A senior tax associate resume is more than just a list of past jobs and educational qualifications. It's a powerful tool that highlights your skills, experience, and expertise in law, compliance, and consulting.

Whether you're looking to advance your career or transition into a new role, crafting a well-structured and impactful application can make all the difference in getting noticed by potential employers.

In this article, we’ll walk you through the key elements that will ensure your document stands out in the competitive tax industry.

Senior tax associate resume examples

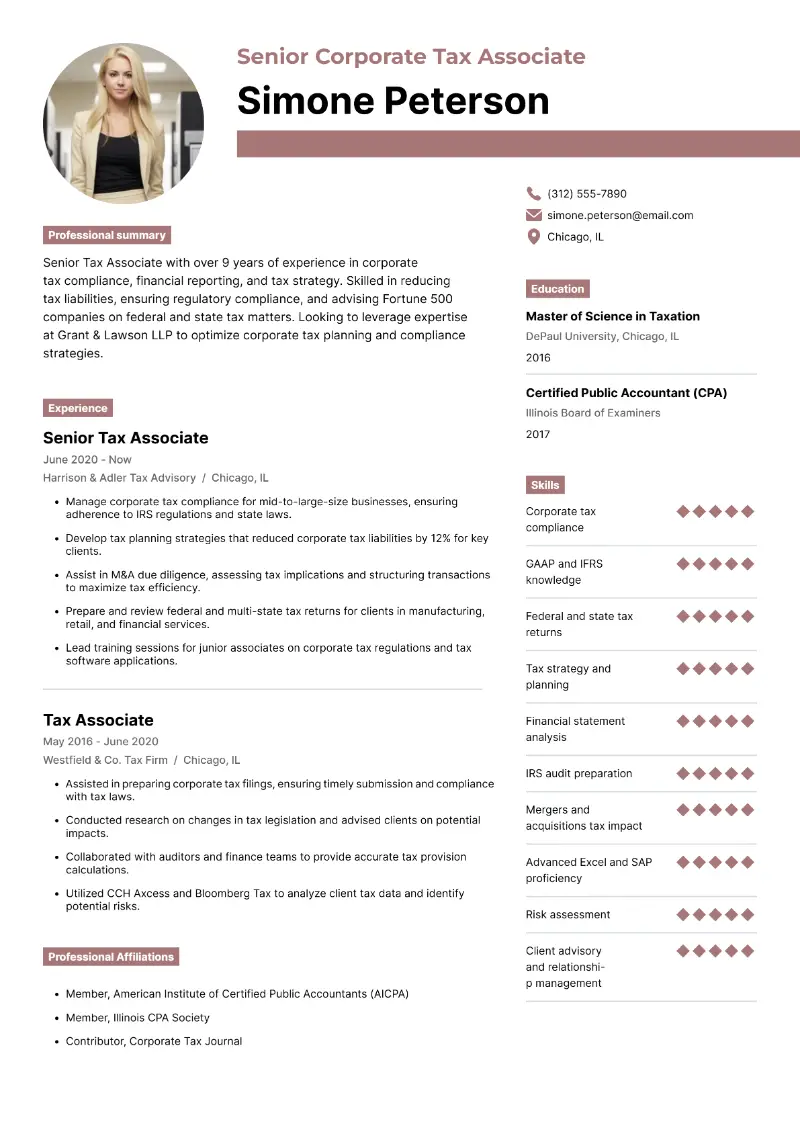

Corporate senior tax associate resume sample

Corporate senior tax associate resume template

Resume for corporate senior tax associate | Plain text

Simone Peterson

Chicago, IL | simone.peterson@email.com | (312) 555-7890 | linkedin.com/in/simonepetersonProfessional Summary

Senior Tax Associate with over 9 years of experience in corporate tax compliance, financial reporting, and tax strategy. Skilled in reducing tax liabilities, ensuring regulatory compliance, and advising Fortune 500 companies on federal and state tax matters. Looking to leverage expertise at Grant & Lawson LLP to optimize corporate tax planning and compliance strategies.

Skills

- Corporate tax compliance

- GAAP and IFRS knowledge

- Federal and state tax returns

- Tax strategy and planning

- Financial statement analysis

- IRS audit preparation

- Mergers and acquisitions tax impact

- Advanced Excel and SAP proficiency

- Risk assessment

- Client advisory and relationship management

Experience

Senior Tax Associate

Harrison & Adler Tax Advisory, Chicago, IL | June 2020 – Present

- Manage corporate tax compliance for mid-to-large-size businesses, ensuring adherence to IRS regulations and state laws.

- Develop tax planning strategies that reduced corporate tax liabilities by 12% for key clients.

- Assist in M&A due diligence, assessing tax implications and structuring transactions to maximize tax efficiency.

- Prepare and review federal and multi-state tax returns for clients in manufacturing, retail, and financial services.

- Lead training sessions for junior associates on corporate tax regulations and tax software applications.

Tax Associate

Westfield & Co. Tax Firm, Chicago, IL | May 2016 – June 2020

- Assisted in preparing corporate tax filings, ensuring timely submission and compliance with tax laws.

- Conducted research on changes in tax legislation and advised clients on potential impacts.

- Collaborated with auditors and finance teams to provide accurate tax provision calculations.

- Utilized CCH Axcess and Bloomberg Tax to analyze client tax data and identify potential risks.

Education & Certifications

- Master of Science in Taxation, DePaul University, Chicago, IL (2016)

- Certified Public Accountant (CPA), Illinois Board of Examiners (2017)

Professional Affiliations

- Member, American Institute of Certified Public Accountants (AICPA)

- Member, Illinois CPA Society

- Contributor, Corporate Tax Journal

Strong sides of this senior tax associate resume:

- Clearly structured with a strong professional summary that highlights expertise in tax planning and compliance.

- Well-organized experience section that quantifies achievements, such as reducing corporate liabilities by 12%.

- Includes relevant professional affiliations, demonstrating industry involvement and ongoing professional development.

- How to properly format a resume for a senior tax associate?

- Use a professional font – Stick to classic options like Arial, Calibri, or Times New Roman in 11-12 pt size.

- Keep the length appropriate – One page is ideal for professionals with less than a decade of experience, while two pages suit those with a longer career history.

- Set proper margins – Maintain 1-inch spacing on all sides for a structured look.

- Employ consistent breaks – Keep line spacing between 1.0 and 1.15 and insert blank lines between sections for better readability.

- Stick to a simple layout – Avoid unnecessary colors, decorative fonts, or excessive graphics that distract from key details.

- Add bullet points – Break down responsibilities, expertise, and achievements into concise, scannable lists.

- Maintain a logical structure – Begin with contact details, followed by a summary or objective, key competencies, work history, academic background, and certifications.

- Save as a PDF – This preserves the layout across different devices and operating systems.

Manually structuring an application can be time-consuming. To simplify the process and ensure a professional look, try an AI resume generator.

- Save time and eliminate formatting inconsistencies.

- Allow easy customization for different applications.

Create your professional Resume in 10 minutes for FREE

Build My Resume

PWC senior tax associate resume example

Sample PWC senior tax associate resume

Emily Rogers

New York, NY | emily.rogers@email.com | (917) 555-4567 | linkedin.com/in/emilyrogersProfessional Summary

Detail-oriented Senior Tax Associate at PwC with 7 years of experience specializing in tax consulting, compliance, and advisory services for multinational corporations. Adept at navigating complex tax regulations, optimizing client tax structures, and mitigating risk. Seeking to continue driving tax efficiencies and strategic solutions within PwC’s Global Tax Services team.

Skills

- International and domestic tax compliance

- Transfer pricing analysis

- Tax due diligence and advisory

- IRS and SEC tax reporting

- ASC 740 provisions and calculations

- Corporate restructuring tax impact

- Data analytics for tax planning

- Proficiency in Alteryx and OneSource

- Client engagement and tax risk assessment

- Cross-border tax structuring

Experience

Senior Tax Associate

PwC, New York, NY | July 2021 – Present

- Provide tax consulting services for Fortune 500 clients across industries including technology, pharmaceuticals, and financial services.

- Conduct ASC 740 tax provision calculations and ensure compliance with regulatory requirements.

- Assist in transfer pricing documentation, ensuring alignment with OECD guidelines and IRS regulations.

- Advise clients on global tax strategies, optimizing cross-border transactions to minimize tax liabilities.

- Train and mentor junior associates in tax research, compliance procedures, and software applications.

Tax Associate

PwC, New York, NY | July 2018 – July 2021

- Prepared federal, state, and international tax filings for corporate clients, ensuring timely and accurate submissions.

- Analyzed the impact of changing tax legislation on multinational companies and provided strategic recommendations.

- Assisted in tax due diligence for mergers and acquisitions, evaluating financial and legal implications.

- Managed client communications, delivering tax updates and planning strategies.

Education & Certifications

- Bachelor of Business Administration in Accounting, New York University, NY (2018)

- Certified Public Accountant (CPA), New York State Board of Accountancy (2019)

Key Projects & Achievements

- Led a tax automation project at PwC, reducing compliance processing time by 20%.

- Developed a new tax risk assessment model that was adopted firm-wide.

- Assisted in a cross-border tax restructuring project, saving a client $2M in annual tax liabilities.

Here are a few reasons why this example of a senior tax associate resume will impress recruiters:

- Emphasizes technical expertise, such as ASC 740 provisions and transfer pricing, making it ideal for Big 4 tax roles.

- Highlights key projects and achievements, showcasing contributions beyond daily responsibilities.

- Uses action-oriented bullet points, making the candidate's impact easy to assess quickly.

- Should I choose a senior tax associate resume objective or summary?

Ideal for seasoned specialists, a summary emphasizes expertise and key contributions.

Length: 2-4 sentences

Must Include:

- Years of experience

- Core strengths

- A key achievement or career goal

Senior tax associate resume summary sample:

Senior Tax Associate with over seven years of experience in corporate tax compliance, audit preparation, and strategic planning. Adept at reducing liabilities through optimized solutions and ensuring full regulatory compliance.

Best suited for career changers or entry-level professionals, an objective focuses on aspirations and relevant qualifications.

Length: 2-3 sentences

Must Include:

- Professional goal

- Relevant skills or credentials

- How you can contribute to the company

Senior tax associate resume objective example:

Detail-oriented tax professional with a solid foundation in regulations and compliance. Recently obtained CPA certification and eager to apply analytical skills and industry knowledge in a Senior Tax Associate role.

- How to showcase your tax associate resume skills?

The skills section quickly conveys expertise to employers, helping them assess suitability for the role.

- Hard skills are technical knowledge gained through education, certifications, and practical experience.

- Soft skills are personal attributes developed through interactions, problem-solving, and workplace adaptability.

Tax associate hard skills:

- Corporate tax compliance

- Financial statement analysis

- Tax return preparation

- IRS regulations and audits

- Transfer pricing

- GAAP and IFRS knowledge

- Tax software proficiency (e.g., UltraTax, Lacerte)

- Data analysis and reporting

- International tax laws

- Risk assessment

Soft skills for tax associates:

- Analytical thinking

- Attention to detail

- Problem-solving

- Communication skills

- Time management

- Leadership

- Client relationship management

- Adaptability

- Team collaboration

- Ethical judgment

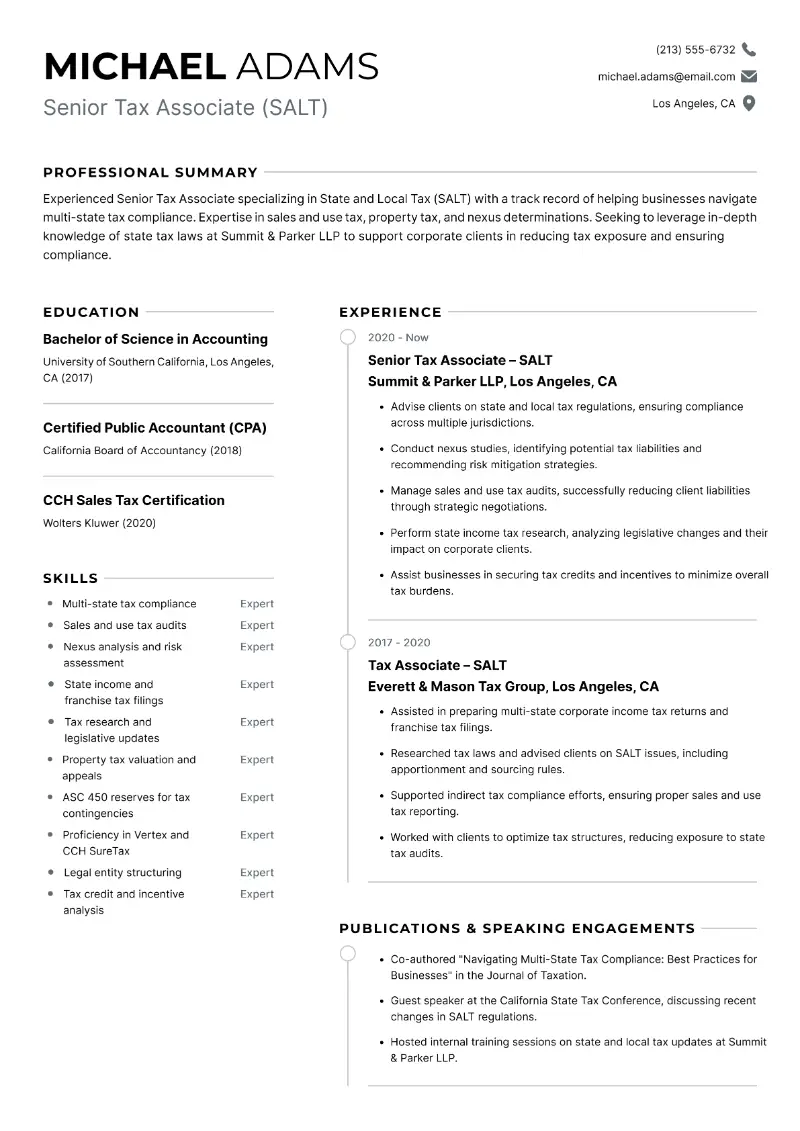

SALT senior tax associate resume template

SALT senior tax associate resume sample

Resume for SALT associate | Text version

Michael Adams

Los Angeles, CA | michael.adams@email.com | (213) 555-6732 | linkedin.com/in/michaeladamsProfessional Summary

Experienced Senior Tax Associate specializing in State and Local Tax (SALT) with a track record of helping businesses navigate multi-state tax compliance. Expertise in sales and use tax, property tax, and nexus determinations. Seeking to leverage in-depth knowledge of state tax laws at Summit & Parker LLP to support corporate clients in reducing tax exposure and ensuring compliance.

Skills

- Multi-state tax compliance

- Sales and use tax audits

- Nexus analysis and risk assessment

- State income and franchise tax filings

- Tax research and legislative updates

- Property tax valuation and appeals

- ASC 450 reserves for tax contingencies

- Proficiency in Vertex and CCH SureTax

- Legal entity structuring

- Tax credit and incentive analysis

Experience

Senior Tax Associate – SALT

Summit & Parker LLP, Los Angeles, CA | August 2020 – Present

- Advise clients on state and local tax regulations, ensuring compliance across multiple jurisdictions.

- Conduct nexus studies, identifying potential tax liabilities and recommending risk mitigation strategies.

- Manage sales and use tax audits, successfully reducing client liabilities through strategic negotiations.

- Perform state income tax research, analyzing legislative changes and their impact on corporate clients.

- Assist businesses in securing tax credits and incentives to minimize overall tax burdens.

Tax Associate – SALT

Everett & Mason Tax Group, Los Angeles, CA | June 2017 – August 2020

- Assisted in preparing multi-state corporate income tax returns and franchise tax filings.

- Researched tax laws and advised clients on SALT issues, including apportionment and sourcing rules.

- Supported indirect tax compliance efforts, ensuring proper sales and use tax reporting.

- Worked with clients to optimize tax structures, reducing exposure to state tax audits.

Education & Certifications

- Bachelor of Science in Accounting, University of Southern California, Los Angeles, CA (2017)

- Certified Public Accountant (CPA), California Board of Accountancy (2018)

- CCH Sales Tax Certification, Wolters Kluwer (2020)

Publications & Speaking Engagements

- Co-authored "Navigating Multi-State Tax Compliance: Best Practices for Businesses" in the Journal of Taxation.

- Guest speaker at the California State Tax Conference, discussing recent changes in SALT regulations.

- Hosted internal training sessions on state and local tax updates at Summit & Parker LLP.

This sample senior tax associate resume is effective for several reasons:

- Specialized in state and local tax (SALT), making it highly relevant for multi-state roles.

- Features publications and speaking engagements, proving thought leadership and expertise.

- Demonstrates industry-specific software proficiency, adding value for firms using Vertex and CCH SureTax.

- What education should I add to my senior tax associate resume?

Academic credentials validate qualifications, making this part crucial for hiring managers.

What to include:

- Degree and major (e.g., Bachelor’s in Accounting)

- University name and graduation year

- Certifications such as CPA or EA

- Relevant coursework (optional for entry-level applicants)

- Academic honors if applicable

- How to organize the experience section in a senior tax associate resume?

- List positions in reverse chronological order, starting with the most recent.

- Add job title, employer name, location, and dates of employment.

- Use bullet points to outline responsibilities and accomplishments.

- Begin each point with a strong action verb (e.g., "Managed," "Developed," "Analyzed").

- Quantify results whenever possible (e.g., "Reduced tax liabilities by 15% through strategic planning").

- Focus on tax-related tasks and achievements relevant to the role.

- Incorporate job-specific keywords for better ATS optimization.

Conclusion

A polished senior tax associate resume is essential for showcasing your technical knowledge, problem-solving abilities, and experience in managing complex issues.

By following the best practices outlined above, you can ensure your document speaks directly to what employers are looking for.

Remember, a strong application can open the door to new career opportunities and help you make a lasting impression on hiring managers in the tax field.

Create your professional Resume in 10 minutes for FREE

Build My Resume