In the highly competitive financial industry, your senior loan officer resume is the first opportunity to make a strong impression and showcase your expertise and dedication.

Whether you're an experienced specialist looking to climb the ladder or a student eager to enter the sphere, a well-crafted document is crucial to stand out.

This article provides a comprehensive guide showing how to create a resume online, complete with resumes examples that highlight the key elements needed to capture the attention of hiring officials.

Senior loan officer resume examples

- Residential senior loan officer resume

- Commercial senior loan officer resume

- Mortgage underwriting senior loan officer resume

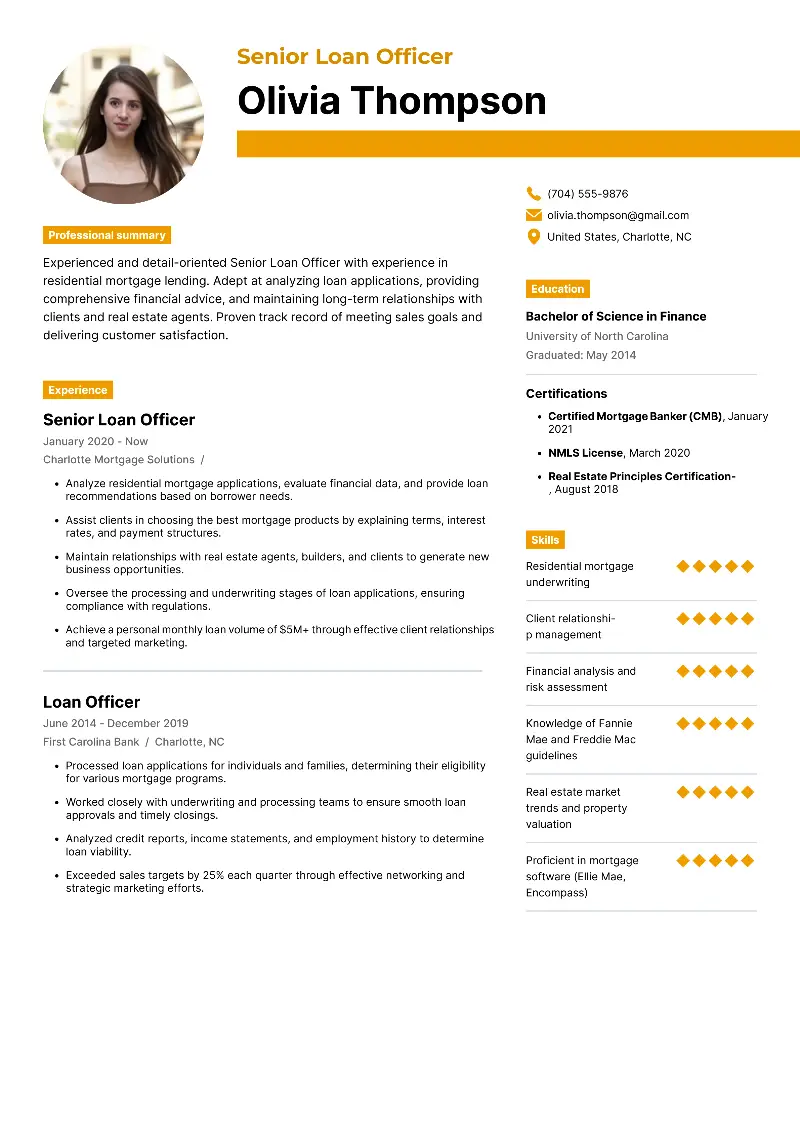

Residential senior loan officer resume

Residential senior loan officer resume template

Residential senior loan officer resume sample | Plain text

Olivia Thompson

Charlotte, NC

Email: olivia.thompson@gmail.com

Phone: (704) 555-9876Resume Summary

Experienced and detail-oriented Senior Loan Officer with experience in residential mortgage lending. Adept at analyzing loan applications, providing comprehensive financial advice, and maintaining long-term relationships with clients and real estate agents. Proven track record of meeting sales goals and delivering customer satisfaction.

Experience

Senior Loan Officer

Charlotte Mortgage Solutions, NC, January 2020 – Present

- Analyze residential mortgage applications, evaluate financial data, and provide loan recommendations based on borrower needs.

- Assist clients in choosing the best mortgage products by explaining terms, interest rates, and payment structures.

- Maintain relationships with real estate agents, builders, and clients to generate new business opportunities.

- Oversee the processing and underwriting stages of loan applications, ensuring compliance with regulations.

- Achieve a personal monthly loan volume of $5M+ through effective client relationships and targeted marketing.

Loan Officer

First Carolina Bank, Charlotte, NC, June 2014 – December 2019

- Processed loan applications for individuals and families, determining their eligibility for various mortgage programs.

- Worked closely with underwriting and processing teams to ensure smooth loan approvals and timely closings.

- Analyzed credit reports, income statements, and employment history to determine loan viability.

- Exceeded sales targets by 25% each quarter through effective networking and strategic marketing efforts.

Education

Bachelor of Science in Finance

University of North Carolina, Charlotte, NC

Graduated: May 2014

Certifications

- Certified Mortgage Banker (CMB), January 2021

- NMLS License, March 2020

- Real Estate Principles Certification, August 2018

Skills

- Residential mortgage underwriting

- Client relationship management

- Financial analysis and risk assessment

- Knowledge of Fannie Mae and Freddie Mac guidelines

- Real estate market trends and property valuation

- Proficient in mortgage software (Ellie Mae, Encompass)

Why this loan processing resume is effective?

- Olivia’s document highlights her career growth, emphasizing responsibilities and achievements.

- The resume certifications listed show that she has industry-standard credentials, demonstrating professionalism.

- The application uses numbers, such as loan volume and quarterly sales, to provide concrete evidence of success and professional accomplishments.

- How to format a resume for loan officer?

- Opt for legible fonts. Consider Arial, Calibri, Times New Roman, Helvetica, or Garamond.

- Body text should be set between 10-12 pt. Headings should be in 14-16 pt.

- Avoid using overly decorative or cursive fonts.

- Keep margins around 1 inch on all sides, though you may slightly reduce them to 0.75 inches.

- Stick to single spacing for bullet points and resume part content.

- One page length resume is ideal for professionals with fewer than 5-7 years of experience.

- Make your accomplishments sound dynamic by adding active verbs.

- Utilize bullets for listings.

- Include resume keywords and phrases from the job description.

- Proofread your draft multiple times to catch any grammar, spelling, or formatting mistakes.

If you don't want to start from scratch, create resume online to streamline the process.

Resume Trick offers a wide variety of unique resume templates, ensuring that you can choose a layout that suits your style.

Create your professional Resume in 10 minutes for FREE

Build My Resume

Commercial senior loan officer resume

Commercial senior loan officer resume example

David Ramirez

Dallas, TX

Email: david.ramirez@gmail.com

Phone: (214) 555-7321Resume Summary

Skilled and results-driven Senior Loan Officer with experience in commercial real estate financing. Specialized in structuring complex loan products, negotiating favorable terms, and collaborating with developers, investors, and business owners.

Experience

Senior Loan Officer, Commercial Lending

Dallas Commercial Lending Group, TX | March 2018 – Present

- Lead the evaluation and underwriting of commercial loan applications for high-value properties.

- Collaborate with developers, investors, and business owners to create tailored financing solutions.

- Negotiate interest rates, repayment terms, and loan conditions based on asset evaluations.

- Successfully close loans exceeding $10 million for both real estate developers and institutional investors.

Commercial Loan Officer

Sunset Financial Group, Dallas, TX | May 2010 – February 2018

- Assisted business owners in obtaining financing for business expansion, capital improvements, and other strategic initiatives.

- Managed a loan portfolio exceeding $100 million, conducting regular reviews and maintaining a strong risk management framework.

- Delivered tailored presentations to potential clients, educating them on loan products and terms, which resulted in the successful closing of several multi-million-dollar deals.

Education

Master of Business Administration (MBA), Finance

Southern Methodist University, Dallas, TX | Graduated: May 2010

Bachelor of Business Administration (BBA), Economics

University of Texas, Austin, TX | Graduated: May 2006

Certifications

- Certified Commercial Loan Officer, June 2020

- Real Estate Finance Certification, July 2019

Skills

- Commercial Real Estate Finance

- Complex Loan Structuring

- Investor and Developer Relations

- Portfolio Management

- Risk Management and Compliance

- Negotiation and Deal Closure

Additional Information

Awards & Recognition:

- Recognized as "Top Loan Officer" by Dallas Commercial Lending Group for 2019 and 2020.

- Awarded “Excellence in Client Relations” by Sunset Financial Group in 2017.

Volunteer Work:

- Active volunteer with Habitat for Humanity, providing financial advice and guidance for affordable housing projects.

Why this loan specialist resume is compelling?

- The opening statement immediately identifies David’s specialization, giving hiring managers a clear understanding of his niche.

- Awards and volunteer work humanize the document and reveal leadership and community involvement.

- Bullet points in the experience section keep information digestible while still showcasing impact.

- What is the difference between loan officer resume summary and objective?

| Aspect | Summary | Objective |

|---|---|---|

| Purpose | Outlines key qualifications. | Communicates your aspirations and enthusiasm. |

| Main Focus | Underscores what you offer to the employer. | Emphasizes what you hope to accomplish in the role. |

| Tone | Confident, concise, and achievement-oriented. | Ambitious, optimistic, and future-focused. |

| Best Fit For | Specialists with a track record of success. | Recent graduates, entry-levels, or those changing careers. |

| Example | Strategic senior loan officer with over 12 years in commercial real estate finance. Expertise in structuring complex loan packages, assessing risk, and partnering with developers and investors to fund multi-million-dollar projects. | Motivated sales professional transitioning into finance, leveraging a decade of client-facing experience. Eager to support customers in finding the right lending solutions. |

- How to list education on a resume for senior loan officer?

What to include:

- Degree

- Field of Study

- School Name

- Location

- Graduation Date

- GPA (optional)

- Relevant Coursework (optional)

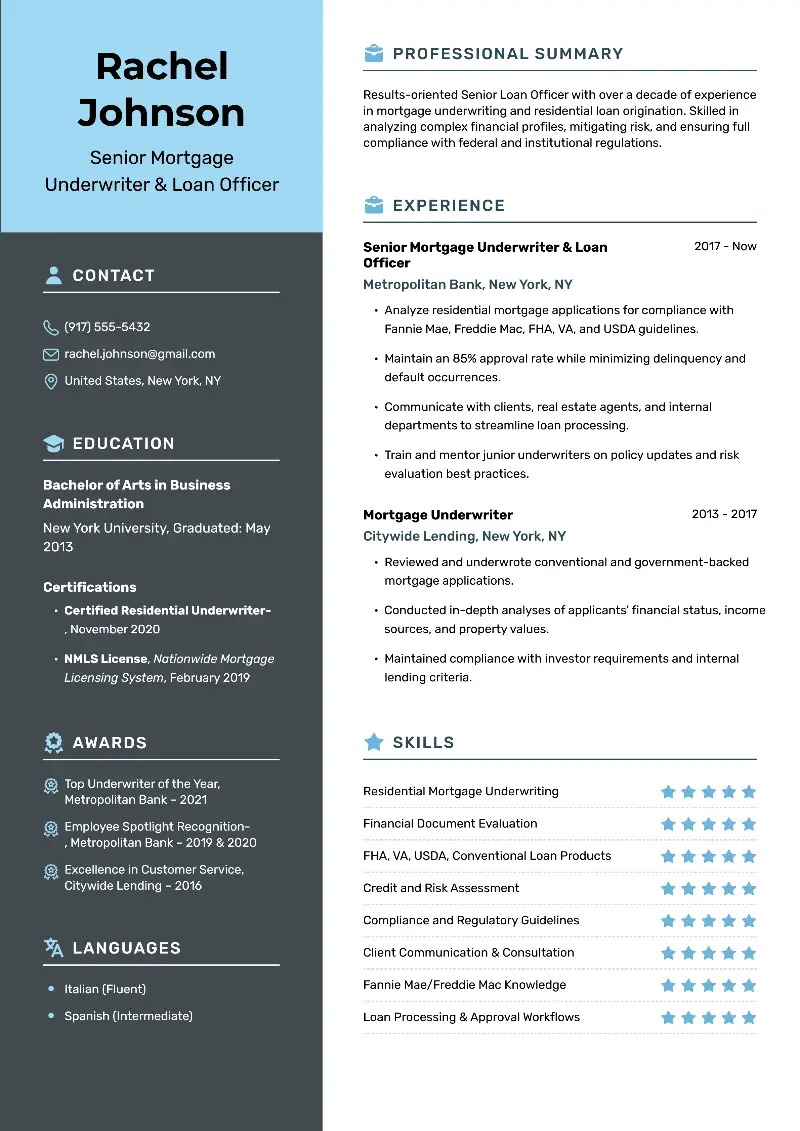

Mortgage underwriting senior loan officer resume

Mortgage underwriting senior loan officer resume template

Mortgage underwriting senior loan officer resume sample | Plain text

Rachel Johnson

New York, NY

Email: rachel.johnson@gmail.com

Phone: (917) 555-5432Resume Summary

Results-oriented Senior Loan Officer with over a decade of experience in mortgage underwriting and residential loan origination. Skilled in analyzing complex financial profiles, mitigating risk, and ensuring full compliance with federal and institutional regulations.

Experience

Senior Mortgage Underwriter & Loan Officer

Metropolitan Bank, New York, NY | October 2017 – Present

- Analyze residential mortgage applications for compliance with Fannie Mae, Freddie Mac, FHA, VA, and USDA guidelines.

- Maintain an 85% approval rate while minimizing delinquency and default occurrences.

- Communicate with clients, real estate agents, and internal departments to streamline loan processing.

- Train and mentor junior underwriters on policy updates and risk evaluation best practices.

Mortgage Underwriter

Citywide Lending, New York, NY | June 2013 – September 2017

- Reviewed and underwrote conventional and government-backed mortgage applications.

- Conducted in-depth analyses of applicants’ financial status, income sources, and property values.

- Maintained compliance with investor requirements and internal lending criteria.

Education

Bachelor of Arts in Business Administration

New York University, NY

Graduated: May 2013

Certifications

- Certified Residential Underwriter, November 2020

- NMLS License, Nationwide Mortgage Licensing System, February 2019

Skills

- Residential Mortgage Underwriting

- Financial Document Evaluation

- FHA, VA, USDA, Conventional Loan Products

- Credit and Risk Assessment

- Compliance and Regulatory Guidelines

- Client Communication & Consultation

- Fannie Mae/Freddie Mac Knowledge

- Loan Processing & Approval Workflows

Awards

- Top Underwriter of the Year, Metropolitan Bank – 2021

- Employee Spotlight Recognition, Metropolitan Bank – 2019 & 2020

- Excellence in Customer Service, Citywide Lending – 2016

Languages

- Italian (Fluent)

- Spanish (Intermediate)

Strong sides of this loan processing resume:

- Rachel proves she’s fully certified and has invested in continuous education.

- The honors she’s received give recruiters proof that her contributions are valued and acknowledged.

- Fluency in Italian and good communication skills and working proficiency in Spanish enhance her appeal.

- How to organize experience on a loan specialist resume?

Always start with your most recent position and go backward. For each role, write:

- Your job title

- Company name and location

- Employment dates

Rather than just describing your duties, indicate the impact you had in your role. Numbers help validate your success.

- What skills to put on a senior loan officer resume?

- Hard skills are teachable abilities or knowledge sets that are usually gained through education, training, or hands-on experience. These are quantifiable and often demonstrated through certifications.

- Soft skills refer to interpersonal competencies that help you work effectively with others. These are behavioral traits which allow them to adapt to different situations.

Hard skills:

- Commercial Real Estate Financing

- Loan Origination

- Mortgage Underwriting

- Credit Analysis

- Risk Assessment

- Loan Structuring

- Portfolio Management

- Financial Statement Analysis

- Knowledge of Fannie Mae/Freddie Mac Guidelines

- Regulatory Compliance (FHA, VA, USDA)

- Debt-to-Income Ratio Analysis

- Loan Documentation & Processing

- Credit Scoring Systems

- Loan Closing Procedures

- Tax Return Analysis

- Financial Modeling

- Loan Portfolio Management Software (e.g., Encompass, Ellie Mae)

Soft skills:

- Strong Communication Skills

- Client Relationship Management

- Negotiation Skills

- Attention to Detail

- Problem-Solving

- Team Collaboration

- Time Management

- Decision-Making

- Analytical Thinking

- Conflict Resolution

- Interpersonal Skills

- Adaptability

- Sales and Business Development

- Customer Service

- Leadership and Mentoring

- Organizational Skills

- Stress Management

Conclusion

Creating an impactful senior loan officer resume requires focusing on specific skills that align with the role, achievements, and certifications.

With the resume writing examples and tips provided, you're ready to craft a document that highlights your background, making you an attractive candidate for your next role.

Create your professional Resume in 10 minutes for FREE

Build My Resume