An effective insurance broker resume can open doors to top firms and high-value clients.

Whether you're just starting out or have years of experience managing complex portfolios, your document needs to demonstrate your ability to analyze risk, build trust, and negotiate the best policies.

In this guide, we’ll walk you through how to write your resume, what skills to highlight, and how to tailor your expertise to stand out in a competitive market.

Insurance broker resume examples

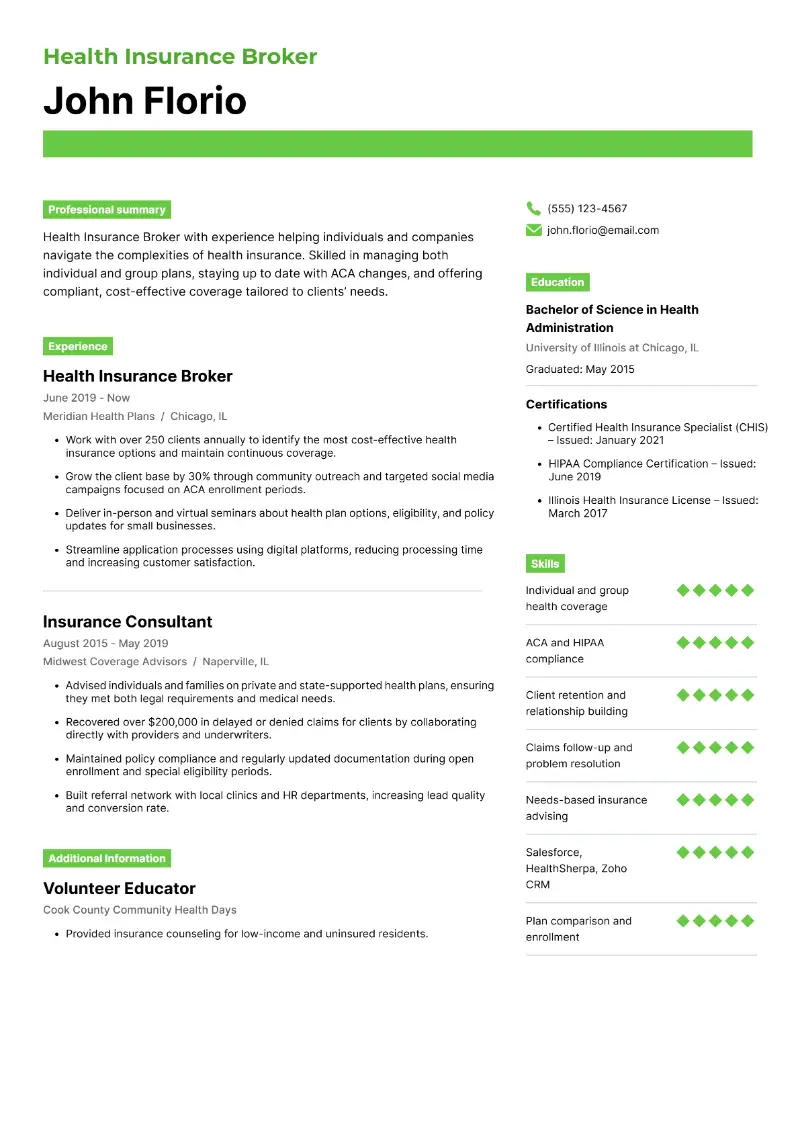

Health insurance broker resume sample

Health insurance broker resume template

Resume for health insurance broker | Plain text

John Florio

Chicago, IL

Phone: (555) 123-4567 | Email: john.florio@email.com | LinkedIn: linkedin.com/in/johnflorioSummary

Health Insurance Broker with experience helping individuals and companies navigate the complexities of health insurance. Skilled in managing both individual and group plans, staying up to date with ACA changes, and offering compliant, cost-effective coverage tailored to clients’ needs.

Skills

- Individual and group health coverage

- ACA and HIPAA compliance

- Client retention and relationship building

- Claims follow-up and problem resolution

- Needs-based insurance advising

- Salesforce, HealthSherpa, Zoho CRM

- Plan comparison and enrollment

- Contract negotiation

- Premium and deductible consulting

- Public speaking and presentation delivery

- Lead generation and referrals

- Medicare and Medicaid guidance

- Written and verbal communication

- Benefits counseling

- Renewal and policy updates

Experience

Health Insurance Broker

Meridian Health Plans | Chicago, IL

June 2019 – Present

- Work with over 250 clients annually to identify the most cost-effective health insurance options and maintain continuous coverage.

- Grow the client base by 30% through community outreach and targeted social media campaigns focused on ACA enrollment periods.

- Deliver in-person and virtual seminars about health plan options, eligibility, and policy updates for small businesses.

- Streamline application processes using digital platforms, reducing processing time and increasing customer satisfaction.

Insurance Consultant

Midwest Coverage Advisors | Naperville, IL

August 2015 – May 2019

- Advised individuals and families on private and state-supported health plans, ensuring they met both legal requirements and medical needs.

- Recovered over $200,000 in delayed or denied claims for clients by collaborating directly with providers and underwriters.

- Maintained policy compliance and regularly updated documentation during open enrollment and special eligibility periods.

- Built referral network with local clinics and HR departments, increasing lead quality and conversion rate.

Education

Bachelor of Science in Health Administration

University of Illinois at Chicago, IL

Graduated: May 2015Certifications

- Certified Health Insurance Specialist (CHIS) – Issued: January 2021

- HIPAA Compliance Certification – Issued: June 2019

- Illinois Health Insurance License – Issued: March 2017

Additional Information

Volunteer Educator, Cook County Community Health Days

- Provided insurance counseling for low-income and uninsured residents.

Strong sides of this insurance broker resume example:

- Strong mix of client experience and technical skills, including ACA and HIPAA compliance.

- Emphasizes measurable achievements like client growth and successful outreach.

- Includes certifications and volunteer work, showcasing ongoing development.

- How to properly format a resume for an insurance broker?

- Choose a clean font such as Arial, Calibri, or Times New Roman. This ensures legibility and a polished appearance.

- Keep the resume size to one page if you have fewer than 10 years of experience. For those with more, a two-page document is acceptable.

- Utilize 1-inch margins on all sides of insurance broker resume for a well-balanced layout.

- Use 1.15 or 1.5 line spacing to create a readable presentation.

- Opt for 10-12 pt for the body text and 14-16 pt for your name at the top to give it prominence.

- Clearly label each resume part (e.g., Experience, Skills) with bold text or slightly larger font to create structure.

To eliminate formatting hassles and avoid starting from scratch, try resume creator free of charge.

Resume Trick offers resume templates in PDF that guarantee consistent, professional formatting.

Create your professional Resume in 10 minutes for FREE

Build My Resume

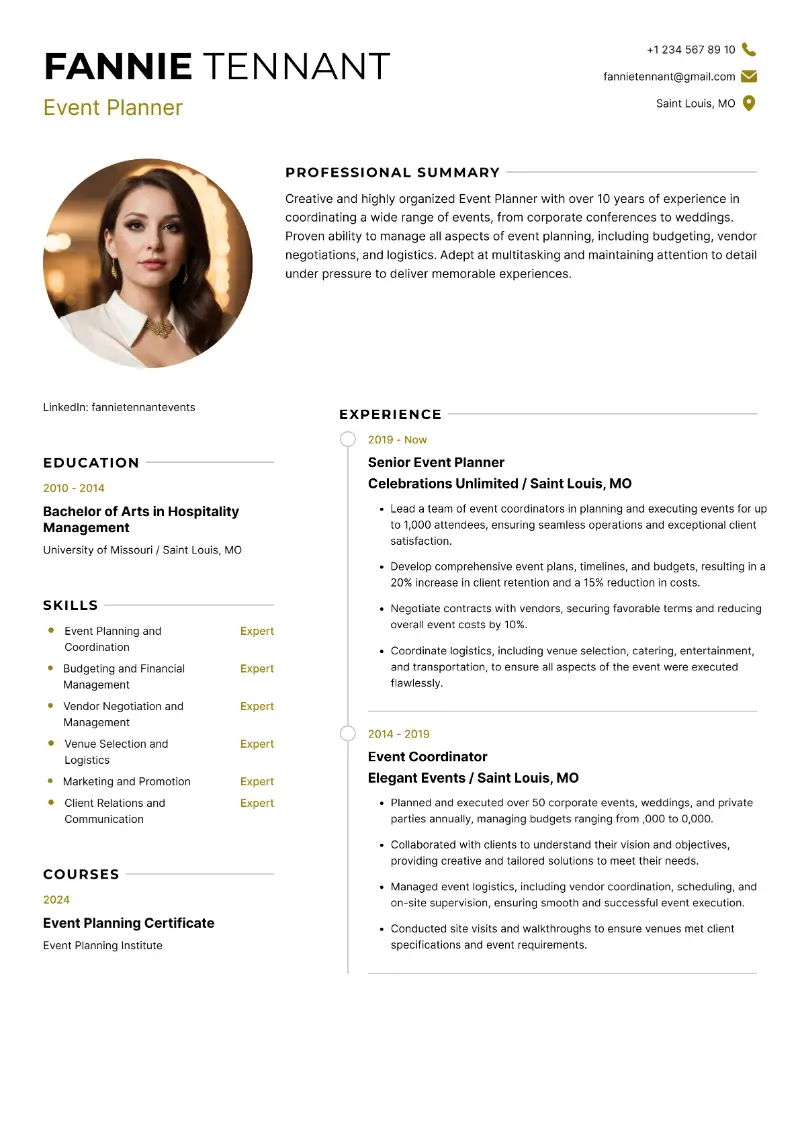

Life insurance broker resume example

Sample life insurance broker resume

Jane Smith

Los Angeles, CA

Phone: (555) 987-6543 | Email: jane.smith@email.com | LinkedIn: linkedin.com/in/janesmithSummary

Life Insurance Broker with over a decade of experience delivering long-term financial security through customized insurance planning. Specialized in helping clients protect their families, grow wealth, and prepare for retirement. Builds trust through transparent communication and holistic financial strategies.

Skills

- Term, whole, and universal life insurance

- Financial goal-based planning

- Lead nurturing and pipeline management

- Retirement planning integration

- CRM tools: Salesforce, Zoho, HubSpot

- Trusts and estate considerations

- Risk profiling and needs assessments

- B2C and B2B sales tactics

- Cross-selling annuities and disability insurance

- Emotional intelligence and empathy

- Regulatory and tax impact awareness

- Referral partnerships with CPAs and attorneys

- Multichannel outreach campaigns

- Policyholder support and claims guidance

- Multilingual communication (English, Spanish)

Experience

Life Insurance Advisor

Western Legacy Financial | Los Angeles, CA

January 2018 – Present

- Tailor life insurance solutions for 300+ clients based on their family needs, retirement plans, and estate objectives.

- Increase sales revenue by 40% over two years by identifying cross-sell opportunities and upselling additional financial products.

- Conduct life insurance reviews with existing clients, leading to policy updates that improved long-term coverage and client loyalty.

- Host webinars educating the public on term vs. whole life and how to integrate insurance into legacy planning.

Life Insurance Broker

Golden Sun Financial | Glendale, CA

June 2013 – December 2017

- Focused on building long-term relationships with families and small business owners, offering comprehensive life insurance strategies.

- Helped over 100 clients reduce tax liabilities through careful beneficiary planning and policy structuring.

- Maintained a 98% client retention rate by offering policy check-ins and ensuring ongoing policy relevance.

- Mentored junior brokers and organized weekly team trainings focused on ethics and product education.

Education

Bachelor of Business Administration (BBA)

University of Southern California | Los Angeles, CA

Graduated: May 2012Certifications

- Certified Life Underwriter (CLU) – Issued: November 2020

- Series 6 & 63 – Issued: May 2018

- California Life Insurance License – Issued: July 2016

Additional Information

Speaker, Southern California Women in Finance Conference

- Panelist on life insurance trends and client education.

Why this example of an insurance broker resume is great:

- Focuses on relationship-building and measurable sales achievements.

- Highlights expertise in retirement planning and trust management.

- Certifications and speaking engagements demonstrate commitment to growth.

- Should I choose an insurance broker resume objective or summary?

Ideal for experienced professionals, this is a short (2-3 sentence) paragraph that emphasizes key accomplishments and skills.

Insurance broker resume summary sample:

Skilled insurance broker with over 8 years of experience in risk management and building client relationships. Known for driving sales growth and delivering exceptional service.

This is more suited to those new to the field or switching careers. It highlights your aspirations and the value you aim to bring to the role.

Insurance broker resume objective example:

Ambitious insurance broker seeking to leverage strong analytical and communication abilities in a dynamic team.

- How to showcase your insurance broker resume skills?

The skills section is vital for demonstrating your expertise and capabilities.

- Hard skills are quantifiable competencies, such as proficiency with insurance software or understanding regulatory requirements.

- Soft skills include essential interpersonal qualities like communication or negotiation, which can often be honed through practice.

Insurance broker hard skills:

- Risk assessment

- Client relationship management

- Insurance software proficiency (e.g., Applied Epic, Vertafore)

- Contract negotiation

- Sales and marketing

- Regulatory knowledge

- Claims processing

- Policy analysis

- Financial forecasting

- Data entry and analysis

- Actuarial skills

- Underwriting procedures

- Fraud detection

- Customer service

- Multi-line insurance coverage

Soft skills for insurance brokers:

- Communication

- Negotiation

- Problem-solving

- Time management

- Customer service

- Relationship building

- Attention to detail

- Critical thinking

- Adaptability

- Conflict resolution

- Organization

- Empathy

- Stress management

- Active listening

- Teamwork

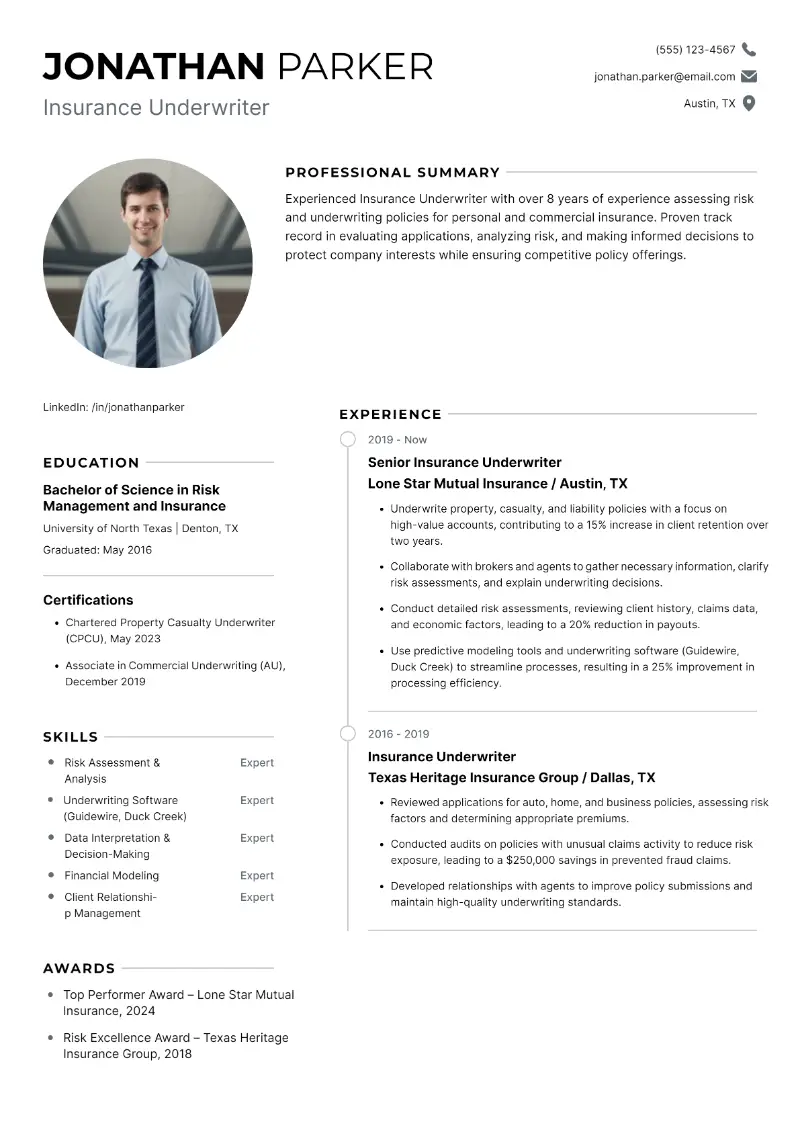

Property insurance broker resume template

Property insurance broker resume sample

Resume for property insurance broker | Text version

Michael Brown

Dallas, TX

Phone: (555) 321-4321 | Email: michael.brown@email.com | LinkedIn: linkedin.com/in/michaelbrownSummary

Results-driven Property Insurance Broker with experience protecting commercial and residential property investments. Strong knowledge of state-specific regulations and risk analysis. Known for simplifying complex insurance terms and securing tailored policies with top-rated carriers.

Skills

- Homeowners, renters, and landlord insurance

- Commercial property risk assessments

- Local property laws and compliance

- Property damage and liability claims

- Negotiation and coverage optimization

- Real estate risk communication

- Data analysis for property valuation

- Underwriting collaboration

- Cold calling and lead conversion

- Policy renewal tracking and follow-up

- Auto and umbrella policy bundling

- CRM platforms: Applied Epic, Salesforce

- Loss prevention strategy advising

- Bilingual client support (English, Spanish)

- Policy endorsements and amendments

Experience

Senior Property Insurance Broker

Lone Star Risk Group | Dallas, TX

April 2018 – Present

- Deliver custom insurance solutions to property owners, increasing average client policy value by 20%.

- Train and supervise a team of 4 junior brokers, resulting in teamwide sales growth and reduced claim errors.

- Partner with local real estate firms to offer pre-close insurance consultations and same-day quotes.

- Maintain 95% client retention rate by offering proactive communication and renewal reviews.

Property Insurance Agent

Southwest InsureCo | Plano, TX

June 2015 – March 2018

- Managed a personal book of business exceeding $3M in annual premium volume, across residential and small business clients.

- Identified gaps in existing coverage and upgraded over 60% of clients to broader, more protective plans.

- Negotiated rates with underwriters during severe storm seasons, saving clients thousands in premium hikes.

- Conducted on-site inspections to identify risk exposures and recommend loss-prevention measures.

Education

Bachelor of Science in Finance

University of Texas at Dallas | Richardson, TX

Graduated: December 2014Certifications

- Certified Insurance Counselor (CIC) – Issued: March 2021

- Commercial Property Insurance Specialist (CPIS) – Issued: December 2018

- Texas Property & Casualty Insurance License – Issued: September 2015

Additional Information

Member, Texas Independent Insurance Agents Association

- Active in monthly workshops on claims trends and legal updates.

This sample insurance broker resume is effective for several reasons:

- Demonstrates leadership skills with team management and mentoring.

- Balances technical knowledge with a focus on client satisfaction.

- Bilingual ability and industry involvement reflect versatility and growth.

- What academic credentials should I add to my insurance broker resume?

The education section in resume provides employers with insight into your background and shows you have the foundational knowledge.

Structure:

- Degree type: Bachelor’s, Master’s, etc.

- Major: Insurance, Business Administration, Finance, etc.

- University/College Name

- Graduation Date

- Relevant courses: Risk Management, Insurance Law, Financial Planning

- How to organize the experience section in an insurance broker resume?

- List your work history in reverse chronological order, with the most recent job first.

- Use action-oriented verbs to show your responsibilities (e.g., "negotiated", "managed", "led").

- Quantify your successes where possible (e.g., “Increased client base by 30% in the first year”).

- Tailor your descriptions to match the skills and qualifications mentioned in the posting.

- Group related positions together to demonstrate progression and consistency in your career.

- Include the company name, your title, and employment dates for each entry.

Conclusion

A insurance broker resume is more than a history of jobs—it's your pitch to future employers.

By showcasing your industry knowledge, client relationship skills, and sales achievements, you can position yourself as a top candidate.

Use the tips and best resumes from this guide to create a polished, tailored document that reflects your strengths and lands you more interviews in the insurance field.

Create your professional Resume in 10 minutes for FREE

Build My Resume