A personal banker resume is your first opportunity to make a strong impression on potential employers.

Whether you’re just starting in the industry or you’re looking to advance your career, crafting a standout document is essential.

A well-organized application highlights your expertise in customer service, financial products, and relationship management, making it easier for hiring managers to see your potential.

In this article, we’ll walk you through the key components of a professional resume.

Personal banker resume examples

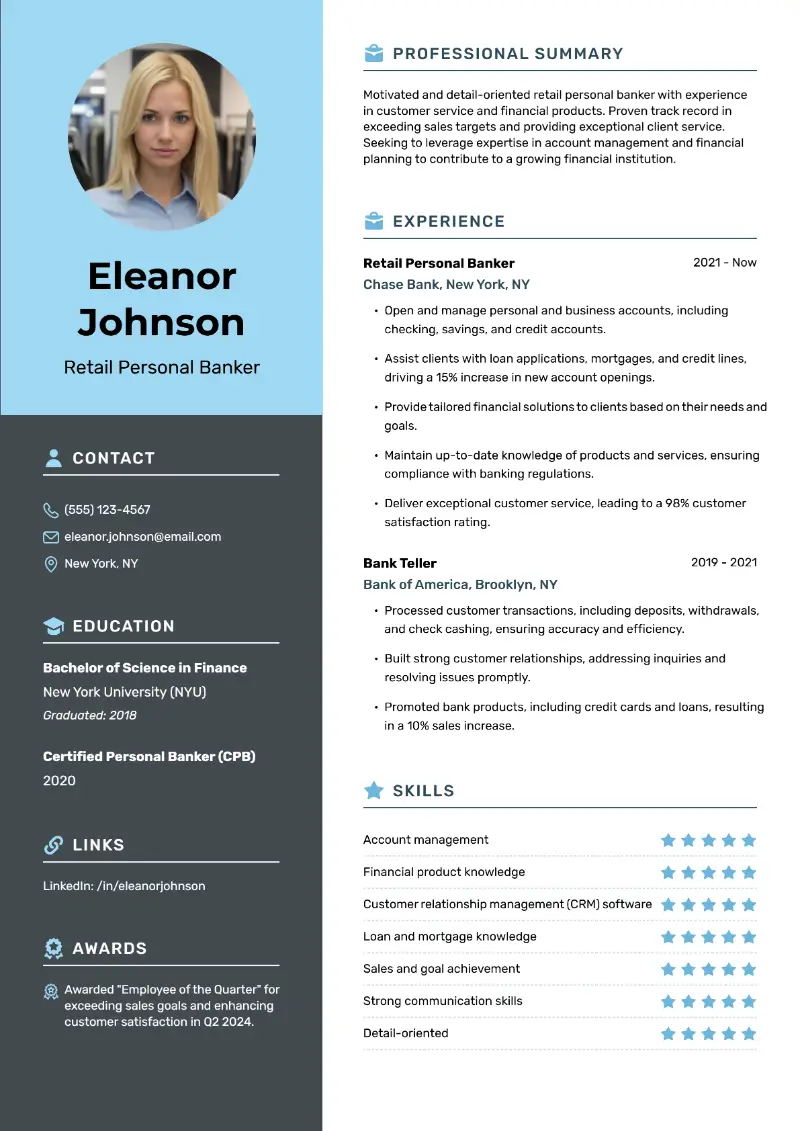

Retail personal banker resume sample

Retail personal banker resume template

Resume for retail personal banker | Plain text

Name: Eleanor Johnson

Phone: (555) 123-4567

Email: eleanor.johnson@email.com

LinkedIn: /in/eleanorjohnsonObjective

Motivated and detail-oriented retail personal banker with experience in customer service and financial products. Proven track record in exceeding sales targets and providing exceptional client service. Seeking to leverage expertise in account management and financial planning to contribute to a growing financial institution.

Experience

Retail Personal Banker

Chase Bank – New York, NY

March 2021 – Present

- Open and manage personal and business accounts, including checking, savings, and credit accounts.

- Assist clients with loan applications, mortgages, and credit lines, driving a 15% increase in new account openings.

- Provide tailored financial solutions to clients based on their needs and goals.

- Maintain up-to-date knowledge of products and services, ensuring compliance with banking regulations.

- Deliver exceptional customer service, leading to a 98% customer satisfaction rating.

Bank Teller

Bank of America – Brooklyn, NY

May 2019 – February 2021

- Processed customer transactions, including deposits, withdrawals, and check cashing, ensuring accuracy and efficiency.

- Built strong customer relationships, addressing inquiries and resolving issues promptly.

- Promoted bank products, including credit cards and loans, resulting in a 10% sales increase.

Education

Bachelor of Science in Finance

New York University (NYU) – New York, NY

Graduated: 2018

Skills

- Account management

- Financial product knowledge

- Customer relationship management (CRM) software

- Loan and mortgage knowledge

- Sales and goal achievement

- Strong communication skills

- Detail-oriented

Certifications

- Certified Personal Banker (CPB) – 2020

Achievements

- Awarded "Employee of the Quarter" for exceeding sales goals and enhancing customer satisfaction in Q2 2024.

- Recognized for achieving a 95% accuracy rate in processing financial transactions and applications.

Strong sides of this personal banker resume example:

- Clear and concise formatting, making it easy for hiring managers to quickly find key information.

- The inclusion of specific achievements, such as "Employee of the Quarter," helps highlight measurable success.

- A strong focus on customer service and sales accomplishments, aligning well with the role's core responsibilities.

- How to properly format a resume for a personal banker?

- Font. Select a classic font like Arial, Calibri, or Times New Roman. Avoid decorative styles that can detract from the content.

- Size. For the body, use a font size of 10-12 points. Increase the size to 14-16 points for section headings to make them stand out.

- Length. Limit your resume to one page if you have fewer than 10 years of experience. Two pages may be acceptable for more seasoned professionals but should still be concise.

- Margins. Stick to 1-inch margins on all sides to maintain a clean look.

- Spacing. Set the line spacing to 1.15 to 1.5 to make the text easier to read.

- Alignment. Left-align the text to create a structured, organized layout.

- File type. Save your draft as a PDF to preserve the design when sharing it digitally.

To eliminate formatting problems and save time on creating a new document from scratch, try an online free resume maker.

Resume Trick offers a variety of top resume templates that you can customize easily and ensures a polished final product.

Create your professional Resume in 10 minutes for FREE

Build My Resume

Personal relationship banker resume example

Sample personal relationship banker resume

Name: Michael Bennett

Phone: (555) 987-6543

Email: michael.bennett@email.com

LinkedIn: /in/michaelbennettObjective

Experienced and dedicated personal relationship banker with 8+ years in banking, specializing in building long-term client relationships and providing personalized financial advice. Skilled in wealth management, investment products, and mortgage solutions. Seeking to contribute expertise in client retention and financial planning to a reputable bank.

Experience

Personal Relationship Banker

Wells Fargo – San Francisco, CA

June 2020 – Present

- Manage a portfolio of high-net-worth individuals, offering customized banking services including investment advice and retirement planning.

- Cultivate lasting relationships with clients, improving client retention by 20% through proactive engagement and financial education.

- Coordinate with investment advisors and loan officers to provide comprehensive financial solutions.

- Exceed sales targets consistently, including a 25% growth in mortgage and loan product sales.

- Facilitate financial planning sessions, helping clients meet short- and long-term goals.

Relationship Banker

Citibank – San Francisco, CA

January 2017 – May 2020

- Developed and maintained relationships with customers, providing advice on personal banking products.

- Increased client base by 15% through networking and targeted marketing strategies.

- Assisted in opening accounts, offering loan products, and resolving client concerns.

- Collaborated with colleagues to deliver tailored financial solutions and services.

Education

Bachelor of Business Administration

University of California, Berkeley

Graduated: 2016

Skills

- Relationship building

- Wealth management

- Financial advising

- Loan and mortgage expertise

- Cross-selling bank products

- Strong interpersonal skills

- Negotiation

Certifications

- Certified Financial Planner (CFP) – 2023

- Certified Personal Banker (CPB) – 2021

Professional Development

- Completed "Advanced Wealth Management" course through the CFA Institute, 2025.

- Attended annual Wells Fargo conference on financial trends and customer service excellence, 2023.

Why this example of a personal banker resume will impress recruiters:

- Emphasizes both client relationship and wealth management skills, showing versatility in the role.

- The professional development section highlights ongoing education, demonstrating a commitment to staying current in the field.

- Clear listing of certifications and academic background, which enhances credibility for the financial advising aspect of the job.

- Should I choose a personal banker resume objective or summary?

A summary works best for individuals with an established history in banking.

Length: 2-4 lines

Include:

- A brief highlight of your career experience

- Key achievements or skills

- Notable strengths like client management or financial analysis

Personal banker resume summary sample:

Results-driven personal banker with experience providing tailored financial solutions, building lasting client relationships, and driving revenue growth. Skilled in consumer lending, wealth management, and risk assessment. Adept at identifying customer needs and offering personalized banking products, ensuring exceptional service and client satisfaction.

An objective is ideal for entry-level candidates or those transitioning careers.

Length: 1-2 lines

Include:

- A statement of your professional aspirations

- What you can contribute to the employer

- The position you are aiming for and your motivations

Personal banker resume objective example:

Motivated and customer-focused professional seeking a personal banker role to leverage strong communication skills and financial acumen. Passionate about helping clients achieve their financial goals through personalized banking solutions.

- How to showcase your personal banker resume skills?

The skills section highlights your key abilities, helping recruiters see that you’re equipped to handle the responsibilities of a personal banker.

- Hard skills are specific, teachable competencies acquired through education or job training. They are essential for performing technical aspects of banking effectively.

- Soft skills are interpersonal attributes that enable you to interact well with clients and colleagues. These are just as important in fostering strong relationships and delivering excellent customer service.

Personal banker hard skills examples:

- Loan processing

- Account management

- Financial reporting

- Cash handling

- Risk assessment

- CRM software proficiency

- Sales strategies

- Data analysis

- Budget management

- Credit evaluation

Sample of soft skills for personal bankers:

- Active listening

- Communication

- Problem-solving

- Time management

- Empathy

- Negotiation

- Adaptability

- Leadership

- Conflict resolution

- Patience

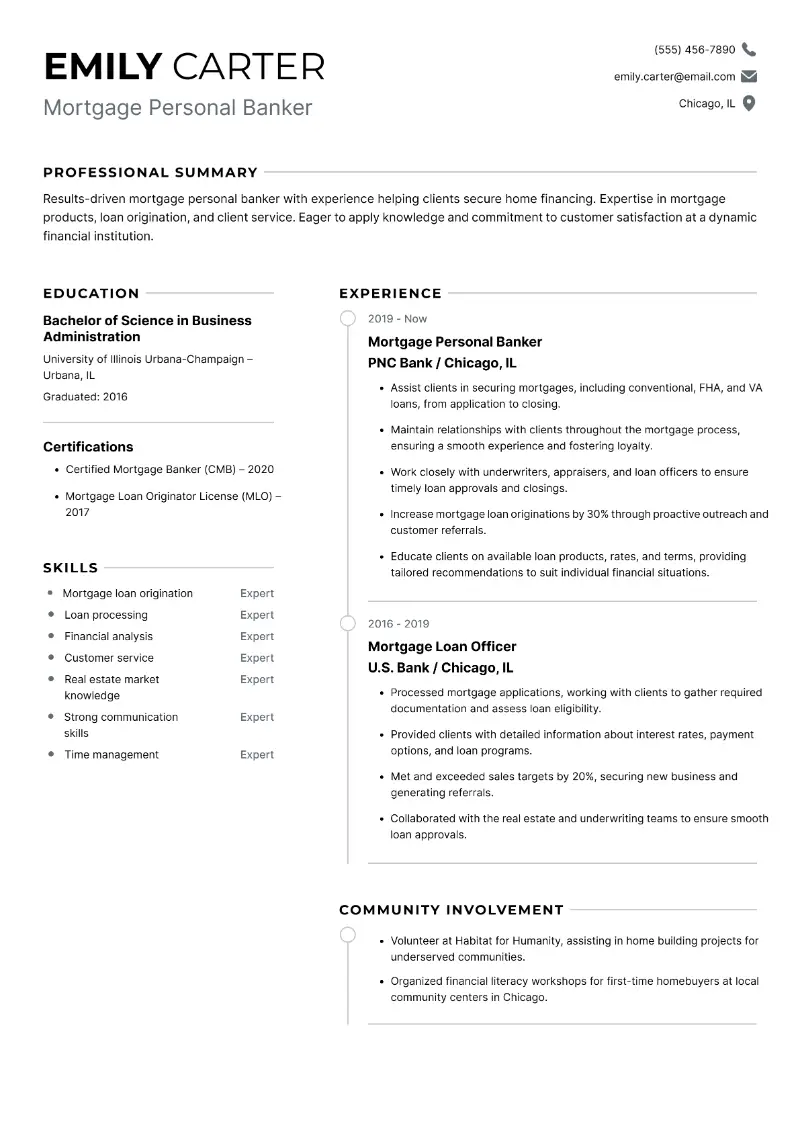

Mortgage personal banker resume template

Mortgage personal banker resume sample

Resume for mortgage personal banker | Text version

Name: Emily Carter

Phone: (555) 456-7890

Email: emily.carter@email.com

LinkedIn: /in/emilycarterObjective

Results-driven mortgage personal banker with experience helping clients secure home financing. Expertise in mortgage products, loan origination, and client service. Eager to apply knowledge and commitment to customer satisfaction at a dynamic financial institution.

Experience

Mortgage Personal Banker

PNC Bank – Chicago, IL

July 2019 – Present

- Assist clients in securing mortgages, including conventional, FHA, and VA loans, from application to closing.

- Maintain relationships with clients throughout the mortgage process, ensuring a smooth experience and fostering loyalty.

- Work closely with underwriters, appraisers, and loan officers to ensure timely loan approvals and closings.

- Increase mortgage loan originations by 30% through proactive outreach and customer referrals.

- Educate clients on available loan products, rates, and terms, providing tailored recommendations to suit individual financial situations.

Mortgage Loan Officer

U.S. Bank – Chicago, IL

August 2016 – June 2019

- Processed mortgage applications, working with clients to gather required documentation and assess loan eligibility.

- Provided clients with detailed information about interest rates, payment options, and loan programs.

- Met and exceeded sales targets by 20%, securing new business and generating referrals.

- Collaborated with the real estate and underwriting teams to ensure smooth loan approvals.

Education

Bachelor of Science in Business Administration

University of Illinois Urbana-Champaign – Urbana, IL

Graduated: 2016

Skills

- Mortgage loan origination

- Loan processing

- Financial analysis

- Customer service

- Real estate market knowledge

- Strong communication skills

- Time management

Certifications

- Certified Mortgage Banker (CMB) – 2020

- Mortgage Loan Originator License (MLO) – 2017

Community Involvement

- Volunteer at Habitat for Humanity, assisting in home building projects for underserved communities.

- Organized financial literacy workshops for first-time homebuyers at local community centers in Chicago.

This sample personal banker resume is effective for several reasons:

- Detailed experience with mortgage products, showcasing expertise and alignment with job responsibilities.

- The community involvement section adds a personal touch, making the candidate stand out as someone who gives back.

- Focus on sales growth and client retention, reinforcing the ability to drive results in a competitive field.

- What academic credentials should I add to my personal banker resume?

Including an education section helps demonstrate that you have the foundational knowledge needed for the role.

What to include:

- Any relevant degrees, such as a Bachelor’s in Finance, Business, or Economics.

- Industry certifications such as Certified Personal Banker (CPB) or other financial qualifications.

- Courses or workshops related to customer service, banking, or financial tools.

- The names of schools where you earned your diplomas and the dates of graduation.

- If you received honors or awards, mention them to showcase your dedication to excellence.

- How to organize the experience section in a personal banker resume?

- Start with your most recent position and work backward in reverse chronological order.

- Use bullet points to make each job's responsibilities and accomplishments clear and concise.

- Focus on quantifiable achievements (e.g., "increased client retention by 25%").

- Include the title, company name, location, and the dates of employment for each entry.

- Highlight relevant banking experience and transferable skills if you've worked in other customer-focused roles.

Tailor this part to the specific role you’re applying for by emphasizing duties that match the job description.

Conclusion

In conclusion, a strong personal banker resume not only showcases your skills and experience but also demonstrates your ability to connect with clients and provide personalized financial services.

By following the tips and focusing on the key elements we’ve discussed, you’ll be well on your way to landing your next position.

Keep refining your document, and make sure it accurately represents the value you bring to a bank or financial institution.

Create your professional Resume in 10 minutes for FREE

Build My Resume