Whether you’re a seasoned expert seeking to climb the career ladder or a newcomer eager to break into the industry, a well-crafted quantitative analyst resume is key to standing out.

A great document not only demonstrates your technical prowess but also your ability to apply complex models to solve real-world problems.

This article provides a comprehensive guide to building an effective application, with resume layout examples tailored for different types of quants.

Quantitative analyst resume examples

- Financial quantitative analyst resume

- Data scientist quantitative analyst resume

- Algorithmic quantitative analyst resume

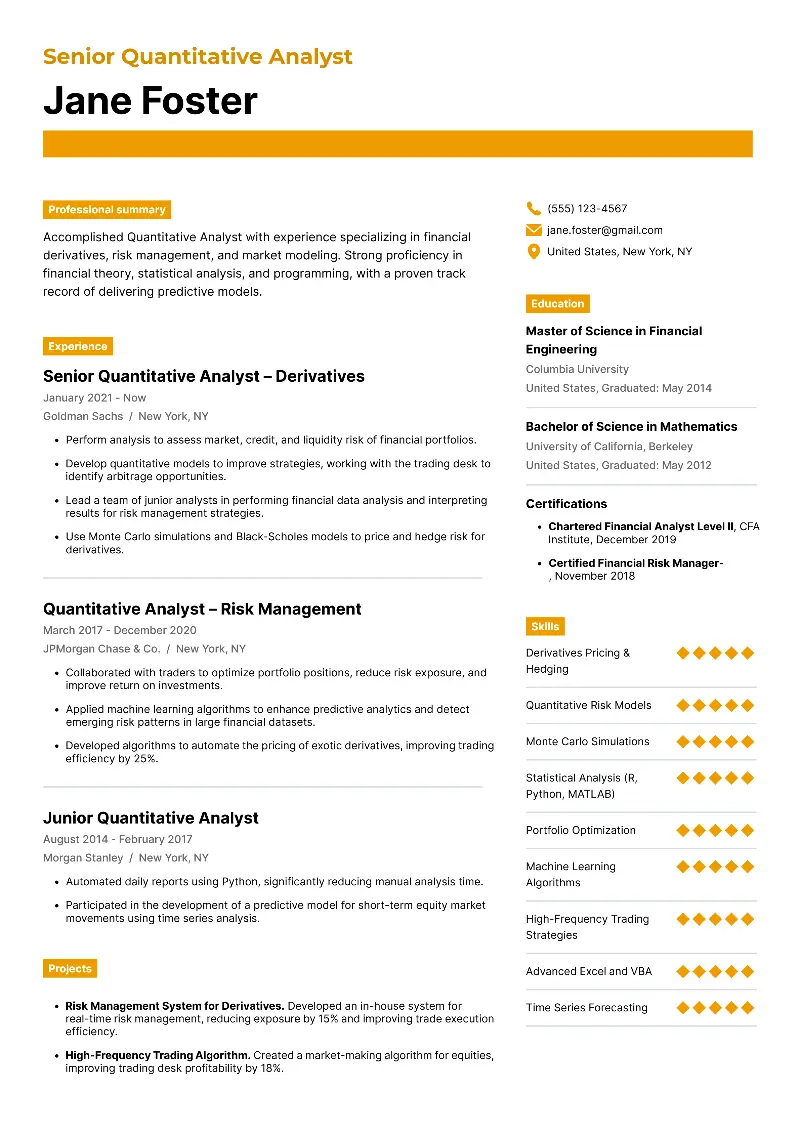

Financial quantitative analyst resume

Financial quantitative analyst resume template

Financial quantitative analyst resume sample | Plain text

Jane Foster

New York, NY

Email: jane.foster@gmail.com

Phone: (555) 123-4567Resume Summary

Accomplished Quantitative Analyst with experience specializing in financial derivatives, risk management, and market modeling. Strong proficiency in financial theory, statistical analysis, and programming, with a proven track record of delivering predictive models for high-frequency trading and portfolio optimization.

Experience

Senior Quantitative Analyst – Derivatives

Goldman Sachs, New York, NY

January 2021 – Present

- Perform analysis to assess market, credit, and liquidity risk of financial portfolios.

- Develop quantitative models to improve strategies, working with the trading desk to identify arbitrage opportunities.

- Lead a team of junior analysts in performing financial data analysis and interpreting results for risk management strategies.

- Use Monte Carlo simulations and Black-Scholes models to price and hedge risk for derivatives.

Quantitative Analyst – Risk Management

JPMorgan Chase & Co., New York, NY

March 2017 – December 2020

- Collaborated with traders to optimize portfolio positions, reduce risk exposure, and improve return on investments.

- Applied machine learning algorithms to enhance predictive analytics and detect emerging risk patterns in large financial datasets.

- Developed algorithms to automate the pricing of exotic derivatives, improving trading efficiency by 25%.

Junior Quantitative Analyst

Morgan Stanley, New York, NY

August 2014 – February 2017

- Automated daily reports using Python, significantly reducing manual analysis time.

- Participated in the development of a predictive model for short-term equity market movements using time series analysis.

Education

Master of Science in Financial Engineering

Columbia University, New York, NY

Graduated: May 2014

Bachelor of Science in Mathematics

University of California, Berkeley, CA

Graduated: May 2012

Certifications

- Chartered Financial Analyst Level II, CFA Institute, December 2019

- Certified Financial Risk Manager, November 2018

Skills

- Derivatives Pricing & Hedging

- Quantitative Risk Models

- Monte Carlo Simulations

- Statistical Analysis (R, Python, MATLAB)

- Portfolio Optimization

- Machine Learning Algorithms

- High-Frequency Trading Strategies

- Advanced Excel and VBA

- Time Series Forecasting

Projects

- Risk Management System for Derivatives. Developed an in-house system for real-time risk management, reducing exposure by 15% and improving trade execution efficiency.

- High-Frequency Trading Algorithm. Created a market-making algorithm for equities, improving trading desk profitability by 18%.

Why this quant resume is effective?

- Clear use of metrics and accomplishments, such as the 18% increase in profitability, helps highlight Jane's impact.

- The inclusion of specific programming languages and tools, ensures that her technical proficiency is evident.

- Certifications add credibility to her qualifications in financial analysis and risk management.

How to format a quantitative researcher resume?

Layout

- One page resume is ideal for early-career professionals.

- Two pages resume are acceptable for seasoned candidates.

- 0.5–1 inch margins on each side.

- Single or 1.15 line spacing for readability.

- Maintain consistent padding between sections of resume.

- Choose modern fonts: Calibri, Helvetica, Arial, Times New Roman, Georgia.

Language

- Use a direct, concise, and results-oriented tone.

- Exclude personal pronouns (no "I" or "my").

- Stick to bullet points — not full paragraphs.

- Start each entry with a strong, unique action verb.

- Include domain-specific keywords.

Final Review

- Save your paper as a PDF to preserve design.

- Avoid visual clutter — utilize section breaks, white space, and bold for emphasis.

- Language is clear, technical, and free of fluff.

To ensure you capture every crucial detail, try building resume with AI for a polished and complete presentation.

Resume Trick offers a wide range of modern, ATS-friendly templates tailored for different roles.

Create your professional Resume in 10 minutes for FREE

Build My Resume

Data scientist quantitative analyst resume

Data scientist quantitative analyst resume example

Michael Anderson

San Francisco, CA michael.anderson@gmail.com (555) 789-0123

Resume Summary

Analytical and results-oriented Quantitative Analyst with experience leveraging machine learning, statistical modeling, and big data technologies to drive impactful financial decisions. Adept at transforming complex data into actionable insights and deploying scalable models in high-stakes environments.

Professional Experience

Quantitative Analyst

Stripe, San Francisco, CA

March 2020 – Present

- Built customer lifetime value and churn prediction models, contributing to a 20% lift in conversion rates.

- Designed and deployed interactive dashboards (Tableau, Streamlit) used daily by product and risk teams.

- Automated reporting pipelines using Python and Airflow, slashing manual processing by 35%.

- Utilize Spark and Hadoop to process terabytes of transaction data for behavioral analysis.

Quantitative Analyst

BlackRock, San Francisco, CA

June 2017 – February 2020

- Engineered risk-adjusted return forecasting models using time-series econometrics and ML techniques.

- Partnered with portfolio managers to implement dynamic asset allocation strategies for institutional clients.

- Integrated alternative data (satellite imagery, earnings sentiment) into predictive equity models.

Junior Analyst

Goldman Sachs, San Francisco, CA

July 2015 – May 2017

- Contributed to volatility prediction models using ensemble learning and sentiment analysis.

- Built a prototype recommendation system for high-net-worth asset management clients.

Education

Master of Science in Data Science

University of California, Berkeley – Graduated: May 2015

Bachelor of Science in Economics

University of Southern California – Graduated: May 2013

Certifications

- Financial Engineering Specialization, edX – January 2022

- Advanced Machine Learning Certification, Coursera – April 2020

- Certified Data Scientist, DASCA – August 2019

Technical Skills

- Programming & ML: Python (scikit-learn, TensorFlow), R, MATLAB

- Data Handling: SQL, NoSQL, Pandas, NumPy

- Big Data & Cloud: Spark, Hadoop, AWS (S3, EC2)

- Visualization: Tableau, Power BI, Seaborn, Plotly

- Modeling Expertise: Time Series Analysis, Optimization, Feature Engineering

- Tools: Git, Docker, Jupyter, Airflow, GitHub Actions

Publications

- "Behavior-Based Segmentation for Fraud Detection in E-commerce" – KDD Conference Proceedings, 2022

- "Improving Equity Return Forecasts with Alternative Data" – Journal of Quantitative Finance, 2021

Awards

- Top Data Scientist Under 35, Analytics Leaders Summit – 2023

- Best Quantitative Research Paper, CFA Institute – 2021

Why this quantitative analyst resume is compelling?

- The opening statement is concise but powerful—it establishes Michael’s identity as a highly skilled specialist.

- Listing peer-reviewed articles and conference papers proves he’s contributing to the field.

- The prestigious awards underscore that his peers and the industry recognize his excellence.

Quantitative analyst resume summary and objective

| Aspect | Summary | Objective |

|---|---|---|

| Purpose | Showcases career highlights, strengths, and key contributions. | Expresses aspirations and intended value. |

| Main Focus | Concentrates on past results and relevant expertise. | Centers on future goals and desired opportunities. |

| Tone | Assertive and evidence-based. | Motivational and forward. |

| Experience Level | Fits professionals with a track record of success. | Ideal for recent grads or those transitioning from another sector. |

| Sample | Risk-focused quantitative analyst with extensive knowledge of stress testing, VaR models, and scenario analysis. Designed risk factor decompositions and liquidity models for banking portfolios. Strong command of SAS, R, and risk regulation frameworks. | Aiming to apply machine learning knowledge to develop innovative forecasting models and improve investment strategies in a data-centric financial institution. |

How to organize education on a quantitative resume?

- Always start with the type of diploma you earned.

- If you have a master's or PhD, it should come first.

- List the name of the institution or university you attended.

- Specify your graduation date clearly, including the month and year.

- Incorporate your GPA only if it is strong (typically above 3.5/4.0).

- You can add a section for relevant coursework.

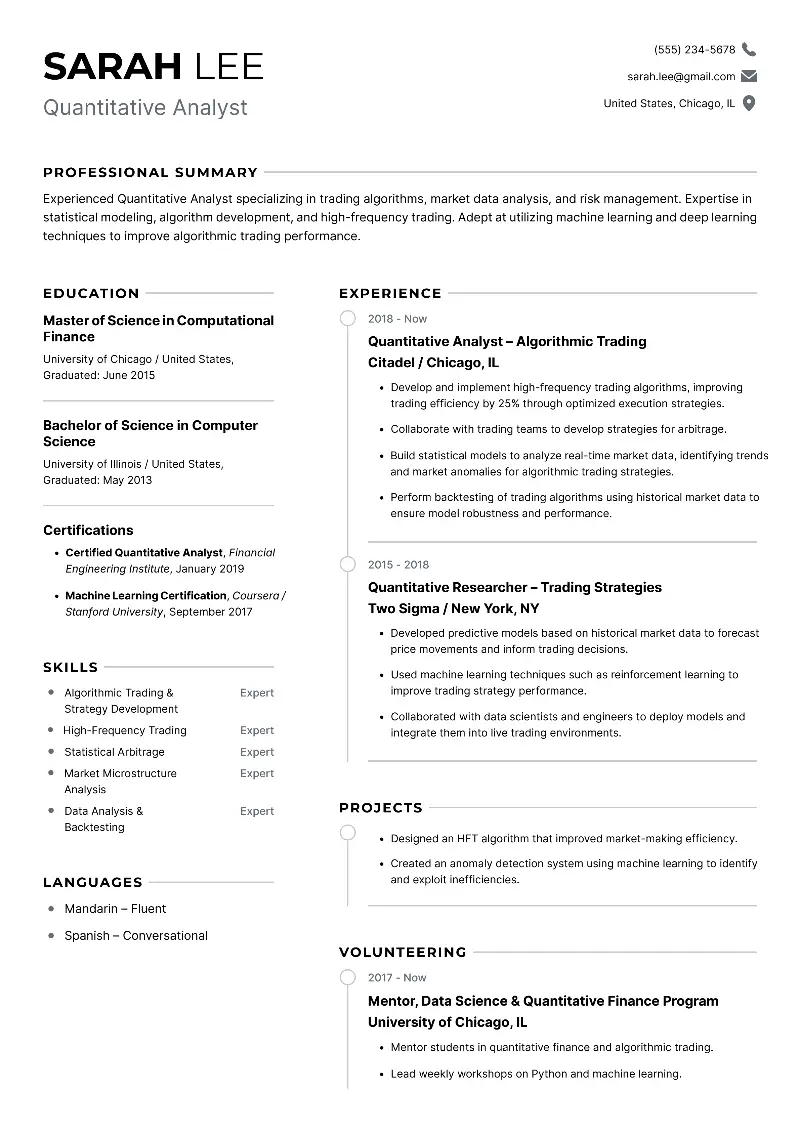

Algorithmic quantitative analyst resume

Algorithmic quantitative analyst resume templates

Algorithmic quantitative analyst resume sample | Plain text

Sarah Lee

Chicago, IL

Email: sarah.lee@gmail.com

Phone: (555) 234-5678Resume Summary

Experienced Quantitative Analyst specializing in trading algorithms, market data analysis, and risk management. Expertise in statistical modeling, algorithm development, and high-frequency trading. Adept at utilizing machine learning and deep learning techniques to improve algorithmic trading performance.

Experience

Quantitative Analyst – Algorithmic Trading

Citadel, Chicago, IL

July 2018 – Present

- Develop and implement high-frequency trading algorithms, improving trading efficiency by 25% through optimized execution strategies.

- Collaborate with trading teams to develop strategies for arbitrage, liquidity provision, and market making.

- Build statistical models to analyze real-time market data, identifying trends and market anomalies for algorithmic trading strategies.

- Perform backtesting of trading algorithms using historical market data to ensure model robustness and performance.

Quantitative Researcher – Trading Strategies

Two Sigma, New York, NY

August 2015 – June 2018

- Developed predictive models based on historical market data to forecast price movements and inform trading decisions.

- Used machine learning techniques such as reinforcement learning to improve trading strategy performance.

- Collaborated with data scientists and engineers to deploy models and integrate them into live trading environments.

Education

Master of Science in Computational Finance

University of Chicago, IL

Graduated: June 2015

Bachelor of Science in Computer Science

University of Illinois, Urbana-Champaign, IL

Graduated: May 2013

Certifications

- Certified Quantitative Analyst, Financial Engineering Institute, January 2019

- Machine Learning Certification, Coursera / Stanford University, September 2017

Skills

- Algorithmic Trading & Strategy Development

- High-Frequency Trading

- Statistical Arbitrage

- Reinforcement Learning & Deep Learning

- Market Microstructure Analysis

- C++, Python, R, MATLAB

- Data Analysis & Backtesting

- Risk Management Models

- Financial Derivatives & Instruments

Languages

- Mandarin – Fluent

- Spanish – Conversational

Projects

- High-Frequency Trading System. Designed an HFT algorithm that improved market-making efficiency and profitability by 20%.

- Market Anomaly Detection. Created an anomaly detection system using machine learning to identify and exploit inefficiencies in real-time market data.

Volunteering

Mentor, Data Science & Quantitative Finance Program

University of Chicago, IL

January 2017 – Present

- Mentor undergraduate students in quantitative finance and algorithmic trading through hands-on projects and coding sessions.

- Lead weekly workshops on Python and machine learning for financial applications.

Why this quantitative finance resume shines?

- Project work demonstrates initiative and creativity, not just task execution.

- Being fluent in Mandarin and conversational in Spanish adds international versatility, valuable for global roles.

- Ongoing involvement as a mentor shows Sarah’s not just technically skilled, but also a collaborator and leader.

How to list experience on a resume?

Start with your most recent job and work backwards. Each entry should include:

- Title (bolded for visibility)

- Company Name, Location

- Dates of Employment

For each role, write 3–6 bullet points that describe responsibilities. Focus on quantifiable outcomes.

What are the key quantitative analysis skills for resume?

- Hard skills are the technical abilities and knowledge you can measure, teach, and test. Think of them as the instruments in your professional toolbox.

- Soft skills are your personal attributes—how you think, communicate, and collaborate. These are harder to quantify, but just as crucial for long-term success.

Hard skills:

- Statistical Modeling

- Machine Learning (Supervised & Unsupervised)

- Time Series Analysis

- Financial Engineering

- Data Mining

- Python, R, MATLAB, C++

- SQL & NoSQL Databases

- Risk Modeling

- Predictive Analytics

- Algorithmic Trading

- Data Visualization (Tableau, Power BI, Plotly)

- Excel (Advanced, VBA)

- Backtesting & Strategy Simulation

- Monte Carlo Simulations

- Big Data Tools (Hadoop, Spark)

Soft skills:

- Analytical Thinking

- Problem-Solving

- Attention to Detail

- Communication

- Collaboration

- Adaptability

- Initiative

- Critical Thinking

- Time Management

- Strategic Planning

- Creativity

- Decision-Making

- Resilience

- Curiosity

- Leadership

Conclusion

Crafting a quantitative analyst resume requires more than listing technical skills—it’s about demonstrating how your expertise leads to tangible outcomes in the finance sphere.

Use the work resume examples and tips provided to tailor your document, ensuring it reflects both your capabilities and real-world impact.

Create your professional Resume in 10 minutes for FREE

Build My Resume