In the dynamic and ever-evolving world of law, a well-crafted junior tax associate resume is your first opportunity to make a strong impression.

Whether you're an entry-level candidate or a student looking to take the next step in your career, a well-structured document is essential to stand out in a competitive job market.

This article will guide you through creating a great resume, featuring a variety of resume examples to help you tailor your resume to your unique experiences.

Junior tax associate resume examples

- International junior tax associate resume

- Corporate junior tax associate resume

- State and local junior tax associate resume

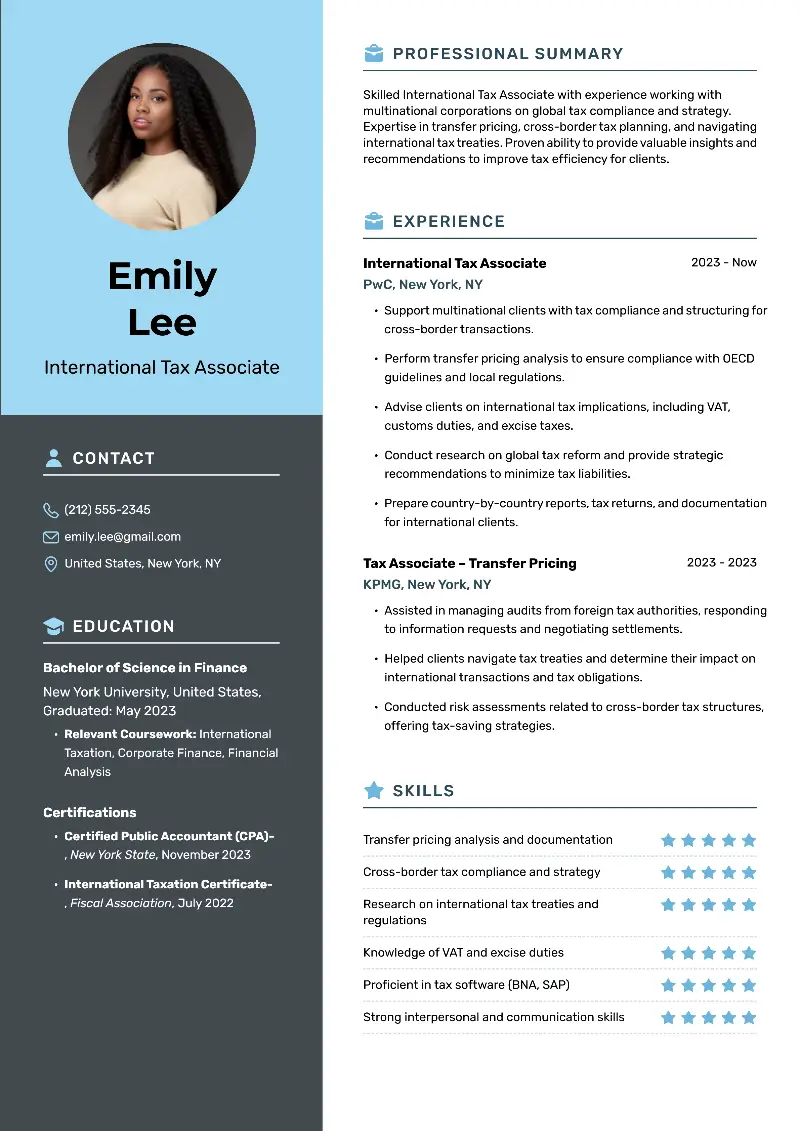

International junior tax associate resume

International junior tax associate resume template

International junior tax associate resume sample | Plain text

Emily Lee

New York, NY

Email: emily.lee@gmail.com

Phone: (212) 555-2345Resume Summary

Skilled International Tax Associate with experience working with multinational corporations on global tax compliance and strategy. Expertise in transfer pricing, cross-border tax planning, and navigating international tax treaties. Proven ability to provide valuable insights and recommendations to improve tax efficiency for clients.

Experience

International Tax Associate

PwC, New York, NY

June 2023 – Present

- Support multinational clients with tax compliance and structuring for cross-border transactions.

- Perform transfer pricing analysis to ensure compliance with OECD guidelines and local regulations.

- Advise clients on international tax implications, including VAT, customs duties, and excise taxes.

- Conduct research on global tax reform and provide strategic recommendations to minimize tax liabilities.

- Prepare country-by-country reports, tax returns, and documentation for international clients.

- Coordinate with local tax authorities to resolve compliance issues efficiently.

Tax Associate – Transfer Pricing

KPMG, New York, NY

January – May 2023

- Assisted in managing audits from foreign tax authorities, responding to information requests and negotiating settlements.

- Helped clients navigate tax treaties and determine their impact on international transactions and tax obligations.

- Conducted risk assessments related to cross-border tax structures, offering tax-saving strategies.

Education

Bachelor of Science in Finance

New York University, NY

Graduated: May 2023

- Relevant Coursework: International Taxation, Corporate Finance, Financial Analysis

Certifications

- Certified Public Accountant (CPA), New York State, November 2023

- International Taxation Certificate, Fiscal Association, July 2022

Skills

- Transfer pricing analysis and documentation

- Cross-border tax compliance and strategy

- Research on international tax treaties and regulations

- Knowledge of VAT and excise duties

- Proficient in tax software (BNA, SAP)

- Strong interpersonal and communication skills

- Risk assessment and tax planning

- Multijurisdictional tax reporting

- Data analysis and financial modeling

Why this international tax associate resume example will impress recruiters?

- Emily's document showcases her experience in a specialized area of tax law , demonstrating expertise and value to clients operating globally.

- Her focus on certifications and continuous learning proves her commitment to professional growth.

- The application highlights her ability to communicate and collaborate with clients.

How to format a junior tax associate resume

- Keep the resume length under 1 page if you are early in your career or have less than 10 years of experience.

- Choose easy-to-read fonts such as: Calibri, Aria, Helvetica, and Times New Roman.

- For the body text use 10 to 12 pt, for headings 14 to 16 pt.

- Set 1-inch margins on all sides (top, bottom, left, right).

- Ensure there is space between parts of a resume to visually separate each part.

- Avoid colloquial language, contractions, and casual expressions.

- Add active verbs to make your responsibilities and achievements more dynamic.

- Define acronyms the first time they appear.

- Incorporate relevant keywords from the job listing.

- Refrain from lengthy paragraphs—keep information in bite-sized chunks.

- Proofread your draft several times before submitting it.

- If you utilize color, limit it to one or two shades, like dark blue or gray.

To ensure you don't miss any important details, try an online resume generator to streamline the process.

Resume Trick offers a variety of free resume templates tailored to different industries and job roles.

Create your professional Resume in 10 minutes for FREE

Build My Resume

Corporate junior tax associate resume

Corporate junior tax associate resume example

Michael Roberts

Los Angeles, CA

Email: michael.roberts@gmail.com

Phone: (323) 555-7654Resume Summary

Recent Accounting graduate with hands-on internship experience in corporate tax compliance, tax research, and financial analysis. Passionate about leveraging knowledge of tax law to support businesses in maintaining compliance and optimizing their tax positions.

Experience

Tax Intern

BDO, Los Angeles, CA

June 2024 – August 2025

- Assisted senior tax associates with the preparation of corporate tax returns for clients in various industries.

- Conducted research on corporate tax regulations and helped ensure compliance with state and federal tax laws.

- Supported in the creation of tax-saving strategies by analyzing clients' financial statements and tax records.

- Collaborated with the tax team to prepare presentations and reports for clients, explaining tax implications and solutions.

- Gained experience using tax preparation software, including ProSystem fx and CCH Axcess, for data entry and analysis.

- Assisted with the reconciliation of tax accounts and preparation of supporting schedules.

Education

Bachelor of Science in Accounting

University of Southern California, Los Angeles, CA

Graduated: May 2025

Relevant Coursework:

- Corporate Taxation

- Financial Accounting

- Tax Planning and Strategy

- Accounting Information Systems

Certifications

CPA Candidate

California Board of Accountancy

Expected Certification: 2023

Skills

- Corporate tax compliance and preparation

- Basic tax research and legal compliance

- Proficient in tax preparation software (ProSystem fx, CCH Axcess)

- Strong organizational and time management skills

- Basic financial statement analysis

- Excellent written and verbal communication skills

- Ability to collaborate in team environments

- Attention to detail in documentation and reporting

- Client-focused problem-solving abilities

Additional Information

Languages:

- English (Fluent)

- Spanish (Basic)

Volunteer Work

Volunteer, Tax Assistance Program (2025–Present)

– Provide free tax preparation services for low-income individuals in the Los Angeles area during tax season.

Why this tax associate resume sample works?

- The opening statement clearly outlines the candidate's expertise as a recent graduate, highlighting skills.

- The resume education section is clear, with Michael mentioning his degree in Accounting, which is directly relevant to the job.

- The inclusion of language proficiency and volunteer work gives a more well-rounded view of the individual.

How to choose between summary and objective

A summary provides an overview of your skills, qualifications, and experience. It is typically used by professionals and those with relevant skills who want to quickly communicate their value to employers.

Example of junior tax associate resume summary:

Recent graduate with practical tax experience through volunteering with the Tax Assistance Program. Skilled in tax preparation and compliance, particularly in individual and small business returns. Proficient in tax software and detail-oriented when reviewing client financials to ensure accuracy.

An objective statement outlines your goals and what you hope to achieve by securing the job. This is used by candidates who are early in their career or making a shift.

Example of junior tax associate resume objective:

Looking for an Associate role where I can apply my solid foundation in accounting to contribute to compliance, research, and strategic planning while gaining deeper expertise in the tax domain.

How to organize education on a junior resume

- Provide the degree you earned.

- Write the institution where you got your diploma.

- Include the month and year of graduation.

- Add the city and state of the university.

- Relevant coursework is helpful for new graduates.

- Optional, but if you achieved any academic latin honors, note them.

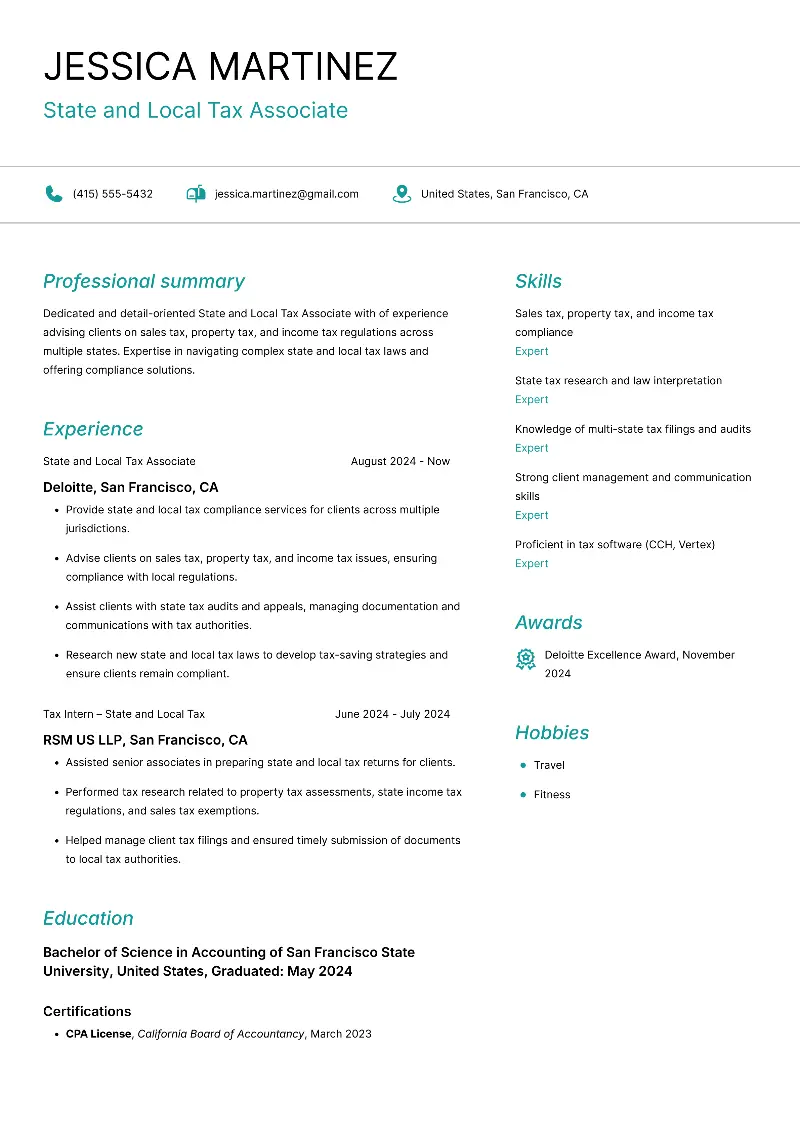

State and local junior tax associate resume

State and local junior tax associate resume template

State and local junior tax associate resume sample | Plain text

Jessica Martinez

San Francisco, CA

Email: jessica.martinez@gmail.com

Phone: (415) 555-5432Resume Summary

Dedicated and detail-oriented State and Local Tax Associate with of experience advising clients on sales tax, property tax, and income tax regulations across multiple states. Expertise in navigating complex state and local tax laws and offering compliance solutions.

Experience

State and Local Tax Associate

Deloitte, San Francisco, CA

August 2024 – Present

- Provide state and local tax compliance services for clients across multiple jurisdictions.

- Advise clients on sales tax, property tax, and income tax issues, ensuring compliance with local regulations.

- Assist clients with state tax audits and appeals, managing documentation and communications with tax authorities.

- Research new state and local tax laws to develop tax-saving strategies and ensure clients remain compliant.

- Monitor legislative changes to anticipate potential impacts on client tax obligations.

Tax Intern – State and Local Tax

RSM US LLP, San Francisco, CA

June – July 2024

- Assisted senior associates in preparing state and local tax returns for clients.

- Performed tax research related to property tax assessments, state income tax regulations, and sales tax exemptions.

- Helped manage client tax filings and ensured timely submission of documents to local tax authorities.

Education

Bachelor of Science in Accounting

San Francisco State University, CA

Graduated: May 2024

Certifications

CPA License, California Board of Accountancy, March 2023

Skills

- Sales tax, property tax, and income tax compliance

- State tax research and law interpretation

- Knowledge of multi-state tax filings and audits

- Strong client management and communication skills

- Proficient in tax software (CCH, Vertex)

- Risk assessment and issue resolution

- Process improvement and workflow optimization

- Cross-departmental collaboration

Award

Deloitte Excellence Award, November 2024

Personal Interests

- Travel

- Fitness

Strong sides of this resume for tax associate example:

- Award provides evidence of Jessica's exceptional performance at work.

- Including personal interests adds a humanizing touch, showing that she has a balanced lifestyle.

- The license is also an indicator of her qualification and commitment to the field.

How to list experience on a JR tax associate resume

- Arrange your previous roles in reverse chronological order.

- Always start with the job title. After it, include the company name and location.

- Mention the start and end dates of employment.

- Use bullet points to outline the tasks and duties you were responsible for.

- Whenever possible, quantify your accomplishments with specific metrics.

What are the key junior tax associate skills for resume

- Hard skills are technical abilities that are often acquired through education, training, or hands-on experience. They are measurable and quantifiable, and are required for a particular job.

- Soft skills are interpersonal attributes that relate to how you interact with others, solve problems, and adapt to different situations.

Hard skills for tax associate resume:

- Tax preparation and compliance

- Financial statement analysis

- Corporate tax regulations

- Knowledge of tax laws (federal, state, local)

- Tax software proficiency (e.g., ProSystem fx, CCH Axcess, QuickBooks)

- Excel (data analysis, pivot tables, formulas)

- Tax research

- Auditing and reviewing tax filings

- Multi-state tax filings

- Tax planning and strategy development

- Budgeting and financial forecasting

- Accounting principles (GAAP)

- Report generation and documentation

- Risk assessment and mitigation strategies

Tax associate resume soft skills:

- Communication (written and verbal)

- Problem-solving

- Teamwork and collaboration

- Time management

- Adaptability and flexibility

- Attention to detail

- Analytical thinking

- Client relationship management

- Organizational skills

- Critical thinking

- Multi-tasking

- Interpersonal skills

- Conflict resolution

- Presentation skills

Conclusion

In conclusion, crafting a standout junior tax associate resume requires a strategic approach.

Highlighting relevant experience, certifications, and technical skills will ensure that your document stands out to hiring managers and positions you as a strong candidate.

Create your professional Resume in 10 minutes for FREE

Build My Resume