In the dynamic world of law, your senior claims adjuster resume serves as your first opportunity to demonstrate your expertise, skills, and commitment to the field.

Whether you're an experienced professional aiming for a senior position or a veteran adjuster looking to refine your document for a competitive job market, a well-crafted document is essential to stand out.

This article provides a detailed guide on creating a top-tier resume, complete with examples of resume that highlight the necessary elements to make your resume stand out to hiring managers.

Senior claims adjuster resume examples

- Senior auto claims adjuster resume

- Senior property claims adjuster resume

- Senior liability claims adjuster resume

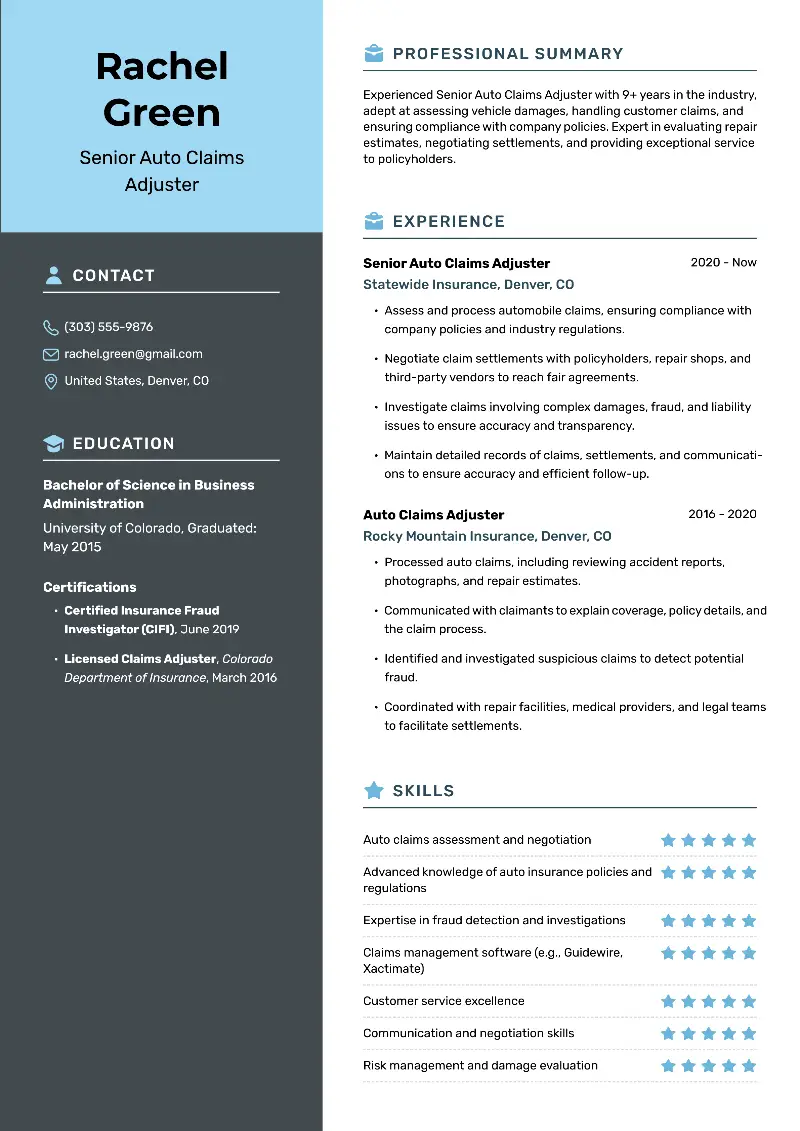

Senior auto claims adjuster resume

Senior auto claims adjuster resume template

Senior auto claims adjuster resume sample | Plain text

Rachel Green

Denver, CO

Email: rachel.green@gmail.com

Phone: (303) 555-9876Resume Summary

Experienced Senior Auto Claims Adjuster with 9+ years in the industry, adept at assessing vehicle damages, handling customer claims, and ensuring compliance with company policies. Expert in evaluating repair estimates, negotiating settlements, and providing exceptional service to policyholders.

Experience

Senior Auto Claims Adjuster

Statewide Insurance, Denver, CO

March 2020 – Present

- Assess and process automobile claims, ensuring compliance with company policies and industry regulations.

- Negotiate claim settlements with policyholders, repair shops, and third-party vendors to reach fair agreements.

- Investigate claims involving complex damages, fraud, and liability issues to ensure accuracy and transparency.

- Maintain detailed records of claims, settlements, and communications to ensure accuracy and efficient follow-up.

Auto Claims Adjuster

Rocky Mountain Insurance, Denver, CO

January 2016 – February 2020

- Processed auto claims, including reviewing accident reports, photographs, and repair estimates.

- Communicated with claimants to explain coverage, policy details, and the claim process.

- Identified and investigated suspicious claims to detect potential fraud.

- Coordinated with repair facilities, medical providers, and legal teams to facilitate settlements.

Education

Bachelor of Science in Business Administration

University of Colorado, Boulder, CO

Graduated: May 2015

Certifications

- Certified Insurance Fraud Investigator (CIFI), June 2019

- Licensed Claims Adjuster, Colorado Department of Insurance, March 2016

Skills

- Auto claims assessment and negotiation

- Advanced knowledge of auto insurance policies and regulations

- Expertise in fraud detection and investigations

- Claims management software (e.g., Guidewire, Xactimate)

- Customer service excellence

- Communication and negotiation skills

- Risk management and damage evaluation

Why this senior claims specialist resume example is effective?

- This document showcases Rachel's career growth, which illustrates her development in the industry.

- The job responsibilities and accomplishments are clearly outlined, with an emphasis on leadership and problem-solving skills.

- Certifications relevant to the role further validate her qualifications.

- How to format a resume for claims adjuster?

- Choose a plain font that is easy to read. Popular ones are: Calibri, Arial, Times New Roman, and Verdana.

- Headings should be in the 16-18 pt range. Body text - 10-12 pt.

- Standard 1-inch margins on all sides are the most commonly used.

- Leave 1.15 or 1.5 line spacing between sections to give the document a clean, organized look.

- If you have less than 10 years of experience, aim for a one-page resume.

- Add strong, action-oriented verbs to describe your responsibilities and achievements.

- Utilize bullets to break up large blocks of text.

- Customize your paper for each job you apply to with keywords.

- Be sure to proofread your draft for spelling, grammar, and punctuation errors before submitting it.

If you prefer not to begin from scratch, consider making resume with AI to streamline the process.

Resume Trick offers a variety of customizable templates and examples, making it simple to get started.

Create your professional Resume in 10 minutes for FREE

Build My Resume

Senior property claims adjuster resume

Senior property claims adjuster resume example

John Miller

Austin, TX

Email: john.miller@gmail.com

Phone: (512) 555-1234Resume Summary

Detail-oriented Senior Property Claims Adjuster with experience in evaluating and managing residential and commercial property claims. Expertise in estimating property damage, providing accurate coverage assessments, and resolving disputes efficiently.

Experience

Senior Property Claims Adjuster

Allstate Insurance, Austin, TX

March 2018 – Present

- Evaluate property damage claims for residential, commercial, and rental properties, ensuring proper policy application.

- Train and mentor junior adjusters on damage assessments, policy interpretation, and best customer service practices.

- Coordinate with contractors, engineers, and inspectors to obtain repair estimates and negotiate settlements.

- Investigate disputed claims, reviewing policy language and determining liability and fair compensation for policyholders.

Property Claims Adjuster

Farmers Insurance, Austin, TX

January 2013 – February 2018

- Managed and resolved a diverse range of residential and commercial claims, including fire, storm, and water damage.

- Conducted property damage assessments and prepared detailed repair estimates using Xactimate software.

- Communicated with policyholders throughout the claims process, providing updates and clarification on coverage.

- Worked with vendors and contractors to facilitate repairs and ensure efficient, timely claims resolution.

Education

Bachelor of Arts in Insurance and Risk Management

Texas State University, San Marcos, TX

Graduated: December 2012

Certifications

- Property Claims Adjuster Certification, NAIC, February 2020

- Certified Professional Insurance Adjuster (CPIA), November 2017

Skills

- Expertise in residential and commercial property claims management

- Advanced proficiency in Xactimate, ClaimsXpert, and claims management software

- Strong negotiation and conflict resolution abilities

- Proficient in risk assessment, damage estimation, and loss mitigation

- Effective mentor and trainer for junior adjusters

- Knowledge of insurance policies and industry regulations

- Fraud detection and claims investigation expertise

- Excellent verbal and written communication skills

- Exceptional customer service and relationship-building

Professional Development

- Claims Management and Negotiation Training, Insurance Claims Institute, June 2019

- Advanced Risk Assessment and Damage Estimation, March 2018

Languages

- Spanish – Intermediate proficiency

Extracurricular Activities

Member, Austin Professional Insurance Adjusters Association

January 2014 – Present

- Attend monthly meetings, collaborate with industry peers, and participate in professional development opportunities.

Why this resume of claims adjuster stands out?

- The addition of Spanish is valuable in a customer service-heavy industry like insurance, as it signals an ability to communicate with a broader range of clients.

- The involvement extracurricular activities demonstrates active participation in the insurance community, showing networking skills and a desire for ongoing growth.

- The opening statement highlights key strengths. It’s brief, directly addressing the core competencies.

- What is the difference between senior claims adjuster resume summary and objective?

| Aspect | Summary | Objective |

|---|---|---|

| Purpose | Outlines the key skills and experience. | States the goals and intentions. |

| Length | 2-4 sentences. | 1-2 sentences. |

| Content | Emphasizes qualifications and competencies. | Describes what the candidate aims to achieve. |

| Tone | Results-oriented. | Aspirational. |

| Common Use | More common for professionals, like senior adjusters. | Often used by entry-levels or those changing careers. |

| Example | Senior Claims Adjuster with 15 years of experience managing residential and commercial claims across various industries. Strong skills in claims analysis, negotiation, and customer service. Currently seeking to transition to a corporate or strategic role where I can use my expertise to improve claims processes at the organizational level. | To secure a Senior Claims Adjuster position focused on catastrophe claims, leveraging my experience in managing large-scale natural disaster claims and driving quick, accurate resolutions. |

- How to list education on a senior resume for claims adjuster?

- Write the degree you earned along with the major or area of study.

- Include the name of the institution and its location.

- Specify the date of graduation or the expected one if applicable.

- For those early in their career, you can add relevant coursework.

- If you received any honors or awards, mention them here.

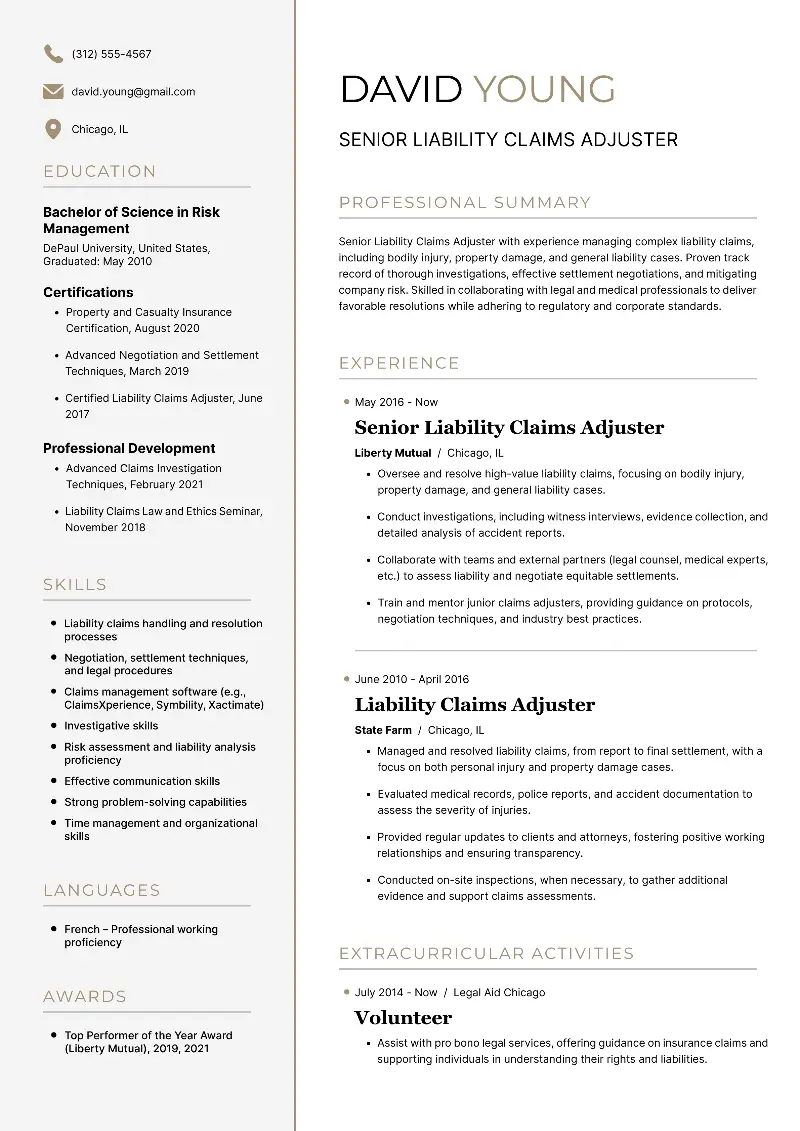

Senior liability claims adjuster resume

Senior liability claims adjuster resume template

Senior liability claims adjuster resume sample | Plain text

David Young

Chicago, IL

Email: david.young@gmail.com

Phone: (312) 555-4567Resume Summary

Senior Liability Claims Adjuster with experience managing complex liability claims, including bodily injury, property damage, and general liability cases. Proven track record of thorough investigations, effective settlement negotiations, and mitigating company risk. Skilled in collaborating with legal and medical professionals to deliver favorable resolutions while adhering to regulatory and corporate standards.

Professional Experience

Senior Liability Claims Adjuster

Liberty Mutual, Chicago, IL

May 2016 – Present

- Oversee and resolve high-value liability claims, focusing on bodily injury, property damage, and general liability cases.

- Conduct comprehensive investigations, including witness interviews, evidence collection, and detailed analysis of accident reports.

- Collaborate with internal teams and external partners (legal counsel, medical experts, etc.) to assess liability and negotiate equitable settlements.

- Train and mentor junior claims adjusters, providing guidance on claim investigation protocols, negotiation techniques, and industry best practices.

Liability Claims Adjuster

State Farm, Chicago, IL

June 2010 – April 2016

- Managed and resolved liability claims, from initial report to final settlement, with a focus on both personal injury and property damage cases.

- Evaluated medical records, police reports, and accident documentation to assess the severity of injuries and determine liability.

- Provided regular updates to clients and attorneys, fostering positive working relationships and ensuring transparency in the claims process.

- Conducted on-site inspections, when necessary, to gather additional evidence and support claims assessments.

Education

Bachelor of Science in Risk Management

DePaul University, Chicago, IL

Graduated: May 2010

Certifications

- Property and Casualty Insurance Certification, August 2020

- Advanced Negotiation and Settlement Techniques, March 2019

- Certified Liability Claims Adjuster, June 2017

Skills

- Liability claims handling and resolution processes

- Negotiation, settlement techniques, and legal procedures

- Claims management software (e.g., ClaimsXperience, Symbility, Xactimate)

- Investigative skills

- Risk assessment and liability analysis proficiency

- Effective communication skills

- Strong problem-solving capabilities

- Time management and organizational skills

Professional Development

- Advanced Claims Investigation Techniques, February 2021

- Liability Claims Law and Ethics Seminar, November 2018

Languages

- French – Professional working proficiency

Extracurricular Activities

Volunteer, Legal Aid Chicago

July 2014 – Present

- Assist with pro bono legal services, offering guidance on insurance claims and supporting individuals in understanding their rights and liabilities.

Awards

- Top Performer of the Year Award (Liberty Mutual), 2019, 2021

Why this senior claims specialist resume sample will impress hiring managers?

- Multiple awards demonstrate consistent excellence and recognition within the firm.

- French proficiency adds value, making David an asset for companies with diverse clients or international operations.

- The inclusion of mentorship shows his impact beyond daily claims handling.

- How to list experience on a resume of claims adjuster?

- Place your most recent occupation first, followed by previous ones.

- Each role should have: job title, company name & location, employment dates.

- Focus on achievements rather than just responsibilities.

- Quantify results when possible.

- What are the key claims adjuster skills for resume?

- Hard skills are teachable abilities acquired through education, training, or experience. These are often job-specific and can be tested or quantified.

- Soft skills are personal attributes that affect how professionals interact with clients, colleagues, and stakeholders. These are harder to quantify but just as important for career success.

Hard skills for senior claims adjuster resume:

- Claims management software (Xactimate, Symbility, ClaimsXperience)

- Policy interpretation and legal compliance

- Risk assessment and liability evaluation

- Negotiation and settlement strategies

- Fraud detection and investigation

- Data analysis and reporting

- Knowledge of insurance laws and regulations

- Estimating property and bodily injury damages

- Documentation and claim file management

- Litigation support and case preparation

Soft skills for senior claims adjuster resume:

- Communication

- Problem-solving

- Attention to detail

- Empathy

- Time management

- Adaptability

- Leadership

- Conflict resolution

- Decision-making

- Customer service

Conclusion

A senior claims adjuster resume needs to highlight not just technical skills, but also leadership and problem-solving abilities.

Using the detailed resume samples provided in this article, tailor your document to showcase your strengths and expertise, ensuring you stand out in the competitive world of claims adjustment.

Create your professional Resume in 10 minutes for FREE

Build My Resume