Crafting an actuarial resume requires more than listing your credentials—it’s about showcasing your analytical skills, technical expertise, and business acumen.

Whether you’re a recent graduate entering the field or a seasoned specialist, a well-written good resume tailored to the actuarial profession can be the key to landing your desired role.

In this article, we’ll guide you through the essential tips, key sections, and actuary resume examples to help you build a document that captures attention and sets you apart from the competition.

Actuarial resume examples

- Health insurance actuarial analyst resume

- Property and casualty actuarial resume

- Entry-level retirement actuary resume

- Environmental and climate actuary resume

Health insurance actuary resume sample

Health insurance actuary resume template

Resume for health insurance actuarial analysts | Plain text

Professional Summary

Detail-oriented Actuarial Analyst with 7 years of experience in health insurance analytics. Skilled in risk assessment, data modeling, and regulatory compliance. Proven track record of developing predictive models to enhance underwriting accuracy and reduce claim costs.

Professional Experience

Actuarial Analyst

HealthFirst Insurance, New York, NY

June 2020 – Present

- Develop and maintain predictive models to forecast healthcare costs, leading to a 12% reduction in claim expenses.

- Conduct statistical analyses to assess the impact of policy changes on claim frequency and severity.

- Collaborate with the finance team to ensure compliance with state and federal regulations.

- Analyze claims data to identify emerging trends and recommend strategies to improve profitability.

- Develop dashboards for real-time monitoring of key performance indicators (KPIs) relevant to claims and underwriting.

Junior Actuarial Analyst

UnitedHealthcare, Chicago, IL

January 2018 – May 2020

- Assisted in the analysis of health insurance data to support pricing and product development.

- Prepared detailed actuarial reports and presented findings to senior management.

- Utilized SAS and R for data analysis and model development.

- Participated in cross-functional team meetings to provide actuarial insights during strategic planning.

- Coordinated with legal teams to align actuarial practices with evolving healthcare legislation.

Education

Master of Science in Actuarial Science

Columbia University, New York, NY

Graduated May 2017

Bachelor of Science in Mathematics

University of Illinois, Urbana-Champaign, IL

Graduated May 2015

Skills

- Proficient in R, SAS, and Excel

- Expertise in health insurance regulations

- Strong analytical and problem-solving abilities

- Effective communication skills

- Familiarity with actuarial valuation and reserving practices

Certifications

- Preparing for SOA Exam C (Models for Financial Economics), scheduled for December 2024

- Passed SOA Exam FM (Financial Mathematics), Society of Actuaries, March 2020

- Passed SOA Exam P (Probability), Society of Actuaries, September 2016

Volunteer Experience

Actuarial Mentor

Society of Actuaries Mentorship Program

September 2021 – Present

- Provide guidance to aspiring actuaries, helping them prepare for SOA exams.

- Assist mentees with resume building and interview preparation.

- Conduct workshops on exam techniques and study strategies.

Strong sides of this actuarial resume example:

- It emphasizes experience specifically in health insurance, highlighting relevant skills like cost forecasting, compliance, and claims analysis.

- Advanced technical computer skills like proficiency in key actuarial tools (R, SAS) and a strong grasp of regulatory requirements strengthen this application’s appeal to employers.

- The volunteer mentoring role demonstrates leadership and commitment to the profession, giving this resume added depth.

Formatting an actuary resume

- One-page resume is typically sufficient for entry to middle level positions, while two pages may be appropriate for those with more experience.

- Choose professional and readable fonts such as Arial, Calibri, or Times New Roman.

- For the body text, a font size of 10 to 12 points is recommended. For section headings, you can use 12 to 14 points to make them stand out.

- Add standard 1-inch margins on all sides of the page. This ensures the content is well-spaced and readable.

- Align text to the left for a clean, professional look. Avoid using full justification, which can create uneven spacing.

- Use bullet points with action verbs for entries under each job or educational experience. This makes it easier for readers to scan the information.

- Ensure consistent formatting throughout the document, including font size, bullet point style, and dates.

- Carefully proofread your actuarial resume to avoid any grammatical or typographical errors.

Using an online resume builder for free can help avoid formatting issues that can occur when creating a document manually.

Resume Trick offers free online resume templates that include sections relevant to your field and are formatted to highlight your qualifications effectively.

Create your professional Resume in 10 minutes for FREE

Build My Resume

Property actuarial resume example

Property actuary resume sample

Professional Summary

Experienced Property and Casualty Actuary with over 10 years in the insurance industry. Expertise in risk modeling, actuarial analysis, and loss forecasting. Demonstrated success in optimizing pricing strategies and improving reserve adequacy.

Professional Experience

Senior Actuarial Analyst

StateFarm Insurance, Atlanta, GA

March 2018 – Present

- Lead the development of new pricing models that improve profitability by 18% through enhanced risk segmentation.

- Analyze historical loss data to refine loss reserving methods and adjust policy rates.

- Coordinate with underwriting and claims departments to integrate actuarial insights into operational strategies.

- Monitor emerging industry trends and adjust models to maintain competitive pricing and adequate reserves.

- Prepare detailed presentations for executive leadership to support strategic decision-making.

Actuarial Analyst

Allstate Insurance, Dallas, TX

August 2015 – February 2018

- Conducted actuarial studies to support the development of commercial and personal lines insurance products.

- Utilized Excel and SQL to analyze data and prepare comprehensive reports for senior management.

- Assisted in the implementation of actuarial software for improved efficiency in data processing.

- Developed loss forecasts and collaborated with the product development team to refine insurance offerings.

- Supported catastrophe modeling efforts by aggregating and analyzing exposure data.

Education

Bachelor of Science in Actuarial Science

University of Texas at Austin, TX

Graduated May 2015

Skills

- Advanced proficiency in Excel, SQL, and actuarial software (e.g., Prophet)

- Strong knowledge of property and casualty insurance products

- Expertise in risk assessment and loss forecasting

- Excellent analytical and teamwork skills

- Familiarity with insurance accounting principles and GAAP standards

Certifications

- Associate of the Casualty Actuarial Society (ACAS), Achieved in October 2022

- Passed CAS Exam 6 (Regulation and Financial Reporting), Casualty Actuarial Society, May 2019

- Passed CAS Exam 5 (Basic Techniques for Ratemaking and Estimating Claim Liabilities), Casualty Actuarial Society, November 2017

Professional Development

Advanced Pricing Seminar

Casualty Actuarial Society (CAS), Atlanta, GA

Attended May 2024

- Participated in workshops on advanced pricing models and risk segmentation.

- Networked with industry leaders to stay informed about the latest actuarial practices.

Why this sample resume for actuary is a great one:

- It highlights more than 9 years of experience, showcasing leadership and ownership in pricing and reserving strategies.

- Quantifiable results, such as improving profitability by 18%, make it clear how the candidate has driven success in the companies they’ve worked for.

- The focus on property and casualty lines makes the resume highly relevant for the intended role, demonstrating a deep understanding of that market segment.

Actuarial resume objective or summary

A resume summary is a brief overview of your professional background, skills, and accomplishments. It highlights what you bring to the role.

- If you have relevant experience and achievements, a summary is ideal for showcasing your expertise.

Actuary resume summary sample:

Detail-oriented actuarial analyst with over three years of experience in risk assessment and financial modeling. Proven track record in developing predictive models that improved forecast accuracy by 20%. Proficient in R, SAS, and Excel, with strong analytical skills and successful completion of SOA Exams P and FM.

A resume objective is a short statement that focuses on what you aim to achieve in the role you are applying for.

- If you’re new to the actuarial field or transitioning from another career, an objective can highlight your enthusiasm and specific work goals.

Actuary resume objective example:

Motivated recent graduate with a Bachelor’s in Actuarial Science seeking an analyst position to leverage strong analytical skills and proficiency in statistical software to contribute to effective risk management and financial forecasting.

Actuarial skills in resumes

Employers often list specific actuary skills in job postings. By including these in your resume, you align your qualifications with the job requirements, making it easier for hiring managers to see that you’re a good fit.

- Hard skills are specific, teachable abilities or knowledge sets that are typically acquired through education, training, or hands-on experience.

- Soft skills are interpersonal or behavioral attributes that enable you to work effectively with others and manage yourself in various situations.

Hard skills for actuary resume:

- Proficiency in R

- Expertise in SAS

- Advanced Excel functions

- Statistical analysis

- Financial mathematics

- Probability theory

- Data modeling

- Actuarial software (e.g., Prophet, GGY AXIS)

- Experience with SQL

- Knowledge of regulatory requirements

Soft skills needed to be on actuary resume:

- Analytical thinking

- Effective communication

- Problem-solving

- Attention to detail

- Time management

- Team collaboration

- Adaptability

- Critical thinking

- Project management

- Client relationship management

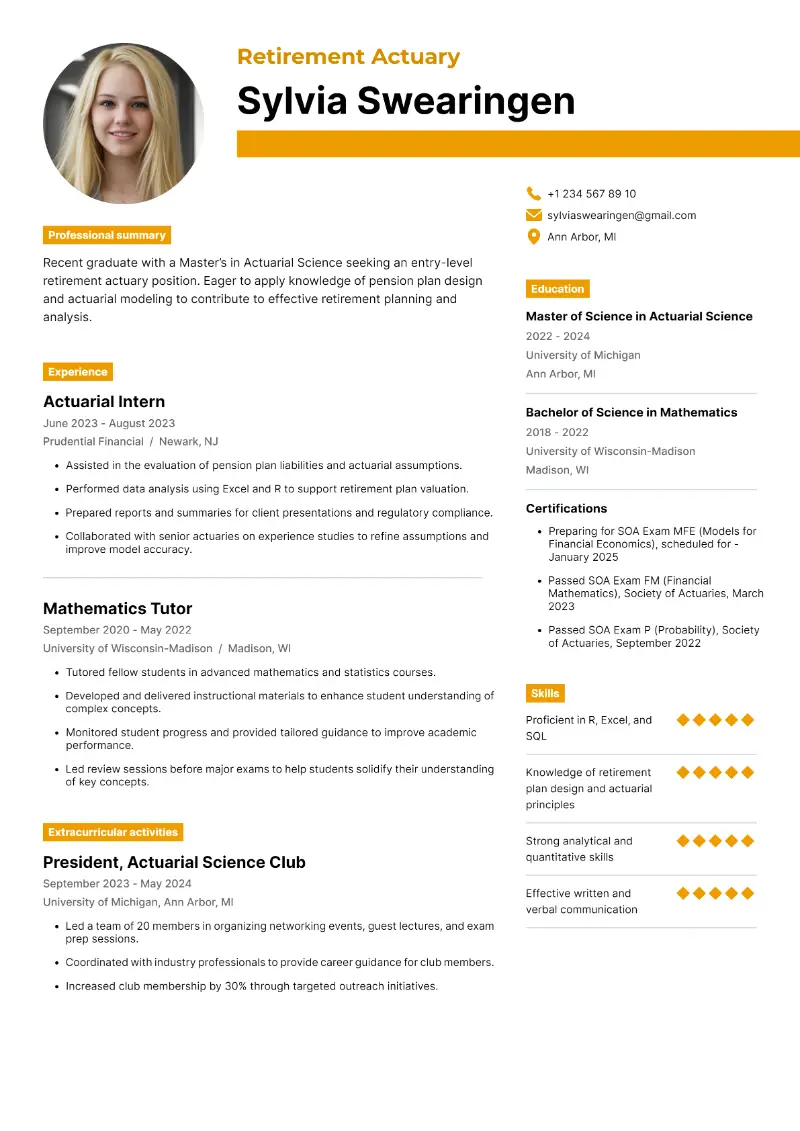

Actuary internship resume sample

Retirement actuarial intern resume example

Beginner actuary resume example | Text version

Objective

Recent graduate with a Master’s in Actuarial Science seeking an entry-level retirement actuary position. Eager to apply knowledge of pension plan design and actuarial modeling to contribute to effective retirement planning and analysis.

Education

Master of Science in Actuarial Science

University of Michigan, Ann Arbor, MI

Graduated May 2025

Bachelor of Science in Mathematics

University of Wisconsin-Madison, WI

Graduated May 2022

Relevant Experience

Actuarial Intern

Prudential Financial, Newark, NJ

June – August 2025

- Assisted in the evaluation of pension plan liabilities and actuarial assumptions.

- Performed data analysis using Excel and R to support retirement plan valuation.

- Prepared reports and summaries for client presentations and regulatory compliance.

- Collaborated with senior actuaries on experience studies to refine assumptions and improve model accuracy.

- Utilized version control systems to maintain transparency and traceability of model updates.

Mathematics Tutor

University of Wisconsin-Madison, WI

September 2022 – May 2024

- Tutored fellow students in advanced mathematics and statistics courses.

- Developed and delivered instructional materials to enhance student understanding of complex concepts.

- Monitored student progress and provided tailored guidance to improve academic performance.

- Led review sessions before major exams to help students solidify their understanding of key concepts.

Skills

- Proficient in R, Excel, and SQL

- Knowledge of retirement plan design and actuarial principles

- Strong analytical and quantitative skills

- Effective written and verbal communication

- Proficient in creating documentation for actuarial procedures and model assumptions

Certifications

- Preparing for SOA Exam MFE (Models for Financial Economics), scheduled for January 2025

- Passed SOA Exam FM (Financial Mathematics), Society of Actuaries, March 2023

- Passed SOA Exam P (Probability), Society of Actuaries, September 2022

Extracurricular Activities

President, Actuarial Science Club

University of Michigan, Ann Arbor, MI

September 2023 – May 2024

- Led a team of 20 members in organizing networking events, guest lectures, and exam prep sessions.

- Coordinated with industry professionals to provide career guidance for club members.

- Increased club membership by 30% through targeted outreach initiatives.

This actuarial resume example is effective for several reasons:

- With a recent Master’s degree in Actuarial Science and a relevant undergraduate degree, this application showcases a solid foundation in studies.

- The progress through SOA exams demonstrates ambition and focus, which is crucial for early-career actuaries aiming to advance quickly.

- Leadership in extracurricular activities adds valuable soft skills like organization and teamwork, which are attractive for entry-level candidates.

Education on actuary resume

Actuarial work requires a strong grasp of mathematics, statistics, finance, and economics. Your education resume section highlights your formal training in these areas.

Degree information:

- List your credentials, such as Bachelor of Science in Actuarial Science, Master of Science in Statistics, etc.

- Include the name of the institution where you obtained the degree.

- Specify the month and year of graduation.

- Mention any academic honors or scholarships, such as Dean’s List, cum laude, or any awards for outstanding performance.

If relevant, add specific courses that are pertinent to actuarial work, such as Probability Theory, Financial Mathematics, or Statistical Analysis.

Environmental and climate actuary resume example

Environmental and climate actuary resume sample

Summary

Dedicated Actuary with 14+ years of experience in environmental risk assessment, climate modeling, and sustainable insurance practices. Skilled in applying statistical analysis, catastrophe modeling, and risk assessment to address the financial implications of environmental hazards and climate change. Proven track record in advising insurers and organizations on climate risk strategies, regulatory compliance, and sustainable asset management.

Experience

Environmental Actuary & Climate Risk Specialist

GreenShield Insurance, St. Louis, MO

June 2018 – Present

- Develop and implement climate risk models for property & casualty insurance, reducing exposure to environmental liabilities by 20% over a four-year period.

- Conduct scenario analyses on extreme weather events (e.g., hurricanes, floods) using climate data to advise on policy premiums, resulting in more accurate and competitive pricing models.

- Spearhead the company’s climate risk assessment initiatives, collaborating with environmental and data scientists to ensure compliance with emerging regulations.

- Presented quarterly reports and climate risk assessments to executive teams, resulting in new strategies for green asset investment and reduced environmental exposure.

Senior Climate Actuary

EcoRisk Solutions, Chicago, IL

January 2014 – May 2018

- Led a cross-functional team in creating predictive models for climate change risks, focusing on temperature anomalies, sea-level rise, and storm frequency to inform policy development.

- Advised major insurance companies on integrating risk into their portfolios, enhancing their resilience to climate-related losses and reducing claim rates by approximately 10%.

- Developed climate stress-testing tools to help clients meet regulatory requirements and align with TCFD recommendations.

- Enhanced portfolio diversification strategies by integrating climate risk factors with traditional financial models.

Actuarial Analyst (Environmental Focus)

GreenEarth Consulting, St. Louis, MO

June 2011 – December 2013

- Provided analytical support for environmental insurance products, assisting with the evaluation of risks associated with pollution, natural disasters, and other hazards.

- Contributed to actuarial analysis for eco-friendly insurance policies, using statistical models to evaluate long-term impact and adjust premiums based on environmental factors.

- Collaborated with senior actuaries on sustainability assessments for clients, focusing on greenhouse gas emissions and other environmental risk factors impacting business longevity.

Education

Bachelor of Science in Actuarial Science

University of Illinois Urbana-Champaign, IL

Graduated: 2011

Certificate in Climate Risk and Sustainable Finance

Global Association of Risk Professionals (GARP)

Completed: 2020

Skills

- Actuarial Software: Prophet, RiskAgility, PolySystems

- Data Analysis: R, Python, SQL, MATLAB

- Climate Modeling: Catastrophe modeling (AIR, RMS), Geospatial analysis (ArcGIS, QGIS)

- Sustainability Tools: GHG Protocol, TCFD reporting tools, SASB Standards

Publications & Presentations

- “Climate Adaptation in the Insurance Industry” — Society of Actuaries Journal, 2023

- Speaker at SOA Annual Meeting (2022): Modeling Climate Risks in Insurance Portfolios

- “Mitigating Environmental Risks: A Practical Guide for Insurers” — Co-authored white paper for EcoRisk Solutions, 2017

Why this actuary resume example is good?

- The tasks outlined show a strong alignment with the duties expected.

- Listing publications and presentations showcases Peggy's active participation in her field and her commitment to sharing knowledge with peers.

- The resume is well-organized with clear headings, making it easy for hiring managers to quickly find information.

Experience section in actuarial resume

List your jobs in reverse chronological order, starting with your most recent or current position and working backward.

For each role, include your job title, the company’s name, and its location (city and state or country).

Use bullet points to tell about your main responsibilities. Focus on duties that align with actuarial functions such as data analysis, risk assessment, or model development.

Use metrics where possible (e.g., "Developed a predictive model that improved forecast accuracy by 15%").

Actuary cover letter

A cover letter is a professional document that you submit along with your resume.

Typically, cover letter for actuarial includes:

- A brief opening where you introduce yourself, mention the job you're applying for, and explain how you came across the position.

- Body section highlights your relevant skills and experiences that make you a strong fit for the role.

- An ending of a cover letter where you express your desire for an interview, thank the employer for considering your application, and provide your contact details.

Actuarial cover letter example

Dear Hiring Manager,

I am writing to express my interest in the Actuarial Analyst position at Prudential Financial, as advertised on your website. With a strong academic background in mathematics and statistics, coupled with hands-on experience in risk assessment and data analysis, I am confident in my ability to contribute effectively to your team.

I graduated with a Bachelor’s degree in Actuarial Science from the University of Colorado Denver, where I excelled in coursework related to probability theory, financial mathematics, and risk management. During my internship at AIG, I assisted in developing actuarial models for insurance products and contributed to the analysis of claims data to identify trends and forecast future risks.

One of my key strengths is my ability to work with large datasets and translate complex statistical concepts into actionable insights. At AIG, I collaborated with senior actuaries to conduct risk assessments and refine pricing models, which helped optimize product offerings and reduce overall risk exposure.

Prudential’s reputation for fostering a collaborative environment and its dedication to leveraging advanced technology for actuarial processes are what drew me to apply. I am excited about the opportunity to work with a team that is committed to maintaining high standards of analytical rigor while creating solutions that drive the financial industry forward.

I would welcome the chance to further discuss how my skills and experiences align with the needs of your team. Thank you for considering my application.

Sincerely,

Lois T. Robinson

Conclusion

Your actuarial resume is more than just a document—it’s your personal marketing tool that highlights your unique qualifications and professional journey.

By focusing on clear formatting, targeted content, strategically emphasizing your strengths and using our actuary resume examples, you can create a document that effectively resonates with hiring managers.

Remember, tailoring your application to each job posting and continuously updating it as you gain experience will keep you competitive in this fast-evolving field.

Create your professional Resume in 10 minutes for FREE

Build My Resume