Due Diligence (CDD) & Enhanced Due Diligence (EDD)

- Risk Assessment & Fraud Detection

- Transaction Monitoring & SAR (Suspicious Activity Reports) Preparation**

- Proficiency in KYC Software: LexisNexis, World-Check, Actimize

- Data Analysis & Financial Risk Assessment (Excel, SQL, Tableau)

- Strong Communication & Report Writing

Professional Development

- AML & Compliance Seminar Attendee, Los Angeles, CA (April 2024)

- FinTech & Regulatory Technology Webinar, Hosted by ABA (May 2024)

Languages

- English (Fluent)

- Spanish (Conversational)

Why this example of resume of KYC analyst works?

- The resume opening statement is concise yet powerful, clearly stating Sarah's motivation, knowledge of compliance regulations, and hands-on experience.

- The relevant coursework section highlights directly applicable subjects, making her education more industry-specific.

- Bilingual ability is a major asset in financial compliance, as firms deal with international clients and regulatory bodies.

- How to choose between resume summary and objective?

Use an objective in resume if:

- You are a recent graduate, entry-level applicant, or facing a career transition.

- You need to show enthusiasm and highlight transferable skills.

- You want to emphasize your goals and how you plan to contribute.

Example of KYC analyst resume objective:

Detail-oriented finance graduate with a strong foundation in KYC/AML compliance. Eager to apply analytical skills, regulatory knowledge, and hands-on internship experience to help financial institutions mitigate risk and ensure regulatory compliance.

Use a resume summary if:

- You have 2+ years of experience.

- You want to outline your key achievements upfront.

Example of KYC analyst resume summary:

Experienced KYC Analyst with 3+ years in financial compliance, specializing in customer due diligence (CDD), transaction monitoring, and risk assessment. Proficient in LexisNexis, Actimize, and World-Check for identifying suspicious activity and ensuring regulatory compliance. Proven track record of mitigating financial risk and improving compliance processes.

- How to list education on a resume for KYC analyst?

- Place the most recent degree first.

- Include the university name, location and diploma earned.

- Indicate years attended and coursework completed.

- If you have industry-recognized certifications, arrange them in a separate section.

Omit high school if you have advanced education.

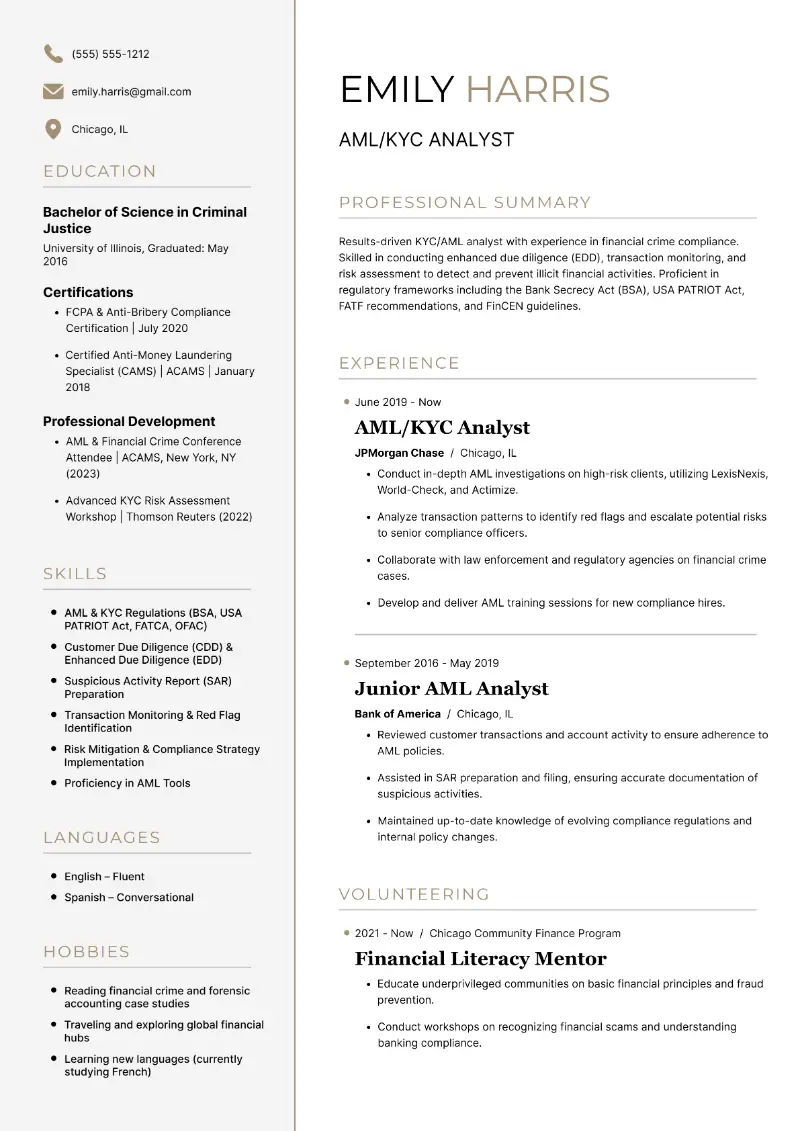

KYC AML analyst resume

KYC AML analyst resume template

KYC AML analyst resume sample | Plain text

Emily Harris

Chicago, IL

Email: emily.harris@gmail.com

Phone: (555) 555-1212Resume Summary

Results-driven KYC/AML analyst with experience in financial crime compliance. Skilled in conducting enhanced due diligence (EDD), transaction monitoring, and risk assessment to detect and prevent illicit financial activities. Proficient in regulatory frameworks including the Bank Secrecy Act (BSA), USA PATRIOT Act, FATF recommendations, and FinCEN guidelines.

Professional Experience

AML/KYC Analyst

JPMorgan Chase, Chicago, IL | June 2019 – Present

- Conduct in-depth AML investigations on high-risk clients, utilizing LexisNexis, World-Check, and Actimize.

- Analyze transaction patterns to identify red flags and escalate potential risks to senior compliance officers.

- Collaborate with law enforcement and regulatory agencies on financial crime cases.

- Develop and deliver AML training sessions for new compliance hires.

Junior AML Analyst

Bank of America, Chicago, IL | September 2016 – May 2019

- Reviewed customer transactions and account activity to ensure adherence to AML policies.

- Assisted in SAR preparation and filing, ensuring accurate documentation of suspicious activities.

- Maintained up-to-date knowledge of evolving compliance regulations and internal policy changes.

Education

Bachelor of Science in Criminal Justice

University of Illinois, Chicago, IL | Graduated: May 2016

Certifications

- FCPA & Anti-Bribery Compliance Certification | July 2020

- Certified Anti-Money Laundering Specialist (CAMS) | ACAMS | January 2018

Skills

- AML & KYC Regulations (BSA, USA PATRIOT Act, FATCA, OFAC)

- Customer Due Diligence (CDD) & Enhanced Due Diligence (EDD)

- Suspicious Activity Report (SAR) Preparation

- Transaction Monitoring & Red Flag Identification

- Risk Mitigation & Compliance Strategy Implementation

- Proficiency in AML Tools: LexisNexis, Actimize, World-Check, Dow Jones Risk & Compliance

Professional Development

- AML & Financial Crime Conference Attendee | ACAMS, New York, NY (2023)

- Advanced KYC Risk Assessment Workshop | Thomson Reuters (2022)

Languages

- English – Fluent

- Spanish – Conversational

Volunteering

Financial Literacy Mentor

Chicago Community Finance Program | 2021 – Present

- Educate underprivileged communities on basic financial principles and fraud prevention.

- Conduct workshops on recognizing financial scams and understanding banking compliance.

Hobbies

- Reading financial crime and forensic accounting case studies

- Traveling and exploring global financial hubs

- Learning new languages (currently studying French)

Strong sides of this KYC analyst resume example:

- Shows engagement in industry events and training, demonstrating continuous learning.

- Involvement in financial literacy programs adds depth to the profile, showcasing leadership and commitment to the field.

- Hobbies reinforce the candidate’s passion for financial crime compliance.

- How to organize experience on a KYC resume?

- Arrange your work history chronologically.

- Ensure that job titles are clear and prominent to allow quick recognition of your role.

- Follow it with the company's name and location.

- Always include the start and end dates of your employment.

- Each position should have 4-6 concise bullet points that describe what you did and how you contributed.

- Quantify your impact whenever possible. Use numbers or metrics.

- What are the key skills required for KYC analyst?

- Hard skills are technical abilities and specific knowledge required to perform a particular job. These are usually learned through education, training programs, or hands-on experience, and they can be quantified.

- Soft skills are interpersonal attributes that help you interact effectively with others and thrive in the workplace. They are generally more difficult to measure but are just as important for career success.

Hard skills for KYC analyst resume:

- KYC/AML Regulations (BSA, USA PATRIOT Act, FATCA, OFAC)

- Customer Due Diligence (CDD) & Enhanced Due Diligence (EDD)

- Suspicious Activity Report (SAR) Preparation

- Financial Crime Risk Assessment

- Transaction Monitoring

- Regulatory Compliance Reporting

- Knowledge of AML Tools (LexisNexis, World-Check, Actimize, Dow Jones)

- Data Analysis (Excel, SQL, Tableau)

- Legal and Regulatory Documentation

- Risk Mitigation Strategies

- Auditing and Compliance Reviews

- Financial Statement Analysis

- Database Management

- Client Onboarding and Verification

- Fraud Detection and Prevention

- Internal and External Audit Assistance

Soft skills for KYC analyst resume:

- Attention to Detail

- Analytical Thinking

- Communication Skills (Written and Verbal)

- Problem-Solving

- Time Management

- Team Collaboration

- Adaptability

- Critical Thinking

- Decision-Making

- Confidentiality and Integrity

- Organization and Multitasking

- Conflict Resolution

- Relationship Building

- Stress Management

- Customer Service Orientation

- Initiative and Self-Motivation

Conclusion

When applying for a KYC analyst role, your document should highlight your regulatory knowledge, technical skills, and ability to assess risk effectively.

Each of the KYC analyst resume examples shared above provides a tailored approach for different levels and backgrounds, helping you craft a standout application.

Create your professional Resume in 10 minutes for FREE

Build My Resume